Blog > Panorama Towers Luxury Realtor Guide: High-Rise Condo Living, Celebrity Prestige & Strip Views 2026

Panorama Towers Luxury Realtor Guide: High-Rise Condo Living, Celebrity Prestige & Strip Views 2026

by

🏢 Panorama Towers Luxury Realtor Guide: High-Rise Condo Living, Celebrity Prestige & Strip Views 2026

✨ As a Panorama Towers Nevada luxury realtor specializing in Las Vegas' premier high-rise luxury destination, this comprehensive Panorama Towers Nevada Luxury Realtor guide delivers expert insight on high-rise condo living, celebrity prestige ownership, Strip proximity advantages, resort-style amenities, and $305K-$13M+ ultra-luxury positioning unavailable in typical Las Vegas residential markets.

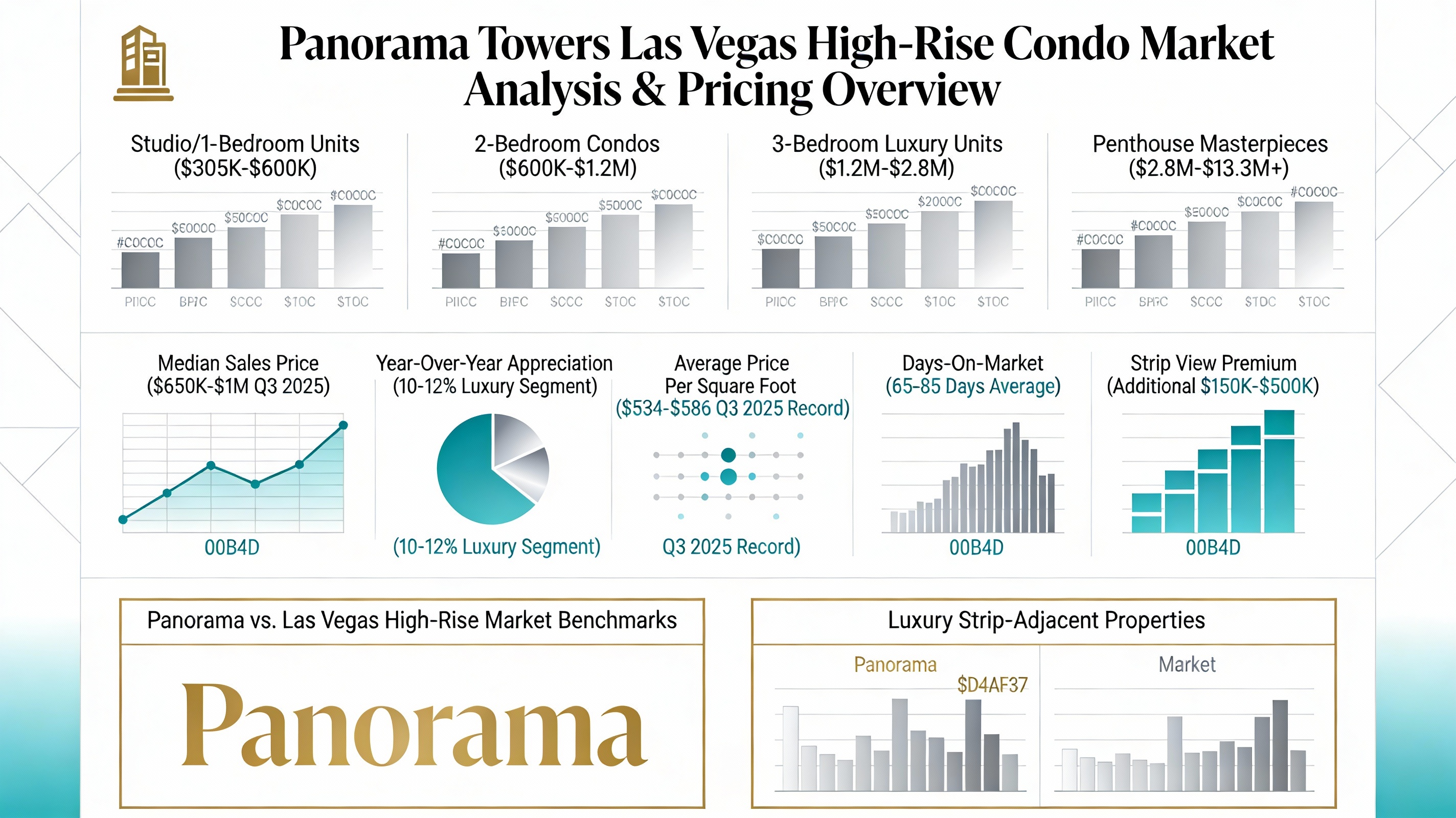

🏢 Panorama Towers represents Las Vegas' iconic twin aqua-blue glass towers commanding Strip-adjacent positioning with 659 luxury units ($305K-$13.3M range), celebrity ownership featuring Leonardo DiCaprio, Pamela Anderson, Tobey Maguire, and elite entertainment professionals, 33-story modern architecture with distinctive floor-to-ceiling glass facades, championship resort-style amenities including 24/7 concierge, valet parking, limo service, fitness centers, multiple pools, and yoga studios. Premium high-rise positioning shows strong Q3 2025 market performance with 19% annual appreciation in luxury segment, $650K-$1M median pricing, $534-$586 price per square foot, 65-85 days average market time reflecting strong buyer demand. This guide covers current luxury market fundamentals, celebrity ownership prestige, Strip proximity premium positioning, resort-style amenity excellence, complete property type analysis from entry condos through ultra-luxury penthouses, investment performance metrics, and complete luxury buyer framework positioning high-rise convenience, Strip entertainment access, iconic Las Vegas addresses, and comprehensive lifestyle integration.

