Blog > Nevada Home Buying Process: Complete Step-by-Step Guide for First-Time and Move-Up Buyers

Nevada Home Buying Process: Complete Step-by-Step Guide for First-Time and Move-Up Buyers

by

Executive Summary: Nevada Home Buying Excellence

The Nevada home buying process offers exceptional opportunities for first-time and move-up buyers, combining no state income tax, diverse housing options, and professional real estate services. With strategic planning, expert guidance, and understanding of Nevada's unique advantages, buyers can successfully navigate the home buying journey to achieve homeownership in America's fastest-growing state.

Quick Answer: Nevada Home Buying Process

Timeline: 60–90 days from pre-qualification to closing

Down payment: 3.5% FHA, 0% VA/USDA, 5–20% conventional loans

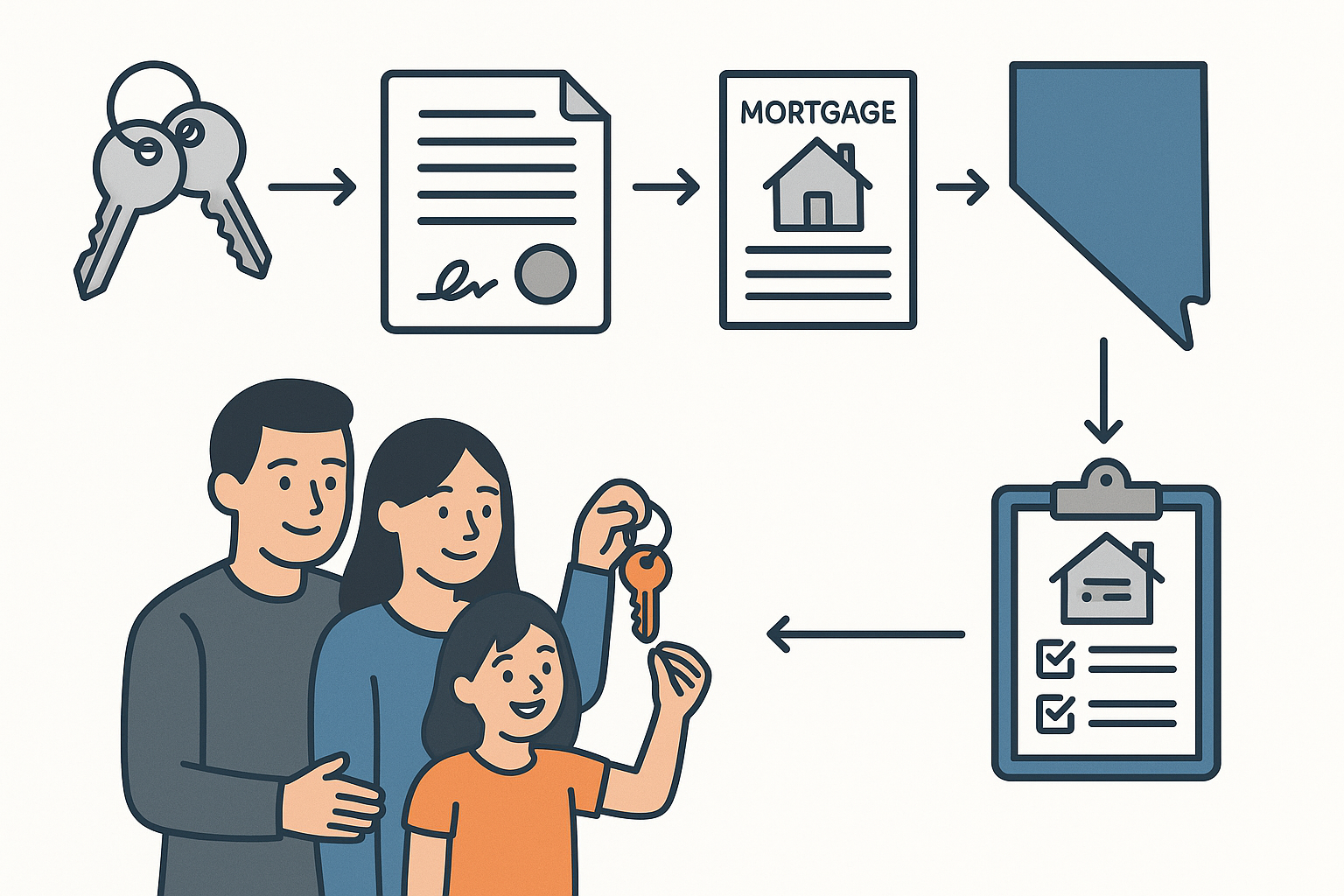

Key steps: Pre-qualification, agent selection, home search, offer, inspections, closing

