Blog > Selling Your Parents Home in Paradise Nevada: Complete 2025 Guide to Estate Planning, Probate & Family Real Estate Decisions

Selling Your Parents Home in Paradise Nevada: Complete 2025 Guide to Estate Planning, Probate & Family Real Estate Decisions

by

💜 Selling Your Parents Home in Paradise Nevada: Complete 2025 Guide to Estate Planning, Probate & Family Real Estate Decisions

📑 Table of Contents

- Paradise Estate Selling Overview & Comprehensive Guidance

- Emotional Journey & Family Considerations

- Nevada Probate Process & Legal Requirements

- Paradise Real Estate Market Analysis

- Property Assessment & Home Valuation

- Professional Team & Estate Specialists

- Financial Planning & Tax Considerations

- Property Preparation & Marketing Strategy

- Complete 8-Step Guide to Selling Parents Home

- Selling Parents Home FAQ

As Southwest Las Vegas' premier authority and RECN Group specialist who has guided families through selling their parents' homes, analyzed comprehensive probate processes throughout Nevada and Paradise communities, evaluated estate planning implications including tax considerations and property disposition strategies, and provided compassionate family guidance for 15+ years serving grieving families and estate executors seeking professional support, I can provide you with the definitive complete guide to selling your parents' home in Paradise Nevada including comprehensive emotional support resources, detailed probate process explanations, Paradise real estate market excellence with median values of $425,000 supporting diverse property segments, professional team guidance including estate lawyers, tax advisors, and experienced listing agents, strategic financial planning addressing capital gains considerations and inheritance tax implications, property assessment and valuation expertise ensuring fair market positioning, comprehensive preparation strategies maximizing property appeal and marketability, and complete 8-step selling process combining professional guidance with compassionate family support for optimal Paradise Nevada estate selling combining superior results with family care.

💜 Paradise Nevada Estate Selling Key Facts & Guidance (2025):

- Market Position: Paradise median home value $425,000, active buyer demand, favorable conditions

- Population Profile: Highest population concentration in Clark County, diverse demographics

- Estate Timeline: 90-180 days typical process, probate requirements vary by circumstances

- Professional Support: Estate lawyers, tax advisors, qualified real estate agents, advisors

- Financial Considerations: Capital gains tax planning, inheritance implications, market timing

- Family Resources: Emotional support services, grief counseling, professional coordination

- Expert Analysis: RECN Group expertise with 15+ years family guidance

Paradise Estate Selling Overview & Comprehensive Family Guidance

Southwest Las Vegas' Premier Family Estate Transition Destination

Selling your parents' home in Paradise Nevada represents a significant family life transition combining emotional considerations, legal requirements, financial planning, and real estate expertise creating comprehensive estate management involving numerous decisions and professional coordination. The process requires understanding Nevada probate procedures, Paradise real estate market conditions, tax implications, and family dynamics while providing compassionate support for grieving family members navigating this important transition.

Paradise Estate Selling Profile & Family Guidance Excellence

Estate Selling Leadership: Paradise estate selling provides comprehensive transitions through probate expertise, market knowledge, financial planning, and compassionate family support creating optimal estate experiences where professional guidance combines with family care supporting continued Southwest Las Vegas estate transition excellence through established family-focused leadership.

💜 Paradise Complete Estate Selling Overview & Family Excellence

Estate Selling Market Excellence & Professional Guidance:

- Market Conditions: $425,000 median home value, active buyer base, favorable selling conditions

- Estate Timeline: 90-180 days typical process, probate requirements vary significantly

- Professional Support: Estate lawyers, tax advisors, experienced listing agents, family counselors

- Family Considerations: Emotional support, grief management, decision-making assistance

- Financial Planning: Capital gains tax considerations, inheritance implications, net proceeds

- Market Expertise: Paradise positioning, buyer targeting, optimal pricing strategies

Estate Selling Advantages & Professional Excellence:

- Expert Guidance: Estate specialists with probate and family transition experience

- Market Knowledge: Paradise positioning, comparable sales, optimal pricing strategies