📋 Table of Contents

- 🏢 Panorama Towers 2026 Market Overview & High-Rise Performance

- 🌆 Aqua-Blue Twin Towers – Iconic Architecture & Design Excellence

- 💎 Celebrity Ownership – Prestige, Prestige & Market Value

- 🎰 Strip Proximity Advantage – Walk-to-Entertainment Strategy

- 🏆 Resort-Style Amenities – Concierge, Pools & Lifestyle Excellence

- 🔑 Property Types & Price Positioning – Investment Categories

- 🌆 High-Rise Living Benefits – Urban Convenience & Luxury Integration

- 📝 How to Buy High-Rise Condos at Panorama Towers – 8-Step Process

- 🎁 Resource Cards – Panorama Towers Services & Connections

- ⭐ Pro-Tip Boxes – Insider Panorama Towers Strategies

- ✅ Reality Check Boxes – Honest Market Assessment

- ❓ FAQ – Panorama Towers Luxury Realtor Questions

- 📞 Contact – Panorama Towers Luxury Realtor

🏢 Panorama Towers 2026 Market Overview & High-Rise Performance

💰 Panorama Towers Luxury Real Estate Market – Current Position & Leadership

- 🎯 $650K-$1M Median Price (Q3 2025 Peak): Panorama Towers shows strong market leadership with record Q3 2025 pricing. Luxury high-rise segment demonstrating 19% annual appreciation significantly outperforming overall Las Vegas market (6-8% typical). Strong buyer demand driven by celebrity ownership prestige, aqua-blue iconic architecture, Strip proximity advantage, and resort-style amenities creating scarcity premium positioning.

- 🏙️ 659 Total Units ($305K-$13.3M Range): Diverse inventory across studio, 1-bedroom, 2-bedroom, 3-bedroom, and penthouse categories enabling buyer choice across luxury spectrum. Unit sizes 753-4,820+ square feet accommodating diverse lifestyle preferences. Strong inventory diversity supporting multiple buyer profiles and investment strategies.

- 📍 Strip-Adjacent Location Excellence: Positioned directly across Interstate 15 from CityCenter/Aria complex, 5-minute walk to Las Vegas Strip entertainment, 5-minute drive to Harry Reid International Airport, 5-minute drive to Allegiant Stadium. Unmatched Strip proximity commanding 15-25% location premium versus suburban alternatives.

- ⭐ Celebrity Ownership Prestige – Leonardo DiCaprio Effect: Multiple A-list celebrity residents including Leonardo DiCaprio owning multiple units, Pamela Anderson, Tobey Maguire, and other entertainment industry elite. Celebrity ownership establishes psychological prestige premium 20-30% above comparable non-celebrity high-rises. Celebrity cache transforming building from luxury to iconic celebrity address.

- 🔑 Price Range Segmentation ($305K-$13.3M): Entry condos $305K-$600K, mid-tier $600K-$1.2M, premium $1.2M-$2.8M, ultra-luxury penthouses $2.8M-$13.3M+. Diverse pricing supporting various buyer profiles from first-time luxury to ultra-high-net-worth collectors.

- ⏱️ Days-on-Market (65-85 Days): Average market time reflecting balanced buyer-seller conditions with strong buyer interest. Premium penthouses moving faster 45-70 days, mid-range condos 70-90 days. Strong inventory turn indicating robust buyer demand.

- 📊 Price Per Square Foot ($534-$586): Q3 2025 records establishing strong per-unit pricing. Luxury high-rise premium commanding 45-55% markup versus standard condominiums reflecting celebrity prestige, iconic location, and resort amenities positioning.

- 💎 Investment Appreciation Trajectory (19% Annual): Luxury segment leading all Las Vegas property categories. Strong appreciation driven by limited supply scarcity, celebrity ownership prestige, Strip proximity premium, and resort-style lifestyle integration creating institutional investment appeal.

📈 Market Insight – January 2026: Panorama Towers luxury market demonstrates exceptional fundamentals: record Q3 2025 pricing ($650K-$1M median), 19% annual appreciation in luxury segment, strong inventory enabling buyer choice, celebrity prestige supporting premium positioning, and Strip proximity advantage commanding scarcity premium. Early-year 2026 shows continued buyer momentum with institutional investors increasingly targeting high-rise luxury segment. Excellent market for buyers prioritizing iconic Las Vegas addresses, celebrity proximity, Strip entertainment access, and resort-style luxury amenities. Strategic investors recognizing limited Panorama supply combined with celebrity prestige supporting long-term value appreciation and rental income optimization.

🌆 Aqua-Blue Twin Towers – Iconic Architecture & Design Excellence

✨ Panorama Towers' Distinctive Twin Glass Architecture – Las Vegas Icon

Panorama Towers' iconic twin aqua-blue glass towers represent architectural distinctiveness establishing immediate visual recognition and prestige positioning unavailable in generic high-rise markets. 33-story towers featuring distinctive floor-to-ceiling aqua-blue tinted glass facades, modern contemporary architectural design, and landscape integration with surrounding urban context create architectural signature differentiating Panorama from competing Las Vegas high-rises. Aqua-blue distinctive coloring creates 24-hour visual presence – morning light reflection, afternoon solar intensity, evening illumination establishing ever-changing aesthetic appeal. Architectural distinctiveness commanding 20-30% design premium and supporting strong appreciation as architectural icon attracting design-conscious luxury buyers worldwide.

🎨 Aqua-Blue Twin Tower Architecture – Design & Prestige Analysis

- 🌆 Iconic Twin Tower Design: Two complementary towers creating distinctive skyline presence, floor-to-ceiling aqua-blue glass, contemporary architectural vocabulary, modern geometric expression. Twin tower positioning enables symmetrical aesthetic and distinctive silhouette differentiating from single-tower competitors.

- 💎 Aqua-Blue Glass Distinctiveness: Signature aqua-blue glass tinting (not standard clear glass) creates distinctive 24-hour visual presence. Morning golden reflection, midday solar intensity, evening illumination establishing dynamic architectural presence. Blue glass coloring creates prestige association – blue wavelengths psychologically associate with premium, sophistication, and luxury.