Nevada benefits: No state income tax, competitive rates, diverse markets

First-time programs: FHA, VA, USDA, state assistance programs available

🏡 Nevada Home Buying Advantages:

- Tax Benefits: No Nevada state income tax maximizing purchasing power

- Diverse Options: Housing options from affordable to luxury across all lifestyles

- Professional Support: Expert real estate professionals and comprehensive services

- Financing Programs: First-time buyer programs and competitive financing options

- Quality of Life: Exceptional lifestyle, climate, and recreational opportunities

🏠 Start Process

Why Nevada Is Ideal for First-Time Buyers

Nevada vs. National Advantages

Nevada’s home buying benefits—especially the no state income tax—create 5–13% more purchasing power versus high-tax states. Competitive mortgage rates and diverse markets further empower first-time buyers.

See our Nevada market trends analysis for context.

Nevada Home Buying Process Overview

60–90 Day Typical Timeline

- Week 1: Pre-Qualification

- Week 1–2: Team Assembly

- Week 2–6: Home Search

- Week 6–7: Purchase Agreement

- Week 7–10: Inspections & Appraisal

- Week 10–12: Final Prep & Funds

- Week 12: Closing & Possession

Success Factors

| Factor | Importance | Nevada Advantage | Support |

|---|---|---|---|

| Financial Prep | Critical | Tax power | Mortgage specialists |

| Market Knowledge | High | Growing opportunities | Local experts |

| Guidance | Essential | Experienced pros | Full-service team |

| Timeline Mgmt | Important | Efficient processes | Coordination |

📅 Process Timeline

Step 1: Financial Preparation & Pre-Qualification

💳 Credit & Documentation

- Excellent (740+): Top rates, low down

- Good (680–739): Standard programs

- Fair (620–679): FHA, higher down

- Building (580–619): FHA 3.5% down

- Tax returns x2, W-2s, pay stubs

- Bank & asset statements

- Debt-to-income analysis

- Gift letter, employment proof

- No State Tax: More mortgage power

- 5–13% More Buying vs. high-tax states

Mortgage Prep

- Pre-Qualify & Pre-Approve

- Loan programs: Conventional, FHA, VA, USDA

- Rate locks & down-payment planning

Budget Planning

- PITI calculation

- HOA, closing costs (2–3%)

- Moving & setup expenses

- Emergency fund maintenance

💳 Financial Planning

Step 2: Professional Team Assembly

🏡 Agent Selection

- Local market expertise

- First-time buyer specialization

- Licensed & experienced

- Strong references & communication

🔧 Support Team

- Mortgage broker & lender

- Inspector & attorney

- Insurance & tax pros

- Title company

👥 Build Team

Step 3: Home Search & Selection

🗺️ Market & Area Analysis

Las Vegas: Summerlin, Henderson, Southwest, North LV, Downtown, Suburbs

Northern NV: Reno-Sparks, Carson City, Lake Tahoe, Minden, Fernley, Dayton

- Proximity to work & schools

- Transit & amenities

- Community character & growth

🔍 Home Search

Step 4: Offer & Negotiation

📝 Offer Components

- Purchase price & earnest money (1–3%)

- Financing terms & contingencies

- Inspection & closing dates

- Seller disclosures & HOA docs

Negotiation Tactics

- Market conditions & comps

- Escalation clauses & seller motivations

- Professional guidance

📋 Make Offer

Step 5: Inspections & Due Diligence

🔍 Inspection Requirements

- Structural, HVAC, electrical, plumbing

- Roof, exterior, desert-specific wear

- Pool/spa, landscape, energy, well & septic

- Radon, mold, pest, chimney, solar

🔍 Schedule Inspections

🏡 Achieve Nevada Homeownership Success

Navigate the process with expert guidance and professional support for homeownership success in America’s opportunity state.

📞 Buyer Team ✉️ Consultation 🌐 Home SearchNevada First-Time Home Buyer Programs

🎯 First-Time Buyer Resources

Essential Home Buying Resources

- Market Reports: Current conditions & trends

- Neighborhood Guides: Area details

- School Info: Ratings & resources

- Mortgage Calculators: Affordability analysis

- Professional Directory: Trusted providers

- Relocation Services: Moving support

Frequently Asked Questions

How long does the Nevada home buying process take?

The Nevada home buying process typically takes 60-90 days from pre-qualification to closing, depending on financing type, property condition, market conditions, and buyer preparation level.

What down payment is required for Nevada home purchases?

Down payments vary by loan type: FHA loans require 3.5%, VA and USDA loans require 0%, conventional loans typically require 5-20%. First-time buyer programs may offer additional assistance.

