Nevada Real Estate Market Trends 2025: Complete Market Analysis and Future Outlook

Executive Summary: Nevada Real Estate Market Excellence 2025

Nevada real estate market trends in 2025 demonstrate exceptional strength, continued growth, and outstanding investment opportunities. With 8.5% annual appreciation, robust job creation, strategic population migration, and no state income tax advantages, Nevada leads the nation in real estate market performance and long-term growth potential.

📈 2025 Nevada Market Highlights:

- Price Growth: 8.5% annual appreciation exceeding national averages

- Market Activity: $15.2B annual transaction volume supporting liquidity

- Population Growth: 75,000+ annual new residents driving demand

- Employment Expansion: 28,000+ new jobs supporting housing demand

- Investment Performance: Superior returns attracting national capital

📊 Market Data

Current Nevada Real Estate Market Conditions

2025 Market Performance Metrics

| Market Indicator | Current Value | Annual Change | National Comparison |

|---|---|---|---|

| Median Home Price | $485,000 | +8.5% | +3.2% above national |

| Days on Market | 18 days | -15% | 12 days faster |

| Inventory Level | 2.8 months | +12% | Balanced market |

| Transaction Volume | $15.2B annually | +6.8% | Above average activity |

Market Strength Indicators

🏆 Nevada Market Leadership Factors

Economic Growth Drivers:

- Population Migration: 75,000+ annual new residents from high-cost states

- Job Creation: 28,000+ new jobs annually across diverse sectors

- Business Relocations: 185+ companies relocated to Nevada in 2024

- Technology Sector: Northern Nevada tech hub expansion continuing rapid growth

- Tourism Recovery: Las Vegas tourism exceeding pre-pandemic levels

- Infrastructure Investment: $2.8B+ in infrastructure projects supporting growth

Market Fundamentals:

- Supply-Demand Balance: Healthy inventory levels supporting stable pricing

- Construction Activity: 45,000+ new homes under construction statewide

- Interest Rate Stability: Competitive mortgage rates supporting affordability

- Cash Transaction Strength: 22% cash purchases indicating market confidence

- Investment Activity: 18% investor purchases demonstrating market appeal

- Market Liquidity: Strong buyer demand and rapid property turnover

📈 Performance Data

Regional Market Trend Analysis

Las Vegas Metropolitan Market Trends

🌟 Las Vegas Market Performance

Market Statistics:

- Median Price: $515,000 (+9.2% annually)

- Transaction Volume: $8.5B annually (56% of state volume)

- Days on Market: 16 days (extremely fast sales)

- Inventory: 2.5 months (seller's market conditions)

- New Construction: 28,000+ new homes planned/under construction

- Population Growth: 45,000+ annual new residents

Submarket Performance:

- Summerlin: $665,000 median (+12.5% appreciation) — Premium master-planned community

- Henderson: $585,000 median (+10.8% appreciation) — Family-focused excellence

- Southwest LV: $595,000 median (+11.2% appreciation) — Golf course luxury

- North Las Vegas: $425,000 median (+15.8% appreciation) — Highest growth area

- Downtown/Urban: $485,000 median (+8.5% appreciation) — Urban revitalization

- East Las Vegas: $385,000 median (+12.2% appreciation) — Value opportunity

Northern Nevada Market Performance

🏔️ Reno-Sparks Market Excellence:

- Median Home Price: $565,000 (+7.8% annual appreciation)

- Technology Sector Impact: Tesla, Google, Apple expansion driving demand

- Population Growth: 18,000+ annual new residents

- Employment Growth: 8,500+ new jobs annually

- Inventory Levels: 3.2 months (balanced market conditions)

- New Construction: 8,500+ new homes planned/under construction

Rural Nevada Market Opportunities

🌄 Rural Market Growth:

- Carson City: $455,000 median (+6.5% appreciation) — Government employment stability