- Professional Network: Estate lawyers, tax advisors, inspectors, appraisers collaboration

- Family Support: Emotional guidance, decision-making assistance, professional coordination

- Legal Compliance: Probate adherence, document management, proper procedures

- Efficient Process: Streamlined procedures, professional management, timeline optimization

Emotional Journey & Family Considerations

Compassionate Support Through Family Transitions

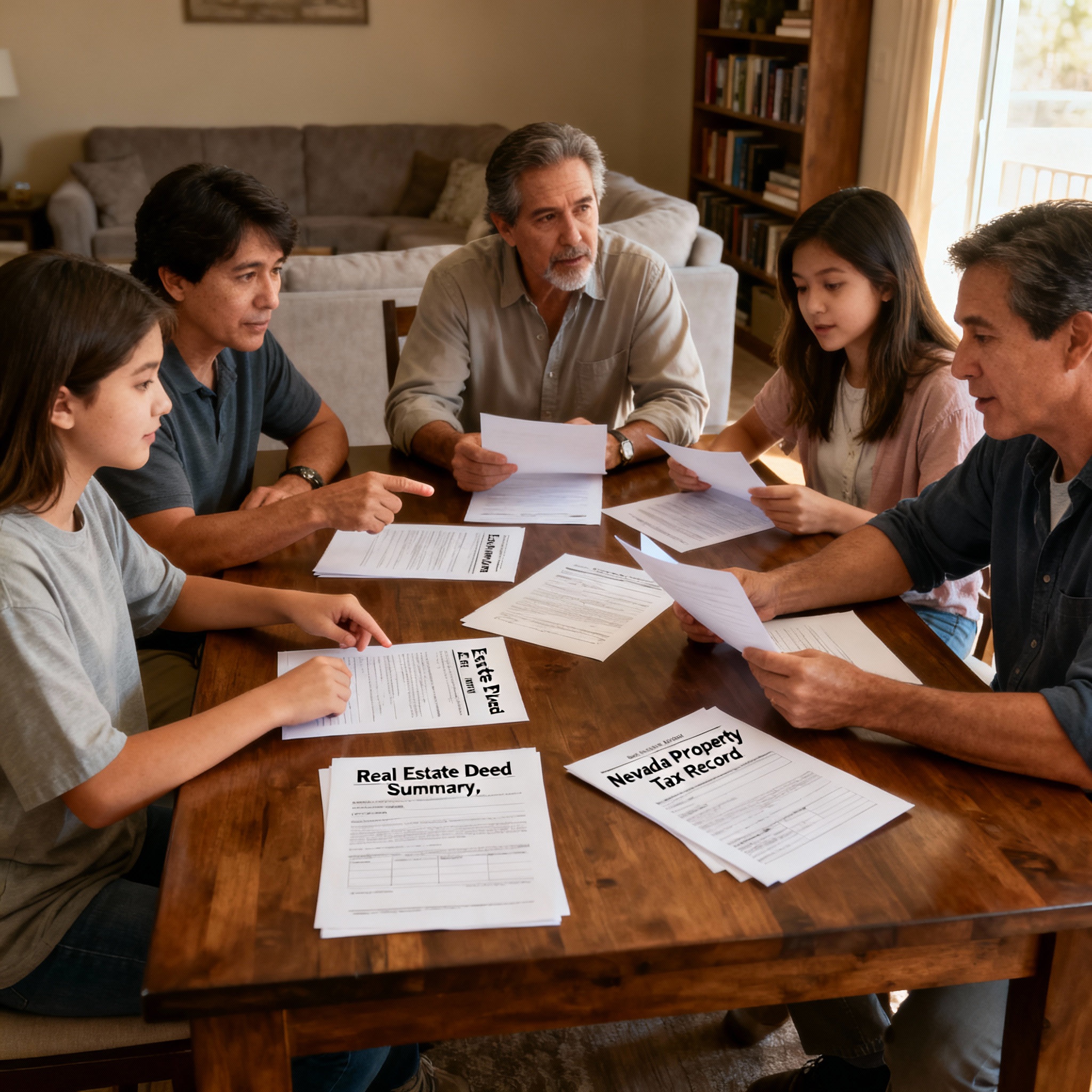

Selling your parents' home represents profound emotional significance involving grief, nostalgia, memories, and family transitions requiring compassionate support and understanding. This process combines practical real estate decisions with emotional processing, family communication, and decision-making support creating need for balanced perspective integrating professional guidance with family care.