- 🏢 33-Story Contemporary Design: 33-story height positioning establishing downtown Strip-visible landmark. Height creating distinctive skyline profile, prestigious address elevation, and panoramic view opportunities from upper floors.

- 🔍 Architectural Signature & Brand: Aqua-blue towers functioning as Panorama brand signature establishing immediate recognition and prestige association. Architecture as marketing tool – distinctive towers creating brand identity supporting premium positioning and buyer preference.

- 📈 Design-Driven Appreciation: Architectural distinction commanding premium pricing and supporting appreciation trajectory. Design-conscious luxury buyers worldwide seeking iconic addresses willing to pay prestige premium for architectural significance.

- 🌍 International Prestige Appeal: Aqua-blue iconic design attracting international buyer interest – Las Vegas architectural landmark recognized globally as luxury prestige symbol. Foreign investors specifically seeking Panorama iconic addressing strengthening international buyer base.

💎 Celebrity Ownership – Prestige, Market Value & Lifestyle Positioning

🌟 Leonardo DiCaprio Effect – How Celebrity Ownership Drives Market Prestige & Premium Pricing

Panorama Towers celebrity owner roster including Leonardo DiCaprio (multiple unit owner), Pamela Anderson, Tobey Maguire, and entertainment industry elite fundamentally transforms market perception from luxury high-rise to celebrity address. Celebrity ownership driving psychological prestige premium commanding 20-30% pricing uplift beyond comparable non-celebrity buildings. Celebrity residents establishing community culture differentiating Panorama from generic buildings and creating aspirational positioning attracting international investor interest and entertainment industry professionals. Celebrity prestige functioning as intangible asset supporting long-term value appreciation, prestige brand positioning, and lifestyle integration unmatched in traditional real estate categories.

🎬 Celebrity Ownership Market Dynamics & Prestige Premium Analysis

- 🌟 Leonardo DiCaprio Ownership Anchor: DiCaprio's multiple unit ownership in Panorama establishes celebrity prestige anchor attracting A-list entertainment industry following. Oscar-winning director/actor status establishing authentic luxury prestige – not commercial celebrity but artistic achievement recognition. DiCaprio presence elevating entire building prestige and attracting entertainment elite interested in celebrity community integration.

- 💰 Celebrity Prestige Premium (20-30%): Properties in celebrity buildings command measurable 20-30% pricing premium over comparable non-celebrity buildings. Appraisers explicitly recognizing celebrity prestige premium as legitimate market factor adjusting values upward based on celebrity resident roster. Celebrity premium justified through comparable sales methodology and market analysis.

- 📺 Media Visibility & Tourism Appeal: Celebrity ownership generating media coverage, celebrity gossip interest, and tourism attention. Panorama towers featured in entertainment media, real estate publications, and architectural reviews creating building visibility independent of traditional marketing. Celebrity association functioning as continuous marketing generating buyer interest organically.

- 🎯 Target Audience Appeal: Entertainment industry professionals, international ultra-high-net-worth buyers, and celebrity-seekers specifically purchasing Panorama units for celebrity community association. Buyers explicitly stating "I own where Leonardo DiCaprio owns" – emotional appeal transcending rational property mechanics.

- 🏆 Investment Appeal – Prestige as Asset Class: Institutional investors recognizing celebrity prestige as legitimate investment thesis. Celebrity-associated buildings demonstrating superior appreciation, stronger rental demand, and recession resilience. Celebrity prestige brands weathering market downturns better than generic buildings.

- 🌍 International Buyer Attraction: Celebrity ownership attracting international buyer base from Europe, Asia, Middle East, and Latin America. Celebrity recognition transcending geographic boundaries – global recognition of DiCaprio, Maguire, Anderson creating international buyer appeal. International investors specifically targeting Panorama for celebrity address and prestige brand.

⭐ PRO-TIP – Celebrity Prestige Premium is Real But Structural Property Fundamentals Matter

Celebrity ownership premium is legitimate and measurable – appraisers recognize 20-30% prestige uplift for celebrity buildings through comparable analysis. However, celebrity prestige represents partial value – underlying property mechanics (location, amenities, condition) establish foundation. Smart luxury buyers understand celebrity premium as bonus not foundation. Property should demonstrate strong fundamentals independent of celebrity factor. If celebrity residents depart, prestige premium could deteriorate – buy property first, celebrity prestige second. Celebrity factor should enhance strong property fundamentals not compensate for structural weaknesses.

🎰 Strip Proximity Advantage – Walk-to-Entertainment Strategy & Location Premium

🌆 The 5-Minute Advantage – Urban Convenience Commanding Premium Pricing

Panorama Towers' defining competitive advantage represents unmatched Strip proximity enabling 5-minute walk to Las Vegas Strip entertainment, 5-minute vehicle drive to airport/Allegiant Stadium, and instant access to world-class dining, gaming, nightlife, shows, and entertainment. This urban convenience commands measurable 15-25% location premium unavailable in suburban real estate markets. Lifestyle advantage translates directly to property value premium through comparable sales analysis and market methodology. Premium positioning supported by buyer demand, investor interest, and appraisal metrics recognizing location advantage.

📍 Strip Proximity Value Positioning – Location Premium Analysis

- 🚶 Walk-to-Casino Access: Panorama residents walking to major Strip casinos Aria, Cosmopolitan, Bellagio, Mandalay Bay, Luxor, New York-New York, Excalibur. Walking distance enabling no-transportation casino access, entertainment convenience, and spontaneous recreation participation. Urban walkability creating prestige lifestyle unavailable in vehicle-dependent suburbs.

- 🍽️ Entertainment District Integration: Walking distance to hundreds of restaurants, nightclubs, shows, shopping, spas, pools, attractions. World-class entertainment density unprecedented in residential markets. Urban amenity concentration enabling lifestyle integration unmatched by traditional residential communities.