What are the main steps in Nevada home buying process?

Key steps include: financial preparation and pre-qualification, professional team assembly, home search and selection, purchase agreement negotiation, due diligence and inspections, final financing approval, and closing with possession transfer.

Do I need a real estate agent to buy a home in Nevada?

While not legally required, a qualified Nevada real estate agent provides essential market knowledge, negotiation expertise, professional coordination, and buyer advocacy throughout the complex home buying process.

What should I expect during Nevada home inspections?

Nevada home inspections cover structural systems, HVAC, electrical, plumbing, roof, exterior, plus desert-specific considerations like pool systems, irrigation, energy efficiency, and climate-related wear patterns.

How does Nevada's no state income tax help home buyers?

Nevada's no state income tax increases purchasing power by 5-13% compared to high-tax states, allowing buyers to qualify for larger mortgages and afford more expensive homes with the same gross income.

What financing programs are available for Nevada first-time buyers?

Nevada first-time buyers can access FHA loans (3.5% down), VA loans (0% down for veterans), USDA rural loans (0% down), conventional loans, and state-specific assistance programs with competitive rates and terms.

What are typical closing costs for Nevada home purchases?

Nevada closing costs typically range 2-3% of purchase price, including loan origination, appraisal, title insurance, escrow fees, recording fees, prepaid taxes and insurance, and other transaction-related expenses.

How do I choose the right Nevada community for home buying?

Consider employment centers, school districts, transportation access, lifestyle amenities, community character, future development plans, HOA fees, property taxes, and long-term appreciation potential when selecting Nevada communities.

What Nevada-specific contract considerations should I know?

Nevada purchase agreements include seller disclosures, HOA documentation, water rights disclosures, mining claims, environmental hazards, lead-based paint disclosures, and other state-specific requirements and protections.

Can I buy a home in Nevada while living in another state?

Yes, remote home buying is common with virtual tours, electronic document signing, professional representation, and coordination services. Many buyers relocate to Nevada for tax benefits and lifestyle advantages.

What should I know about Nevada property taxes and HOA fees?

Nevada property taxes are competitive nationally, varying by county and community. HOA fees range from $50-500+ monthly depending on amenities. Both factors should be included in affordability calculations and budgeting.

How to Navigate the Nevada Home Buying Process

- Get Pre-Qualified: Gather pay stubs, tax returns, bank statements, and credit info to obtain a pre-qualification letter from a lender for FHA, VA, USDA, or conventional financing.

- Assemble Your Team: Select a local real estate agent, mortgage broker, home inspector, title company, and insurance provider experienced in Nevada transactions.

- Define Your Criteria: Choose preferred locations (Las Vegas, Henderson, Reno, etc.), price range, home type, school districts, and must-have features.

- Start Your Home Search: Work with your agent to tour properties, attend open houses, and refine your criteria based on market inventory and personal preferences.

- Make an Offer: Prepare a competitive purchase agreement with earnest money deposit, financing and inspection contingencies, and desired closing timeline.

- Complete Inspections & Appraisal: Schedule home, pest, roof, and specialty inspections; lender orders appraisal to confirm property value for financing approval.

- Finalize Financing & Close: Satisfy lender requirements, review closing disclosures, fund closing costs, and sign documents to receive keys on closing day.

Conclusion: Nevada Home Buying Success

With no state income tax, diverse financing, and expert support, Nevada offers unparalleled home buying opportunities. From pre-qualification through closing, RECN’s specialists guide you every step for a seamless path to homeownership.

This content is informational only and not legal or financial advice. Consult professionals for guidance tailored to your circumstances.

Stay Informed with RECN Insights

Subscribe to our blog for exclusive real estate tips, market updates, and community guides.

Real Estate Concierge Network

Your gateway to exceptional real estate services with 20%+ savings on agent fees, lifetime concierge support, and comprehensive solutions for buyers, sellers, businesses, and agent partners.

Save Contact

Save my contact info directly to your phone for easy access anytime you need help.

📲 Save to PhoneCall Direct

Speak with our specialists for immediate assistance with your real estate needs.

🗣 Call NowEmail Us

Send detailed inquiries and receive comprehensive responses within 2 hours during business hours.

📤 Send EmailSchedule Video Call

Book a free 30-minute consultation to discuss your real estate needs via secure video call.

📅 Book MeetingSend Text

Text me your real estate questions about buying, selling, market conditions, or property values for fast, personalized responses.

👥 Start ChatLeave Review

Help others discover our exceptional real estate concierge services.

📝 Write Review

Agent | License ID: BS.0144709

+1(702) 213-5555 | info@recngroup.com