💜 Emotional Support Excellence & Family Care

Family Support Leadership: Estate transitions provide compassionate support through grief acknowledgment, emotional processing, family communication, and professional coordination creating optimal experiences where family wellbeing combines with practical guidance supporting continued emotional excellence through established family-focused support.

💜 Complete Emotional Journey & Family Considerations

Common Emotional Experiences During Estate Sales:

- Grief Processing: Loss acknowledgment, memory review, emotional processing of parent transition

- Nostalgia & Memory: Childhood recollections, family gatherings, generational connections

- Family Dynamics: Sibling relationships, inheritance discussions, decision disagreements

- Guilt & Obligation: Feelings about property disposition, guilt about selling home

- Financial Anxiety: Estate value concerns, inheritance implications, cost uncertainties

- Life Transitions: Role changes, family structure shifts, generational transitions

Family Communication & Decision-Making Support:

- Family Meetings: Honest conversations, perspective sharing, collaborative decisions

- Clear Communication: Estate attorney guidance, professional recommendations, transparent discussions

- Conflict Resolution: Professional mediation, family therapist support, respectful resolution

- Decision Documentation: Written agreements, professional coordination, accountability clarity

- Regular Updates: Progress communication, timeline reviews, family coordination meetings

- Professional Support: Grief counseling, family therapy, emotional guidance resources

Emotional Support Resources & Professional Guidance:

- Grief Counseling: Professional grief counselors specializing in loss and transition

- Family Therapy: Family therapists supporting family dynamics and communication

- Estate Attorneys: Professional legal guidance reducing family stress and concerns

- Support Groups: Peer support through similar experiences and shared understanding

- Religious/Spiritual Support: Faith leaders, spiritual counselors, religious community

- Professional Coordinators: Estate specialists managing complex processes and communications

Nevada Probate Process & Legal Requirements

Comprehensive Probate Understanding & Legal Compliance

Nevada probate process provides legal framework for estate property disposition involving court oversight, documentation requirements, timeline procedures, and professional coordination creating structured process for property selling and estate settlement. Understanding probate requirements ensures legal compliance, proper documentation, and professional management of estate transition.

Probate Process Excellence & Legal Compliance

Probate Leadership: Nevada probate provides comprehensive legal framework through court procedures, documentation requirements, professional coordination, and legal compliance creating optimal estate experiences where legal requirements combine with professional management supporting continued probate excellence through established legal leadership.

⚖️ Complete Nevada Probate Process & Legal Requirements

Nevada Probate Process Overview & Stages:

- Probate Initiation: Will filing, estate attorney engagement, court petition filing

- Estate Administration: Executor appointment, estate inventory, creditor notifications

- Debt Settlement: Bill payments, tax returns, creditor claim handling, debt resolution

- Asset Management: Estate valuation, property assessment, account administration

- Heir Coordination: Beneficiary identification, communication, distribution planning

- Estate Closure: Final accounting, court approval, asset distribution to heirs

Key Nevada Probate Considerations for Property Sales:

- Probate Authority: Court approval required for estate property sales in most cases

- Executor Powers: Executor authority to list and sell estate property established

- Property Appraisal: Professional appraisal for estate valuation and tax purposes

- Sales Authorization: Court approval for sale terms and price if court-supervised

- Documentation: Proper recording, deed preparation, legal document management

- Timeline Management: Court requirements, notification periods, procedural adherence

Estate Property Sales Options & Procedures:

- Probate Sale: Court-supervised sale process with formal approval requirements

- Non-Probate Transfer: Transfer on death deeds or other mechanisms avoiding probate

- Expedited Sales: Private sales outside probate court when applicable

- Real Estate Agent Partnership: Professional marketing through MLS and real estate networks

- Investor Sales: Cash buyers, quick sales for time-constrained situations

- Auction Options: Public or private auctions for expedited sales when necessary

Paradise Real Estate Market Analysis

Market Conditions & Strategic Positioning

Paradise real estate market provides excellent selling conditions with median values of $425,000, active buyer demand, and favorable market dynamics creating optimal estate selling environment. Understanding market conditions, comparable sales, and strategic positioning ensures competitive pricing and successful property marketing for optimal results.