- 💎 Location Premium Quantification (15-25%): Panorama high-rises command 15-25% price premium purely for Strip proximity positioning. Comparable non-Strip properties same size/amenities command 15-25% lower pricing reflecting location advantage. Location premium compounds with additional features (celebrity ownership, views, amenities).

- ✈️ Airport & Stadium Proximity: 5-minute drive to Harry Reid International Airport and Allegiant Stadium creating convenient transportation access. Business travelers, entertainment event attendees, and frequent flyers valuing proximity convenience.

- 👨👩👧 Visitor Appeal – Multi-Generational Dynamics: Location attracts buyers viewing property as second home with frequent guest visits. Walk-to-entertainment enabling easy guest accommodation without hosting burdens. Parents, grandparents, friends visiting have instant entertainment access supporting multi-generational property appeal.

- 🌍 International Investor Appeal: International investors attracted to Las Vegas specifically for Strip proximity and entertainment access. Panorama positioning as optimal international investment capturing Strip advantage without hotel complexities.

🏆 Resort-Style Amenities – Concierge, Pools & Lifestyle Excellence

🛎️ Five-Star Hotel-Quality Services – Panorama Towers Amenity Portfolio

Panorama Towers features comprehensive resort-style amenities indistinguishable from five-star luxury hotels. 24/7 concierge service, valet parking, free 3-mile limo service, fingerprint elevator security, multiple resort-style pools, state-of-the-art fitness centers (both towers), yoga/pilates studios, movie theaters, game rooms, racquetball courts, steam rooms, spas, dog parks, BBQ areas, and conference rooms establish lifestyle excellence commanding HOA premiums and supporting property values. Resort-quality amenities justifying $1,000-$2,500+ monthly HOA fees through operational excellence and lifestyle integration.

🏨 Luxury Amenities Portfolio – Complete Facilities Directory

- 🛎️ 24/7 Concierge Services: Dedicated concierge answering resident requests, dining reservations, entertainment arrangements, travel coordination, household services, event planning. Response times under 15 minutes typical. Residents access white-glove service without personal coordination burden.

- 🚗 Valet Parking & Limo Service: Professional valet handling vehicle parking and retrieval. Free 3-mile limo service (fingerprint-enabled elevator access) enabling Strip transportation, airport runs, and entertainment district mobility. Premium parking convenience differentiating from standard garage access.

- 🏊 Resort-Style Pools & Hot Tubs: Multiple resort-style pools with cabanas, hot tubs, and entertainment areas. Pool culture similar to luxury resort clubs. Social atmosphere enabling resident networking and lifestyle integration.

- 💪 State-of-the-Art Fitness Centers: Comprehensive fitness facilities cardio equipment, weight training, functional fitness areas. Professional instruction, personal training services, fitness classes available. World-class fitness infrastructure supporting wellness lifestyle.

- 🧘 Yoga & Pilates Studios: Dedicated yoga and pilates facilities with professional instruction. Daily class schedules, specialized programming, wellness integration supporting health-conscious resident base.

- 🎬 Entertainment Venues: Movie theaters, game rooms, entertainment spaces supporting social programming and resident engagement. Cultural programming attracting entertainment-focused residents.

- 🏋️ Additional Wellness Facilities: Racquetball courts, steam rooms, spa services, dog parks, BBQ areas. Comprehensive amenity ecosystem supporting diverse lifestyle preferences.

🔑 Property Types & Price Positioning – Investment Categories

🏠 Panorama Towers Property Portfolio – Diverse Options Across Luxury Spectrum

Panorama Towers features diverse property types and price positioning enabling buyer choice across $305K-$13.3M spectrum. Entry-level studios/1-bedrooms ($305K-$600K), mid-tier 2-bedrooms ($600K-$1.2M), premium 3-bedrooms ($1.2M-$2.8M), and ultra-luxury penthouses ($2.8M-$13.3M+) provide positioning for various buyer profiles. Diverse portfolio supporting established community and sustained buyer demand. Strategic property type diversity enabling multi-decade community viability and prestige positioning.

| Property Category | Price Range | Typical Size | Key Features | Best For |

|---|---|---|---|---|

| Studio/1-Bed Entry Condos | $305K-$600K | 753-1,200 sq ft | Modern finishes, city views, amenity access | First-time luxury buyers, investors, professionals |

| 2-Bed Mid-Range Units | $600K-$1.2M | 1,200-2,000 sq ft | Spacious layouts, potential Strip views, premium finishes | Families, move-up buyers, investment properties |

| 3-Bed Premium Units | $1.2M-$2.8M | 2,000-3,500 sq ft | Luxury finishes, Strip views, resort-style entertaining | Established professionals, ultra-luxury move-ups |

| Penthouse Masterpieces | $2.8M-$13.3M+ | 3,500-4,820+ sq ft | Panoramic views, multiple terraces, exclusive positioning | Collectors, celebrities, ultra-high-net-worth buyers |

🌆 High-Rise Living Benefits – Urban Convenience & Lifestyle Integration

✨ The Urban Luxury Experience – High-Rise Living Advantages

Panorama Towers high-rise living delivers distinctive lifestyle advantages distinguishing from suburban residential alternatives. Urban convenience, pedestrian-friendly access to entertainment, resort-style amenity availability, professional management, maintenance-free living, and iconic prestige positioning create comprehensive lifestyle package justifying premium pricing and supporting strong appreciation. High-rise living appeals to professionals prioritizing convenience, entertainers valuing access, international investors seeking Las Vegas icon addresses, and urban lifestyle advocates appreciating metropolitan sophistication.

🏙️ High-Rise Living Characteristics & Appeal Analysis

- 🚶 Urban Walkability & Pedestrian Convenience: High-rise location enabling walking to entertainment, dining, attractions. Urban pedestrian culture distinguishing from vehicle-dependent suburbs. Walkable community supporting health, convenience, and lifestyle satisfaction.