- Minden-Gardnerville: $525,000 median (+8.2% appreciation) — Rural luxury

- Fernley: $385,000 median (+9.8% appreciation) — Growth corridor

- Dayton: $415,000 median (+7.5% appreciation) — Historic character

- Lake Tahoe: $895,000 median (+5.2% appreciation) — Resort market stability

- Rural Acreage: $325,000 median (+6.8% appreciation) — Lifestyle properties

🗺️ Regional Data

Market Trend Drivers and Analysis

Population Migration and Demographics

🚚 Strategic Population Migration Trends

Migration Source Analysis:

- California (45%): 33,750+ annual migrants seeking tax benefits and affordability

- New York (12%): 9,000+ annual migrants escaping high taxes and costs

- Illinois (8%): 6,000+ annual migrants seeking business-friendly environment

- Texas (7%): 5,250+ annual migrants attracted to Nevada advantages

- Washington (6%): 4,500+ annual migrants seeking tax optimization

- Other States (22%): 16,500+ migrants from remaining states and territories

Demographic Characteristics:

- Age Distribution: 35% millennials, 28% Gen X, 22% baby boomers, 15% Gen Z

- Income Levels: $85,000 average household income of new residents

- Education: 68% college-educated professionals and skilled workers

- Employment: 42% remote workers, 35% relocating employment, 23% retirees

- Family Status: 58% families with children seeking quality schools and communities

- Housing Preferences: 65% seeking single-family homes, 35% considering condos/townhomes

Migration Impact on Housing:

- Demand Generation: New residents creating 52,000+ annual housing demand

- Price Impact: Migration supporting 4–6% of annual appreciation

- Market Sustainability: Diverse migration sources creating market stability

- Community Development: New residents supporting master-planned community expansion

- Economic Growth: Migration driving business expansion and employment growth

- Long-Term Trends: Sustainable migration patterns supporting long-term growth

Employment and Economic Growth

💼 Robust Employment Market:

- Job Creation: 28,000+ new jobs annually across diverse sectors

- Unemployment Rate: 3.8% unemployment indicating healthy job market

- Sector Diversity: Technology, healthcare, hospitality, logistics, manufacturing

- Wage Growth: 4.2% annual wage growth supporting housing affordability

- Business Expansion: 185+ major companies relocated/expanded in Nevada

- Economic Diversification: Reduced dependence on single industries

Tax and Business Environment Impact

🎯 Nevada Competitive Advantages:

- No State Income Tax: Permanent competitive advantage attracting residents and businesses

- Business-Friendly Policies: Pro-business environment supporting economic growth

- Regulatory Efficiency: Streamlined permitting and development processes

- Infrastructure Investment: Strategic infrastructure supporting business and residential growth

- Education Investment: Growing investment in education and workforce development

- Quality of Life: Climate, recreation, and lifestyle benefits attracting quality workers

📊 Growth Drivers

Investment Market Trends and Analysis

Real Estate Investment Performance

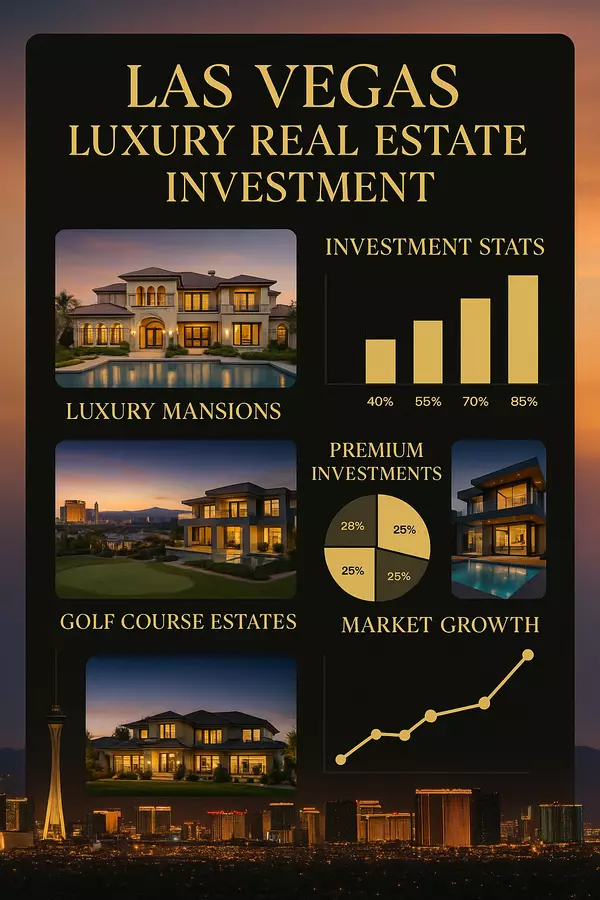

💰 Nevada Investment Market Excellence

Investment Market Scale:

- Annual Investment Volume: $2.8B+ annual real estate investment transactions

- Investor Participation: 18% of purchases by real estate investors

- Cash Transactions: 22% cash purchases indicating investor confidence

- Rental Market Size: 380,000+ rental units generating $4.8B+ annual income

- Vacation Rentals: 15,000+ short-term rentals serving 40M+ visitors

- Commercial Investment: $1.2B+ annual commercial real estate investment

Investment Performance Metrics:

- Rental Yields: 8.2% average gross rental yield across property types

- Cash-on-Cash Returns: 12–18% cash-on-cash returns with leverage

- Appreciation Performance: 8.5% annual appreciation exceeding national averages

- Total Returns: 16–26% total returns combining cash flow and appreciation

- Market Liquidity: 18 days average marketing time for investment properties

- Tenant Demand: 4.8% vacancy rate indicating strong rental demand

Investment Property Categories:

- Single-Family Rentals: $425K average price, 8.5% yields, 75% of investment activity

- Multi-Family Properties: $285K–$1.2M range, 6.8–9.2% cap rates, institutional interest

- Vacation Rentals: $485K average price, 12–18% gross yields, tourism market

- Commercial Properties: Office, retail, industrial showing strong performance

- Land Investment: Development land showing 15–25% annual appreciation

- Luxury Investment: $1M+ properties with celebrity and international appeal

Institutional and International Investment

🏢 Sophisticated Investment Capital:

- Institutional Investment: $450M+ annual institutional real estate investment

- International Capital: Growing international investment in Nevada markets

- REIT Activity: Real Estate Investment Trust acquisitions and development

- Private Equity: Private equity fund investment in Nevada real estate

- Pension Fund Investment: Pension fund allocation to Nevada commercial properties

- Opportunity Zones: Qualified Opportunity Zone investment and development

💰 Investment Data

Market Forecast and Future Outlook

Short-Term Market Projections (2025–2027)

📅 Near-Term Market Outlook

Price Appreciation Projections:

- 2025 Forecast: 7–10% appreciation continuing strong growth trajectory

- 2026 Projection: 6–9% appreciation with market maturation

- 2027 Estimate: 5–8% appreciation reflecting sustainable growth

- Cumulative Growth: 20–30% total appreciation over 3-year period

- Regional Variation: North Las Vegas leading, luxury markets stable

- Market Cycle: Continued expansion phase with eventual moderation

Market Activity Projections:

- Transaction Volume: $16–18B annual volume maintaining market liquidity

- New Construction: 50,000+ annual new home starts meeting demand

- Population Growth: 80,000+ annual new residents driving demand

- Employment Growth: 30,000+ annual job creation supporting market

- Inventory Levels: 3–4 months inventory achieving balanced market

- Days on Market: 20–25 days with slight market cooling

Long-Term Market Outlook (2025–2035)

🔮 Strategic Long-Term Projections:

- Population Growth: 1M+ additional residents over 10-year period

- Economic Diversification: Continued technology and professional services expansion

- Infrastructure Development: Major transportation and utility infrastructure expansion

- Market Maturation: Evolution to mature, stable real estate market

- Sustainable Growth: Transition to sustainable 4–6% annual appreciation

- National Recognition: Nevada established as premier relocation destination

Risk Factors and Market Considerations

⚠️ Market Risk Assessment:

- Interest Rate Sensitivity: Market sensitivity to mortgage rate changes

- Economic Cycles: National economic cycles affecting local market

- Supply Management: Construction capacity managing demand growth

- Water Resources: Long-term water resource management and development

- Climate Considerations: Climate change impact on desert living

- Policy Changes: Potential federal and state policy changes

🔮 Future Outlook

Market Opportunities and Strategic Insights

Buyer Market Opportunities

🏠 Strategic Buyer Opportunities

Optimal Buying Strategies:

- Market Timing: Current market conditions favorable for strategic buyers

- Location Selection: Growth areas offering superior appreciation potential

- Property Types: Single-family homes in master-planned communities

- Financing Optimization: Competitive mortgage rates supporting affordability

- Tax Benefits: Nevada tax advantages maximizing homeownership benefits

- Long-Term Value: Properties positioned for long-term appreciation and equity building

Priority Market Areas:

- North Las Vegas: Highest appreciation potential with affordable entry points

- Henderson: Family-focused communities with superior amenities

- Summerlin Expansion: New phases offering modern amenities and appreciation

- Reno Growth Areas: Technology sector expansion driving demand

- Master-Planned Communities: Comprehensive amenities supporting values

- New Construction: Modern features and warranties with builder incentives

Seller Market Advantages

💰 Strategic Selling Opportunities:

- Market Conditions: Strong seller's market with multiple buyer competition

- Pricing Power: Continued appreciation supporting optimal pricing

- Quick Sales: 18-day average marketing time for properly priced properties

- Cash Buyers: 22% cash transactions providing certainty and speed

- Investment Demand: Strong investor interest supporting pricing

- Market Timing: Current peak market conditions optimizing sale proceeds

Investment Market Strategies

📈 Investment Excellence Opportunities:

- Rental Property Investment: 8.2% average yields with strong tenant demand

- Fix-and-Flip Opportunities: Value-add opportunities in growth markets

- New Construction Investment: Builder partnerships and bulk purchase opportunities

- Commercial Investment: Office, retail, and industrial opportunities

- Land Banking: Development land in growth corridors

- Opportunity Zones: Tax-advantaged investment in designated areas

📈 Capitalize on Nevada Market Excellence

Leverage Nevada's exceptional real estate market trends with expert guidance, strategic positioning, and comprehensive market intelligence for optimal outcomes in America's premier growth market.

Interactive Nevada Market Tools

💰 Investment Calculator

🛠️ Comprehensive Market Resources

Conclusion: Nevada Market Leadership

Nevada real estate market trends in 2025 demonstrate exceptional strength, sustainable growth, and outstanding opportunities across all market segments. With superior economic fundamentals, strategic population migration, and comprehensive tax advantages, Nevada leads the nation in real estate market performance and investment potential.

RECN's market intelligence team provides comprehensive market analysis, trend identification, and strategic guidance for buyers, sellers, and investors seeking optimal outcomes in Nevada's dynamic real estate market. Our deep market knowledge and professional expertise ensure clients capitalize on market opportunities while navigating trends and timing for maximum success.

This content is for informational purposes only and does not constitute investment or real estate advice. Real estate markets involve inherent risks and opportunities. Consult qualified professionals for guidance specific to your real estate objectives and market timing.

Categories

- All Blogs (64)

- Agent Benefits (1)

- Agent Growth (1)

- Agent Resources (2)

- Assessment Tools (1)

- Benchmarking (1)

- Benefit Comparison (1)

- Budget Planning (1)

- Budget-Friendly Programs (1)

- Buyer Resources (1)

- Case Studies (2)

- CFO Resources (1)

- Client Services (1)

- Closing Services (1)

- Communication Strategy (1)

- Compliance Guide (1)

- Concierge Coordination (23)

- Concierge Services (3)

- Concierge vs Agents (1)

- Contractor Selection (1)

- Corporate Benefits (7)

- Corporate Housing (1)

- Corporate Programs (1)

- Corporate Relocations (1)

- Cost Analysis (1)

- Cost Calculators (1)

- Data Analytics (1)

- Digital Tools (1)

- Downsizing (1)

- Employee Benefits (21)

- Employee Housing (1)

- Employee Programs (1)

- Employee Retention (1)

- Employer Resources (1)

- Executive Resources (1)

- Family Communities (1)