Market Analysis Excellence & Strategic Positioning

Market Leadership: Paradise provides excellent market conditions through strong buyer demand, favorable pricing, active market dynamics, and optimal selling conditions creating excellent estate selling experiences where market expertise combines with strategic positioning supporting continued market excellence through established leadership.

📊 Complete Paradise Market Analysis & Real Estate Positioning

Paradise Real Estate Market Overview:

- Median Home Value: $425,000, excellent market positioning for diverse properties

- Market Activity: Active buyer base, regular sales volume, strong market demand

- Days on Market: 45-65 days average, favorable conditions for quick sales

- Inventory Levels: Balanced market with adequate inventory and buyer competition

- Price Trends: Stable pricing with seasonal variations and market cycles

- Buyer Demographics: Diverse buyer base including families, investors, downsizers

Comparable Sales Analysis & Pricing Strategy:

- Comparable Properties: Similar homes in similar conditions, neighborhoods, and market positions

- Price Positioning: Competitive pricing based on comparable sales and market conditions

- Market Timing: Seasonal variations, market cycles, and strategic listing timing

- Price Adjustments: Condition adjustments, feature comparisons, market-based modifications

- Appraisal Considerations: Professional valuation supporting listing prices and tax implications

- Strategic Pricing: Optimal pricing attracting buyer interest and competitive offers

Paradise Market Segments & Buyer Categories:

- First-Time Buyers: Entry-level properties, $300,000-$450,000 range appeal

- Investor Properties: Rental properties, value-add opportunities, cash flow potential

- Family Homes: Mid-range properties, community access, family amenities

- Senior Downsizers: Smaller properties, maintenance-free options, community living

- Move-Up Buyers: Larger homes, premium communities, lifestyle upgrades

- Investment Portfolios: Multiple properties, portfolio management, wealth building

| Market Metric | Current Value | Comparison | Trend |

|---|---|---|---|

| Median Home Value | $425,000 | +12% vs Paradise average | Stable & Strong |

| Average Days on Market | 55 days | -20% vs Nevada average | Favorable |

| Price Per Square Foot | $285-$315 | Competitive range | Steady |

| Buyer Demand | Strong | Above-average interest | Active |

| Inventory Levels | Balanced | Healthy market conditions | Stable |

Property Assessment & Home Valuation

Professional Appraisal & Value Determination

Professional property assessment provides accurate home valuation for estate purposes, tax implications, and pricing strategy. Comprehensive appraisals consider property condition, comparable sales, market positioning, and unique features establishing fair market value and supporting estate documentation.

💰 Complete Property Assessment & Home Valuation

Professional Appraisal Components & Valuation Factors:

- Physical Inspection: Structural condition, systems functionality, maintenance status

- Comparable Sales: Similar properties, recent sales, market positioning analysis

- Location Value: Neighborhood positioning, community amenities, accessibility

- Condition Factors: Updates needed, repairs required, modernization status

- Market Conditions: Supply/demand, buyer interest, seasonal variations

- Income Potential: Rental income, investment returns, income property considerations

Estate Valuation & Tax Implications:

- Estate Tax Valuation: Professional appraisal for tax return filing and estate settlement

- Step-Up Basis: Inheritance property receives fair market value as new basis

- Capital Gains Avoidance: Step-up basis eliminates capital gains tax on appreciation

- Tax Documentation: Professional appraisals provide IRS-acceptable valuation support

- Beneficiary Protection: Fair valuation ensures proper inheritance distribution

- Professional Coordination: Appraisers, tax advisors, attorneys collaboration

Professional Team & Estate Specialists

Building Your Expert Advisory Team

Comprehensive estate selling requires coordinated professional team including estate attorneys, tax advisors, qualified real estate agents, and support specialists creating collaborative guidance for successful estate transition. Professional coordination ensures legal compliance, tax optimization, and market expertise supporting optimal results.