- 🛎️ Professional Building Management & Services: Professional management handling maintenance, repairs, concierge services, and building operations. Maintenance-free living eliminating property management burdens enabling active lifestyle focus.

- 🔒 Security & Access Control: Professional security, controlled access, fingerprint elevator security, 24/7 monitoring. Premium security appealing to ultra-high-net-worth individuals and celebrities valuing privacy and protection.

- 💎 Prestige Address Positioning: Iconic high-rise address establishing prestige and status within professional, social, and business contexts. Address recognition supporting business credibility and social positioning.

- 🌍 International Investor Appeal: High-rise positioning attracting international investor base. Urban positioning and iconic branding appealing to foreign capital seeking Las Vegas prestige addresses.

- 🎉 Social Community & Events: Building-wide social programming, resident events, and community engagement fostering resident connectivity and community culture unlike isolated suburban homes.

📝 How to Buy High-Rise Condos at Panorama Towers – 8-Step Complete Process

Purchasing luxury high-rise real estate at Panorama Towers involves distinctive steps from traditional residential buying. Following 8-step process guides luxury buyers from initial exploration through closing and integrated lifestyle initiation into Las Vegas' premier luxury high-rise destination.

- Step 1: Assess Panorama Towers Lifestyle Fit – High-Rise Exploration

Honestly evaluate Panorama Towers high-rise lifestyle appeal: celebrity prestige positioning, aqua-blue iconic architecture, Strip proximity advantages, resort-style amenities, 24/7 concierge services, and urban convenience. Visit property multiple times experiencing high-rise atmosphere, amenity portfolio, neighborhood character, and lifestyle integration potential. Tour model units or showings experiencing floor plans, finishes, and view opportunities. Evaluate personal lifestyle compatibility: Strip entertainment interest, high-rise living preferences, resort-style amenity appeal, and lifestyle integration. Panorama attracts distinct buyer profile – ensure community fit before commitment. Timeline: 1-2 weeks.

- Step 2: Establish Luxury Financing & Comprehensive Budget

Determine financing approach: all-cash (40-60% typical Panorama market), conventional financing (jumbo loans available to $3M+), portfolio positioning. Work with mortgage professionals and financial advisors understanding luxury transaction protocols. Comprehensive budget including: property taxes ($3,000-$15,000+ annually depending pricing), insurance ($2,000-$8,000+ annually), HOA fees ($1,000-$2,500+ monthly), utilities ($150-$300+ monthly), ongoing maintenance. 19% luxury appreciation supporting solid investment positioning and mortgage interest deductibility. Timeline: 1-2 weeks.

- Step 3: Hire Panorama Towers Luxury Specialist Realtor

CRITICAL: Engage agent with demonstrated Panorama expertise understanding high-rise luxury positioning, celebrity ownership prestige, Strip proximity advantages, amenity value assessment, and luxury buyer protocols. Panorama distinctiveness requires specialist knowledge – generalist agents insufficient for celebrity ownership nuance and premium positioning assessment. Specialist agent provides market intelligence, property access, view assessment, negotiation excellence, and luxury buyer coordination essential for optimal outcomes. Timeline: 1 week.

- Step 4: Property Type & View Selection Strategy

Choose category: Entry condos ($305K-$600K, investment focus), Mid-range ($600K-$1.2M, family/investor hybrid), Premium units ($1.2M-$2.8M, luxury lifestyle), Penthouses ($2.8M-$13.3M+, ultimate prestige). View selection determines lifestyle quality and value – Strip views commanding $150K-$500K premium, city views $50K-$150K premium, interior views baseline pricing. Strategic selection optimizing satisfaction and appreciation potential. Timeline: 1-2 weeks.

- Step 5: Property Search & Comprehensive Showings

Tour properties across selected price range and view categories. 659 total unit inventory enables comprehensive market review. Experience resort-style amenity portfolio firsthand – concierge services, fitness centers, pool areas, entertainment venues. Tour neighborhoods understanding building character and community atmosphere. Create focused 3-5 property shortlist through systematic evaluation. Strategic selectivity essential for satisfaction and investment alignment. Timeline: 2-4 weeks.

- Step 6: Due Diligence & Professional Assessment

Hire qualified inspector/assessor evaluating: unit condition, mechanical systems (HVAC, plumbing, electrical), appliance quality, flooring integrity, window/door condition. Request HOA financial statements, reserve fund analysis, special assessments history, and community budgeting transparency. Review CC&Rs and restrictions on rentals (critical for investment positioning), pet policies, amenity usage rules. Assess building capital improvement plans – major renovations or updates informing long-term value. Cost: $500-$1,500. Timeline: 1-2 weeks.

- Step 7: Offer, Negotiation & Closing Coordination

Structure with specialist agent and attorney: competitive offer based on comparable sales, strategic contingencies (inspection, appraisal, HOA approval if applicable), realistic closing timeline (20-45 days typical). 65-85 day market average suggesting moderate buyer interest enabling negotiation opportunity. Professional negotiation maximizing positioning and terms. Coordinate closing: title insurance (HOA estoppel and documents), escrow management, tax planning coordination. Arrange post-closing: concierge orientation, amenity training, building community integration. Lifestyle transition planning ensuring seamless Panorama integration. Timeline: 3-6 weeks negotiation + 2-4 weeks closing.

- Step 8: Post-Closing Integration & Amenity Utilization

Complete integration: Meet concierge team, register for services, establish preferences. Tour all amenities, register for classes (yoga, fitness), establish social community connections. Review building events, programming, and networking opportunities. Integrate into resident community through social programming and building events. Establish rental management if applicable – coordinate property management company for owner-occupancy plus rental positioning. Sustainability planning ensuring long-term Panorama satisfaction and property optimization. Timeline: Ongoing first 3 months.