- Financial Justification (1)

- Financial Planning (1)

- First-Time Buyers (1)

- First-Time Sellers (1)

- Future of Work (1)

- Future Predictions (1)

- Government Benefits (1)

- Healthcare Benefits (1)

- Henderson Employee Benefits (1)

- Henderson Home Buying (1)

- Henderson Real Estate (1)

- Home Buying Guide (1)

- Home Improvement (1)

- Home Improvement Tips (1)

- Home Maintenance (1)

- Home Selling Tips (4)

- Home Staging (2)

- Homeowner Guides (1)

- Homeowner Tips (1)

- Homeownership Support (1)

- Homeownership Tips (1)

- Housing Assistance (1)

- Housing Assistance Programs (1)

- Housing Concierge Services (1)

- HR Analytics (1)

- HR Resources (11)

- HR Strategy (2)

- Implementation Guide (4)

- Industry Analysis (1)

- Industry Trends (2)

- Investor Resources (2)

- Las Vegas Employee Benefits (1)

- Las Vegas High-End Homes (1)

- Las Vegas Investment Properties (1)

- Las Vegas Luxury Communities (1)

- Las Vegas Luxury Properties (1)

- Las Vegas Luxury Real Estate (2)

- Las Vegas Property Investment (1)

- Las Vegas Real Estate (1)

- Las Vegas Real Estate Investment (1)

- Legal Requirements (1)

- Lifetime Support (1)

- Location Independence (1)

- Luxury Investment Properties (1)

- Luxury Real Estate (1)

- Market Analysis (3)

- Market Research (2)

- Market Timing (1)

- Marketing Strategies (1)

- Marketing Tips (1)

- Medical Industry (1)

- Metrics & Analytics (1)

- Moving & Relocation (1)

- Moving Tips (1)

- Negotiation Strategies (1)

- Nevada Business (1)

- Nevada Custom Homes (1)

- Nevada Employee Benefits (1)

- Nevada Family Living (1)

- Nevada First-Time Home Buyers (1)

- Nevada Home Builders (1)

- Nevada Home Buying (1)

- Nevada Home Buying Guide (1)

- Nevada Home Buying Process (1)

- Nevada HR (1)

- Nevada Luxury Investment (1)

- Nevada Luxury Real Estate (1)

- Nevada Market Outlook (1)

- Nevada New Home Construction (1)

- Nevada Real Estate (2)

- Nevada Real Estate 2025 (1)

- Nevada Real Estate Fees (1)

- Nevada Real Estate Investment (1)

- Nevada Real Estate Market Analysis (1)

- Nevada Real Estate Market Trends (1)

- Nevada Real Estate Process (1)

- New Construction Nevada (1)

- Nonprofit Benefits (1)

- Northern Nevada (1)

- Premium Benefits (2)

- Program Evaluation (1)

- Program Management (2)

- Project Management (1)

- Provider Comparison (1)

- Public Sector (1)

- Real Estate Concierge (1)

- Real Estate Marketing (1)

- Real Estate Partnerships (1)

- Real Estate Savings (1)

- Real Estate Services (9)

- Real Estate Strategy (2)

- Real Estate Technology (1)

- Real Estate Tips (1)

- RECN Network (1)

- Referral Strategies (1)

- Relocation Assistance (1)

- Relocation Services (1)

- Remote Work Benefits (1)

- Remote Work Resources (1)

- Reno Employee Benefits (1)

- Reno Home Buying (1)

- Reno Real Estate (1)

- Rental Property Sales (1)

- Retention Strategies (2)

- ROI Analysis (3)

- ROI Projects (1)

- Seller Resources (8)

- Selling Options (1)

- Small Business Benefits (1)

- SMB Resources (1)

- Southern Nevada (1)

- Startup Benefits (1)

- Success Metrics (1)

- Success Stories (1)

- Survey Data (1)

- Tax Benefits (2)

- Tax Guide (1)

- Title & Escrow (1)

- Transaction Efficiency (1)

- Vendor Analysis (1)

- Vendor Network (1)

Recent Posts

${companyName}

Phone