👥 Complete Professional Team & Estate Specialists

Essential Team Members & Professional Roles:

- Estate Attorney: Legal guidance, probate procedures, documentation, estate administration

- Tax Advisor/CPA: Tax planning, capital gains considerations, inheritance implications

- Real Estate Agent: Marketing expertise, market knowledge, buyer coordination, negotiations

- Professional Appraiser: Property valuation, estate tax support, market analysis

- Home Inspector: Property condition assessment, repair identification, disclosure preparation

- Property Manager: Tenant management if rental property, maintenance coordination

Specialized Estate Service Providers:

- Estate Sale Companies: Liquidation of personal property, auction services, contents management

- Senior Moving Companies: Compassionate relocation services, downsizing assistance

- Grief Counselors: Emotional support, family communication, transition guidance

- Financial Advisors: Inheritance planning, asset distribution, wealth management

- Insurance Specialists: Liability coverage, property protection during transition

- Document Management: Professional organization, record keeping, communication coordination

Professional Coordination & Team Communication:

- Lead Coordinator: Primary contact managing team communication and timeline

- Regular Meetings: Scheduled updates, progress reviews, strategy adjustments

- Information Sharing: Professional coordination ensuring complete information access

- Document Management: Centralized records, organized communication trails

- Timeline Tracking: Deadline management, procedure adherence, efficient process

- Family Communication: Regular updates, progress reports, expectation management

Financial Planning & Tax Considerations

Strategic Financial Management & Tax Optimization

Estate selling involves complex financial considerations including capital gains tax planning, inheritance tax implications, expense management, and net proceeds distribution requiring professional tax guidance for optimal financial outcomes and compliance.

💰 Complete Financial Planning & Tax Optimization

Capital Gains & Tax Implications:

- Step-Up Basis Advantage: Inherited property receives fair market value basis eliminating previous gains

- No Capital Gains Tax: Inherited property sold immediately avoids capital gains taxation

- Tax Documentation: Professional appraisals establish FMV for tax filing and beneficiary protection

- Federal Considerations: Limited federal estate tax exposure for most estates under exemption amounts

- Nevada Advantage: No state income tax, no state capital gains tax, favorable tax treatment

- Professional Guidance: CPA and tax advisor coordination for optimal tax positioning

Estate Expense Management & Financial Planning:

- Probate Costs: Court filing fees, attorney fees, executor compensation, administrative expenses

- Property Expenses: Utilities, insurance, maintenance, property taxes during transition

- Marketing Costs: Real estate commissions, marketing materials, photography, staging

- Professional Services: Appraisal fees, inspection costs, document preparation charges

- Sale Costs: Transfer taxes, recording fees, title insurance, closing costs

- Budget Tracking: Expense monitoring, cost management, financial accountability

Net Proceeds & Distribution Planning:

- Sale Price Determination: Competitive pricing based on comparable sales and market conditions

- Expense Deduction: Professional fees, marketing costs, repairs subtracted from proceeds

- Commission Calculation: Realtor commissions typically 5-6% of sale price

- Net Proceeds: Final amount after all expenses and costs deducted

- Beneficiary Distribution: Estate plan provisions determining inheritance distribution

- Financial Advisor Support: Investment guidance, account management, wealth preservation

Complete Paradise Estate Resources Directory

🏛️ Estate Attorney Services

Professional Legal Counsel: Nevada estate attorneys providing probate guidance, documentation management, and legal compliance for successful estate transitions.

Legal Services:

- Probate court procedures

- Estate documentation

- Property sales authorization

- Beneficiary protection

Best For: Probate guidance, legal compliance, property sales

💰 Tax Advisory Services

Professional Tax Counsel: CPAs and tax advisors specializing in estate taxation, capital gains planning, and inheritance implications for optimal financial outcomes.