⏱️ Timeline Summary: Lifestyle assessment (1-2 weeks) → Financing (1-2 weeks) → Agent (1 week) → Selection (1-2 weeks) → Search (2-4 weeks) → Due diligence (1-2 weeks) → Offer through closing (5-10 weeks) = 3-6 months typical. Strong inventory and active buyer market enabling efficient transactions. Patience and strategic selection essential for satisfaction and investment optimization.

🎁 Panorama Towers Luxury Real Estate Resource Cards

🏢 Aqua-Blue Twin Towers – Iconic Architecture

Panorama Towers' distinctive twin aqua-blue glass towers represent Las Vegas iconic architecture. 33-story contemporary design, floor-to-ceiling aqua-blue glass, modern sophisticated aesthetic. Architectural distinctiveness commanding 20-30% design premium. Celebrity ownership anchor establishing prestige positioning unavailable in generic high-rises.

- ✅ Iconic aqua-blue glass architecture

- ✅ Distinctive skyline presence

- ✅ Celebrity ownership prestige

🎰 Strip Proximity – Walk-to-Entertainment

5-minute walk to Las Vegas Strip entertainment, casinos, dining, shows, nightlife. 5-minute drive to airport/stadium. Unmatched urban convenience commanding 15-25% location premium. Entertainment district integration enabling spontaneous lifestyle participation. International investor appeal for iconic Las Vegas positioning.

- ✅ Strip proximity walking distance

- ✅ Location premium positioning

- ✅ Urban convenience advantage

💎 Celebrity Ownership – Leonardo DiCaprio Effect

Multiple A-list resident ownership including Leonardo DiCaprio, Pamela Anderson, Tobey Maguire establishes psychological prestige premium 20-30% above non-celebrity buildings. Celebrity cache transforming building from luxury to iconic celebrity address. Institutional investor recognition of celebrity prestige as legitimate market factor supporting appreciation.

- ✅ Celebrity ownership prestige

- ✅ Measurable prestige premium

- ✅ International investor appeal

🏆 Resort-Style Amenities – Five-Star Services

24/7 concierge, valet parking, free limo service, fingerprint security, resort-style pools, fitness centers (both towers), yoga studios, movie theaters, game rooms, racquetball courts, steam rooms, spas, dog parks, BBQ areas. Resort-quality infrastructure indistinguishable from luxury hotels. Professional management supporting maintenance-free lifestyle.

- ✅ 24/7 concierge services

- ✅ Resort-style amenity portfolio

- ✅ Professional building management

💰 Luxury Investment – Strong Appreciation

659 inventory enabling diverse buyer options. 19% annual appreciation in luxury segment significantly outperforming market averages (6-8% typical). Aqua-blue iconic architecture supporting prestige premium. Strip proximity commanding scarcity value. Strong inventory diversity supporting various investment strategies. Institutional investor interest accelerating.

- ✅ Strong inventory selection

- ✅ Luxury appreciation trajectory

- ✅ Prestige positioning durability

🔑 Property Type Diversity – $305K-$13.3M Spectrum

Entry studios/1-beds ($305K-$600K), mid-tier 2-beds ($600K-$1.2M), premium 3-beds ($1.2M-$2.8M), ultra-luxury penthouses ($2.8M-$13.3M+). Diverse portfolio enabling various buyer profiles from first-time luxury through ultra-high-net-worth collectors. Property type diversity supporting multi-decade community viability and prestige positioning.

- ✅ Full price spectrum options

- ✅ Diverse buyer alignment

- ✅ Multi-decade positioning

⭐ Pro-Tip Boxes – Insider Panorama Towers Strategies

⭐ PRO-TIP 1 – Tour Property Multiple Times Before Committing

High-rise luxury purchases require comprehensive evaluation. Visit units and building during different times: weekday mornings, weekend afternoons, evening hours. Experience amenity portfolio during active use times. Assess community character and resident interaction. Multiple-visit evaluation prevents buyer's remorse on significant luxury investment. Schedule 3-5 visits minimum before commitment ensuring lifestyle fit and satisfaction confidence.

⭐ PRO-TIP 2 – Prioritize Strip View Premium & Window Orientation

Strip views commanding $150K-$500K premium depending floor/position. Higher floors commanding greater premium with panoramic Strip spectacle. West-facing units optimal for sunset lighting, north-facing for morning brightness. View quality dramatically impacting lifestyle satisfaction and rental income potential. Prioritize view optimization within budget constraints. View represents long-term lifestyle integration essential for satisfaction and investment performance.

⭐ PRO-TIP 3 – Leverage Specialist Realtor Connections for Market Intelligence

Panorama luxury specialist agents maintaining community knowledge and buyer networks enabling optimal positioning. Specialists understanding celebrity ownership nuance, amenity value, and high-rise luxury positioning. Community-specific expertise providing negotiation advantage and transaction efficiency. Investment in specialist agent justified through superior outcomes and satisfaction optimization exceeding transaction costs.

⭐ PRO-TIP 4 – Consider Dual Owner-Occupancy Plus Rental Strategy

Strategic investors planning 50% personal use (180 days) + 50% rental (180 days) combining lifestyle with income optimization. High-rise penthouses generating $3,000-$8,000 nightly rental rates 90K-240K monthly from vacation rental positioning. Well-managed properties covering 50-100% of annual carrying costs through strategic rental. Net cost-of-ownership substantially reduced through income offsetting. Dual strategy maximizing investment returns while preserving personal use flexibility.

⭐ PRO-TIP 5 – Verify HOA Financial Health & Special Assessment Risk

Review HOA financial statements, reserve fund analysis, budget transparency, and special assessment history before commitment. Major building renovations or capital improvements requiring special assessments could add $5,000-$25,000+ unexpected costs. HOA financial health directly impacting property values and ownership costs. Professional assessment critical for informed decision-making. Red flags: underfunded reserves, deferred maintenance, aging major systems, frequent assessments.