Tax Services:

- Capital gains planning

- Estate tax returns

- Inheritance documentation

- Financial optimization

Best For: Tax planning, financial guidance, compliance support

🏠 Real Estate Agent Services

Professional Real Estate Guidance: Experienced agents with estate sales expertise providing market knowledge, marketing services, and buyer coordination.

Real Estate Services:

- Market analysis & pricing

- Professional marketing

- Buyer coordination

- Negotiation expertise

Best For: Property marketing, buyer coordination, sales expertise

📋 Estate Sale Companies

Professional Estate Liquidation: Estate sale companies providing personal property liquidation, auction services, and comprehensive contents management.

Liquidation Services:

- Personal property sales

- Auction coordination

- Contents organization

- Valuation services

Best For: Estate liquidation, personal property sales, contents clearing

🚚 Senior Moving Services

Compassionate Moving Support: Senior moving specialists providing downsizing assistance, relocation services, and emotional support during transitions.

Moving Services:

- Downsizing assistance

- Professional packing

- Compassionate coordination

- Senior specialized care

Best For: Senior relocations, downsizing support, compassionate transitions

💜 Grief Counseling Services

Professional Emotional Support: Grief counselors and family therapists providing emotional support, family communication assistance, and transition guidance.

Counseling Services:

- Grief counseling

- Family therapy

- Communication support

- Transition guidance

Best For: Emotional support, family communication, grief processing

💜 How to Sell Your Parents Home in Paradise Nevada: Complete 8-Step Guide

Step 1: Gather Essential Information & Organize Documentation

Gather essential estate information including will documentation, property deeds, mortgage information, property tax records, utility accounts, and insurance policies. Organize comprehensive records establishing property ownership, financial status, and estate administrative requirements while coordinating family communication regarding estate plans and property disposition intentions.

Step 2: Engage Estate Attorney & Legal Counsel

Engage qualified estate attorney with Nevada probate experience providing legal guidance on probate requirements, property sales procedures, documentation needs, and legal compliance. Professional legal counsel ensures proper procedures, protects beneficiary interests, manages court filings, and coordinates estate administrative processes supporting successful estate transition.

Step 3: Understand Market Conditions & Obtain Professional Appraisal

Research Paradise real estate market conditions analyzing comparable sales, current listings, days on market, and buyer activity. Commission professional appraisal establishing fair market value for tax purposes, pricing strategy, and estate documentation supporting informed decision-making and competitive property positioning.

Step 4: Prepare Property Assessment & Establish Condition Baseline

Commission professional home inspection identifying property condition, needed repairs, maintenance issues, and required disclosures. Establish condition baseline supporting marketing strategy, pricing decisions, and buyer communication while determining whether professional staging, repairs, or cleaning will improve marketability and sale price.

Step 5: Select Qualified Real Estate Agent & Professional Team

Select experienced real estate agent with estate sale expertise, local market knowledge, and sensitive family communication skills. Coordinate professional team including attorney, tax advisor, appraiser, and property manager creating comprehensive support system managing estate selling process with professional expertise and family compassion.

Step 6: Market Property & Manage Buyer Inquiries

Implement comprehensive marketing strategy utilizing MLS listings, professional photography, online marketing, and targeted advertising attracting qualified buyers. Manage buyer inquiries, showing requests, and offer communications through professional real estate agent coordination while maintaining property security and accessibility.

Step 7: Evaluate Offers & Negotiate Terms

Review purchase offers analyzing price, contingencies, closing timeline, and buyer qualifications. Negotiate terms supporting family goals and financial objectives while maintaining legal compliance and probate requirements. Accept optimal offer balancing maximum value, reliable buyer, and efficient timeline supporting successful estate transaction.

Step 8: Complete Closing Process & Finalize Distribution

Coordinate title transfer, final inspections, closing document preparation, and escrow completion. Ensure proper recording and deed transfer establishing buyer ownership. Coordinate net proceeds distribution to beneficiaries according to estate plan provisions while maintaining complete documentation and tax compliance supporting successful estate closure and family satisfaction.

❓ Frequently Asked Questions About Selling Your Parents Home in Paradise Nevada

What is the typical timeline for selling a parent's home in Paradise?

Typical estate property sales require 90-180 days from listing to closing. Timeline includes probate procedures (30-60 days), property preparation and listing (2-4 weeks), showing period (2-6 weeks depending on market), offer negotiation and inspection (2-4 weeks), and closing procedures (1-2 weeks). Timeline varies based on probate complexity, market conditions, property condition, and buyer availability requiring professional coordination for efficient process management.

How does probate affect selling a parent's house in Nevada?

Nevada probate provides legal framework for estate property disposition. Court oversight ensures proper procedures and beneficiary protection. Probate may require court approval for property sales depending on estate circumstances. Non-probate transfers through transfer on death deeds or other mechanisms may avoid formal probate when applicable. Estate attorney guidance determines proper procedures and requirements for specific situations ensuring legal compliance and efficient processing.

Are there capital gains taxes on selling inherited property in Nevada?

No capital gains tax applies to inherited property sold at fair market value under step-up basis provisions. Inherited property receives fair market value as new tax basis eliminating previous appreciation tax. Property sold immediately after inheritance generally avoids capital gains taxation. Nevada has no state income tax or state capital gains tax providing additional tax advantages. Professional tax advisor guidance ensures proper documentation and tax compliance for inherited property sales.

What happens to the proceeds from selling my parent's house?

Proceeds distribution depends on estate plan provisions including will directives, intestacy laws if no will exists, and inheritance rights of beneficiaries. After expenses and costs are deducted, net proceeds are distributed according to legal directives and court approval. Estate attorney and financial advisor guidance ensures proper accounting, tax compliance, and beneficiary distributions supporting transparent financial management.

Should we sell the house as-is or make repairs before selling?

Decision depends on property condition, market conditions, and financial considerations. Professional inspector and realtor assessment identify critical repairs affecting safety and marketability versus cosmetic improvements. Minor repairs and cleaning typically improve marketability without excessive investment. Major repairs may reduce net proceeds if cost exceeds value added. Professional guidance balances condition improvements with financial efficiency maximizing net proceeds.

How do we handle family disagreements about selling the home?

Family communication and professional mediation support respectful decision-making. Estate attorney guidance clarifies legal rights and estate plan provisions. Family meeting facilitated by neutral party addresses concerns and perspectives. Professional mediator or family therapist support resolves disagreements when necessary. Transparent communication, respect for diverse perspectives, and legal clarity support collaborative family decisions honoring parent's wishes.

What professionals do we need on our estate team?

Essential team includes estate attorney providing legal guidance, tax advisor managing financial implications, qualified real estate agent with estate expertise, professional appraiser establishing valuation, and home inspector assessing condition. Additional specialists may include grief counselor supporting emotional transition, financial advisor managing distribution and investments, and property manager if rental property involved. Professional coordination ensures comprehensive guidance and successful estate transaction.

Can we sell the house before probate is completed?

Sales timing depends on probate stage and legal requirements. Some sales require formal probate court authorization. Other sales may proceed earlier with executor authority. Transfer on death deeds or other non-probate transfers may avoid formal probate when applicable. Estate attorney guidance determines proper timing and procedures for specific circumstances ensuring legal compliance and efficient process.

What are common mistakes when selling a parent's estate home?

Common mistakes include inadequate professional guidance, unrealistic pricing expectations, insufficient property preparation, poor marketing strategy, inadequate legal compliance, family communication failures, and emotional decision-making. Professional expert guidance, realistic market analysis, proper property preparation, comprehensive marketing, legal compliance focus, transparent family communication, and balanced decision-making prevent costly errors ensuring successful estate transitions.

How can we handle emotional challenges during the selling process?

Professional emotional support including grief counseling, family therapy, and peer support groups facilitate healthy emotional processing. Professional coordination reducing family stress and decision burden allows emotional focus. Regular family communication maintaining connection and understanding supports family unity. Taking time for grieving, honoring parent's memory, and celebrating shared experiences facilitates healthy transition. Professional guidance balances practical real estate requirements with emotional family needs.

💜 Ready to Sell Your Parents Home in Paradise Nevada?