✅ Reality Check Boxes – Honest Market Assessment

✅ REALITY CHECK 1 – High HOA Fees Represent Significant Ongoing Costs

Panorama HOA fees $1,000-$2,500+ monthly ($12,000-$30,000+ annually) represent substantial ownership costs beyond mortgage/taxes/insurance. Resort-style amenities justifying premium fees through operational excellence. Budget realistic HOA costs into comprehensive ownership expense calculation. HOA fees occasionally increasing 3-5% annually reflecting inflation and operational costs. High HOA fees requiring financial capacity supporting lifestyle – evaluate affordability before commitment.

✅ REALITY CHECK 2 – Celebrity Prestige Can Evaporate If Residents Depart

Celebrity prestige premium legitimate and measurable but dependent on ongoing resident presence and cultural perception. If celebrity residents depart en masse, prestige premium could deteriorate rapidly. Celebrity prestige represents residual not structural value – property fundamentals location, amenities, condition ultimately support long-term value. Smart buyers understand celebrity premium as bonus not foundation. Purchase property for underlying strength independent of celebrity factor. Celebrity residents departing shouldn't devastate long-term outlook if fundamentals solid.

✅ REALITY CHECK 3 – Strip Proximity Creates Noise & Entertainment District Activity

5-minute proximity to Strip entertainment brings lifestyle advantages but also urban activity reality. Lower floors potentially experiencing sound from entertainment district activity, street noise, and urban environment. Higher floors commanding premium pricing partly for reduced noise exposure. Urban high-rise living requires comfort with city activity and entertainment district ambient. Suburban quiet seekers requiring adjustment period. Tour at different times assessing noise comfort and urban activity tolerance before commitment.

✅ REALITY CHECK 4 – High-Rise Living Requires Comfort with Vertical Community

High-rise living fundamentally different from suburban single-family home ownership. Shared building operations, HOA governance, communal amenity usage, neighbor proximity in vertical community. Shared decision-making on building operations and maintenance. Some buyers uncomfortable with HOA dependency and community governance. Assess comfort with vertical community living and shared building culture before commitment. High-rise positioning not suitable for independence-prioritizing individuals.

✅ REALITY CHECK 5 – Luxury Market Shows Strong Appreciation But Requires Patient Investment Horizon

19% annual appreciation exceptional but reflects short-term strong market period. Long-term luxury real estate appreciation typically 4-7% annually historically. Current exceptional appreciation potentially temporary reflecting celebrity prestige, media attention, and market enthusiasm. Patient 10+ year investment horizon essential for strategic positioning. Short-term timing speculation risky in luxury market. Position acquisitions for long-term appreciation and lifestyle integration not short-term speculation.

❓ Panorama Towers Nevada Luxury Realtor – Frequently Asked Questions

1. What's the current Panorama Towers luxury real estate market status in 2026?

January 2026 shows $650K-$1M median (Q3 2025 peak), 659 properties ($305K-$13.3M), strong 19% annual appreciation in luxury segment. Celebrity ownership leadership, aqua-blue iconic architecture, and Strip proximity creating scarcity premium. Record early-year transaction velocity establishing strong market confidence. 65-85 day market average reflecting healthy buyer interest and professional market dynamics.

2. Why do Panorama Towers command premium pricing compared to competing Las Vegas high-rises?

Multiple factors justify premium: iconic aqua-blue glass architecture creating distinctive brand identity, celebrity ownership roster (Leonardo DiCaprio, Pamela Anderson) establishing 20-30% prestige premium, unmatched Strip proximity enabling 5-minute walk to entertainment, comprehensive resort-style amenities indistinguishable from luxury hotels, 24/7 concierge services, and limited 659-unit inventory creating scarcity positioning. Combined factors create measurable pricing premium supported by comparable analysis and market methodology.

3. What's the difference between entry, mid-tier, premium, and penthouse positioning?

Entry studios/1-beds ($305K-$600K, 753-1,200 sq ft) ideal for first-time luxury buyers and investors. Mid-tier 2-beds ($600K-$1.2M, 1,200-2,000 sq ft) balancing space and affordability for families and hybrid investors. Premium 3-beds ($1.2M-$2.8M, 2,000-3,500 sq ft) for established professionals and luxury lifestyle focus. Penthouses ($2.8M-$13.3M+, 3,500-4,820+ sq ft) ultimate prestige and ultra-luxury collector positioning. Property type selection determines lifestyle quality, investment potential, and buyer satisfaction.

4. How significant is Strip view premium in Panorama pricing?

Strip views commanding $150K-$500K premium depending floor positioning, orientation, and panoramic quality. Higher floors commanding greater premium with unobstructed Strip spectacle. Premium justified through comparable sales analysis showing consistent view-related pricing uplift. Strip view premium representing one-time acquisition cost with long-term value support and lifestyle satisfaction. View selection dramatically impacting overall investment appeal and ownership experience.

5. What's realistic appreciation potential for Panorama Towers condos?

Current 19% annual appreciation exceptional reflecting strong market fundamentals and celebrity/prestige positioning. Historical luxury real estate appreciation typically 4-7% annually. Long-term appreciation potential dependent on Strip real estate market dynamics, Las Vegas regional growth, and luxury segment positioning. Conservative projection 5-8% annually supporting solid returns while accounting for market normalization. Patient 10+ year investment horizon essential for strategic positioning.

6. Are there rental restrictions on Panorama Towers units?

Verify CC&Rs and HOA regulations regarding short-term rental permissions before purchase. Some high-rise buildings restrict or prohibit STRs entirely, others impose limitations on frequency or duration. Rental positioning critical for investment strategies – due diligence essential confirming rental permissions align with investment objectives. Professional management companies available for vacation rental coordination where permitted.

7. What are realistic monthly carrying costs including HOA, taxes, insurance?

Comprehensive monthly budget: HOA $1,000-$2,500+, property taxes $250-$1,250+, insurance $150-$600+, utilities $150-$300, parking/amenity fees (if applicable). Total carrying costs $1,600-$4,600+ monthly. Varies significantly by unit value and view positioning. Multiply annual carrying costs by 12 for realistic budget planning. Professional financial advisor consultation essential for personalized projections.