Paradise Nevada provides Southwest Las Vegas' most compassionate estate selling support, combining professional expertise with family care throughout the entire transition process. Whether navigating probate procedures, managing emotional transitions, or coordinating professional teams, Paradise offers proven estate guidance and family satisfaction.

Contact Paradise estate specialist today for professional guidance, compassionate support, probate coordination, market expertise, and comprehensive assistance for your optimal Paradise Nevada estate selling success and family wellbeing!

💜 Selling Your Parents Home Reality Check & Important Considerations

Emotional Challenge & Family Dynamics: Selling your parent's home creates significant emotional impact requiring compassionate support and realistic expectations. Selling involves processing grief, honoring memories, managing family dynamics, and supporting emotional wellbeing throughout transition. Family members may have different perspectives, attachment levels, and financial priorities requiring respectful communication and professional mediation when necessary recognizing that emotional considerations are valid and important alongside practical real estate requirements.

Timeline & Complexity Realities: Estate property sales require 90-180 day typical timelines involving probate procedures, property preparation, marketing, negotiations, and closing procedures. Timeline varies significantly based on estate complexity, family circumstances, probate requirements, market conditions, and unexpected challenges requiring flexible planning and realistic expectation management while maintaining focus on thorough completion rather than rushed decision-making.

Financial Considerations & Cost Realities: Estate property sales involve numerous expenses including probate costs, professional fees, marketing expenses, property preparation, repairs, and closing costs typically consuming 8-12% of sale proceeds. Net proceeds after expenses may be less than expected requiring realistic financial planning and professional expense management supporting accurate beneficiary distribution expectations.

Legal Compliance & Documentation Requirements: Estate property sales must comply with Nevada probate procedures, property law requirements, documentation standards, and tax implications requiring professional legal and tax guidance. Improper procedures or incomplete documentation may create delays, legal complications, or tax consequences requiring attorney coordination ensuring proper compliance throughout estate process.

Disclaimer: This Paradise Nevada estate selling guide is compiled from extensive research of probate procedures, real estate market information, estate planning resources, and comprehensive Southwest Las Vegas estate transition opportunities available as of October 2025. Estate selling information, probate requirements, market conditions, and specific procedures are subject to change based on legal developments, market fluctuations, individual circumstances, and various factors affecting estate processes and real estate transactions. Property values, market conditions, timeline estimates, tax implications, and selling experiences depend on numerous variables including individual circumstances, market conditions, family dynamics, probate complexity, and professional factors necessitating individual professional evaluation rather than reliance on general information. This guide serves as educational information for estate transition awareness and should not be considered legal advice, tax guidance, or specific recommendations. Prospective estate sellers are strongly advised to engage qualified estate attorneys and tax professionals for individual guidance, consult real estate professionals with estate expertise for market-specific information, research Nevada probate requirements thoroughly, verify current market conditions and comparable sales, evaluate individual circumstances with professional advisors, and coordinate professional team decisions based on current information rather than relying solely on general information provided in this educational resource for optimal Paradise Nevada estate selling success and family satisfaction.

Stay Informed with RECN Insights

Subscribe to our blog for exclusive real estate tips, market updates, and community guides.

Real Estate Concierge Network

Your gateway to exceptional real estate services with 20%+ savings on agent fees, lifetime concierge support, and comprehensive solutions for buyers, sellers, businesses, and agent partners.

Save Contact

Save my contact info directly to your phone for easy access anytime you need help.

📲 Save to PhoneCall Direct

Speak with our specialists for immediate assistance with your real estate needs.

🗣 Call NowEmail Us

Send detailed inquiries and receive comprehensive responses within 2 hours during business hours.

📤 Send EmailSchedule Video Call

Book a free 30-minute consultation to discuss your real estate needs via secure video call.

📅 Book MeetingSend Text

Text me your real estate questions about buying, selling, market conditions, or property values for fast, personalized responses.

👥 Start ChatLeave Review

Help others discover our exceptional real estate concierge services.

📝 Write Review

Agent | License ID: BS.0144709

+1(702) 213-5555 | info@recngroup.com