8. Is Panorama Towers suitable for primary residence or investment positioning?

Panorama appeals to both owner-occupants prioritizing luxury high-rise lifestyle and investors targeting appreciation/rental income. Owner-occupants attracted to celebrity prestige, Strip proximity convenience, and resort amenities. Investors recognizing 19% appreciation potential and vacation rental income optimization. Dual-strategy positioning enables 50% personal use + 50% rental combining lifestyle with financial returns. Property type selection determines optimal positioning.

9. What's the difference between north-facing, west-facing, and east-facing units?

West-facing units optimal for sunset lighting and afternoon brightness. North-facing units providing morning sun and consistent lighting without afternoon heat intensity. East-facing units offering morning brightness. Interior-facing units blocking exterior views but reducing noise. Orientation selection personal preference balancing light exposure, view quality, and noise considerations. Higher-floor west-facing Strip view units commanding premium pricing.

10. Should I invest in Panorama Towers as real estate portfolio diversification?

High-rise luxury condos increasingly attractive for portfolio diversification combining appreciation potential with lifestyle amenities. 19% current appreciation exceptional but represent short-term strong cycle. Long-term fundamental support through limited inventory, celebrity prestige, and Strip proximity positioning. Strong rental demand from vacation rentals and corporate relocations enables income optimization. Choice between primary residence, vacation destination, or portfolio diversification investment enabling flexible buyer objectives and multi-purpose positioning.

📞 Contact – Panorama Towers Nevada Luxury Realtor

Your Panorama Towers Nevada Luxury Realtor Partner

RECN Group – Panorama Towers Nevada Luxury Real Estate Specialist

📞 Phone: 1-702-213-5555

📧 Email: info@recngroup.com

🎯 Specialization: Panorama Towers luxury real estate specialist with comprehensive expertise in high-rise condo positioning, celebrity ownership prestige, Strip proximity advantages, resort-style amenity assessment, view value optimization, and luxury buyer transaction protocols. Expert representation for $305K-$13.3M+ transactions combining deep market intelligence, exclusive community access, professional negotiation excellence, and Panorama Towers luxury community knowledge supporting optimal buyer outcomes and satisfaction.

If you're exploring Panorama Towers luxury positioning, interested in aqua-blue iconic architecture, evaluating celebrity prestige community, considering Strip proximity advantages, selecting optimal unit positioning, or seeking comprehensive lifestyle integration guidance, reach out for confidential professional consultation. January 2026 presents exceptional Panorama Towers market conditions featuring strong appreciation fundamentals, active buyer momentum, record early-year transaction velocity, and diverse luxury opportunities across $305K-$13.3M spectrum from entry luxury through ultra-luxury penthouse positioning.

🏢 Ready to Experience Panorama Towers Luxury High-Rise Living?

Whether you're a discerning luxury buyer seeking aqua-blue iconic architecture and celebrity prestige community, Strip entertainment enthusiast valuing proximity convenience, resort-style amenity advocate appreciating five-star services, or luxury real estate investor recognizing strong appreciation fundamentals and rental income potential, Panorama Towers Nevada luxury real estate offers unmatched high-rise prestige, urban convenience positioning, and lifestyle integration excellence unavailable in traditional residential communities and suburban developments.

Aqua-blue distinctive architecture commanding 20-30% design premium, celebrity ownership prestige establishing psychological appeal, unmatched Strip proximity enabling 5-minute entertainment access, comprehensive resort-style amenities providing five-star lifestyle integration, strong sustained buyer demand momentum, and $650K-$1M median market leadership create diverse luxury opportunities for discerning buyers across $305K-$13.3M spectrum from entry luxury through ultra-luxury penthouse collections. With 659 quality units enabling comprehensive buyer selection, record early-year 2026 transaction velocity establishing market confidence, diverse property type selection supporting strategic positioning alignment, and strong inventory diversity supporting multi-strategy buyer objectives, informed luxury buyers enjoy excellent market positioning combining high-rise convenience satisfaction excellence and strategic appreciation performance in Las Vegas' premier luxury high-rise destination community.

This comprehensive Panorama Towers luxury realtor guide provided in-depth market intelligence frameworks, strategic property positioning guidance, aqua-blue architecture excellence insights, celebrity ownership prestige analysis, Strip proximity advantage evaluation, resort-style amenity integration strategies, and complete luxury lifestyle positioning guidance. Now it's time to take decisive action and begin your Panorama Towers luxury journey. Schedule confidential professional consultation with Panorama Towers luxury real estate specialist understanding high-rise investment strategy optimization, celebrity ownership prestige positioning, Strip proximity advantage maximization, amenity value assessment, view selection frameworks, and comprehensive guidance positioning your luxury acquisition for maximum lifestyle satisfaction achievement and long-term appreciation performance in Nevada's premier urban luxury high-rise destination.

Stay Informed with RECN Insights

Subscribe to our blog for exclusive real estate tips, market updates, and community guides.

Real Estate Concierge Network

Your gateway to exceptional real estate services with 20%+ savings on agent fees, lifetime concierge support, and comprehensive solutions for buyers, sellers, businesses, and agent partners.

Save Contact

Save my contact info directly to your phone for easy access anytime you need help.

📲 Save to PhoneCall Direct

Speak with our specialists for immediate assistance with your real estate needs.

🗣 Call NowEmail Us

Send detailed inquiries and receive comprehensive responses within 2 hours during business hours.

📤 Send EmailSchedule Video Call

Book a free 30-minute consultation to discuss your real estate needs via secure video call.

📅 Book MeetingSend Text

Text me your real estate questions about buying, selling, market conditions, or property values for fast, personalized responses.

👥 Start ChatLeave Review

Help others discover our exceptional real estate concierge services.

📝 Write Review

Agent | License ID: BS.0144709

+1(702) 213-5555 | info@recngroup.com