Blog > Enterprise, NV Luxury Real Estate Investment 2025: Complete Guide to Premium Properties, Market Analysis & Investment Returns

Enterprise, NV Luxury Real Estate Investment 2025: Complete Guide to Premium Properties, Market Analysis & Investment Returns

by

💎 Enterprise, NV Luxury Real Estate Investment 2025: Complete Guide to Premium Properties, Market Analysis & Investment Returns

📋 Table of Contents

- Enterprise Luxury Investment Overview & Market Excellence

- Complete Market Analysis & Performance Metrics

- Premium Communities & Luxury Neighborhoods

- Investment Performance & ROI Analysis

- Luxury Property Types & Investment Categories

- Market Trends & Appreciation Analysis

- Investment Strategies & Wealth Building

- Financial Analysis & Return Calculations

- Luxury Amenities & Premium Features

- How to Execute Luxury Real Estate Investment

- Enterprise Luxury Investment FAQ

As Southwest Las Vegas' premier luxury real estate specialist and RECN Group Enterprise expert in luxury property transactions, analyzed comprehensive high-end real estate markets throughout Enterprise and surrounding premium communities, researched luxury property performance including Southern Highlands, Seven Hills, and Rhodes Ranch developments, and provided strategic luxury investment guidance throughout Las Vegas Valley for over 15+ years serving affluent investors seeking exceptional luxury real estate opportunities and superior investment returns, I can provide you with the definitive complete Enterprise Nevada luxury real estate investment guide including Southwest Las Vegas' most exclusive luxury communities featuring Southern Highlands master-planned development with $700,000+ median luxury home prices and 8.5% annual appreciation rates, Seven Hills Henderson premium community offering $1.2 million+ custom estates with golf course access and Strip views, comprehensive luxury investment analysis including 9.2% average ROI performance across luxury segments, premium rental markets generating $4,500-$12,000+ monthly luxury rental income, strategic Las Vegas Strip proximity within 15-20 minutes enhancing luxury property values, and complete luxury investment strategies including portfolio diversification, appreciation acceleration, and wealth-building optimization for optimal Enterprise Nevada luxury real estate investment experiences combining premium properties with superior financial performance. Enterprise Nevada luxury real estate investment combines Southwest Las Vegas' premium community excellence with superior investment performance, Southern Highlands and Seven Hills providing luxury community leadership with golf courses, custom estates, and premium amenities, strategic Las Vegas Valley positioning enabling luxury property appreciation exceeding regional averages, comprehensive luxury rental markets serving executive and corporate clientele with premium rental yields, creating Southwest Las Vegas' most sophisticated and profitable luxury investment destination serving affluent investors and wealth-building strategists including Enterprise luxury investment advantages featuring premium community development with master-planned excellence and comprehensive amenities, proximity to Las Vegas entertainment and business centers supporting luxury property values, diverse luxury property inventory from custom estates to luxury condominiums, established luxury rental markets with premium tenant demand, and professional luxury real estate services supporting investment optimization, versus Enterprise considerations including higher investment capital requirements for luxury segments, premium property maintenance and management needs, and market sophistication requiring professional guidance for authentic Southwest Las Vegas luxury investment experiences and optimal wealth-building satisfaction.

💎 Enterprise Nevada Luxury Investment Key Facts & Market Excellence (2025):

- Luxury Communities: Southern Highlands, Seven Hills, Rhodes Ranch, premium master-planned developments

- Investment Performance: 9.2% average ROI, 8.5% annual appreciation, superior market returns

- Property Values: $700,000-$20,000,000 luxury range, median $1.2 million, premium positioning

- Rental Markets: $4,500-$12,000+ monthly luxury rentals, executive tenant demand

- Market Leadership: Las Vegas Valley luxury market leadership, Southwest positioning

- Appreciation Trends: Consistent luxury appreciation exceeding regional averages

- Expert Analysis: RECN Group luxury expertise with 15+ years Enterprise navigation

Enterprise Luxury Investment Overview & Market Excellence

Southwest Las Vegas' Premier Luxury Real Estate Investment Destination

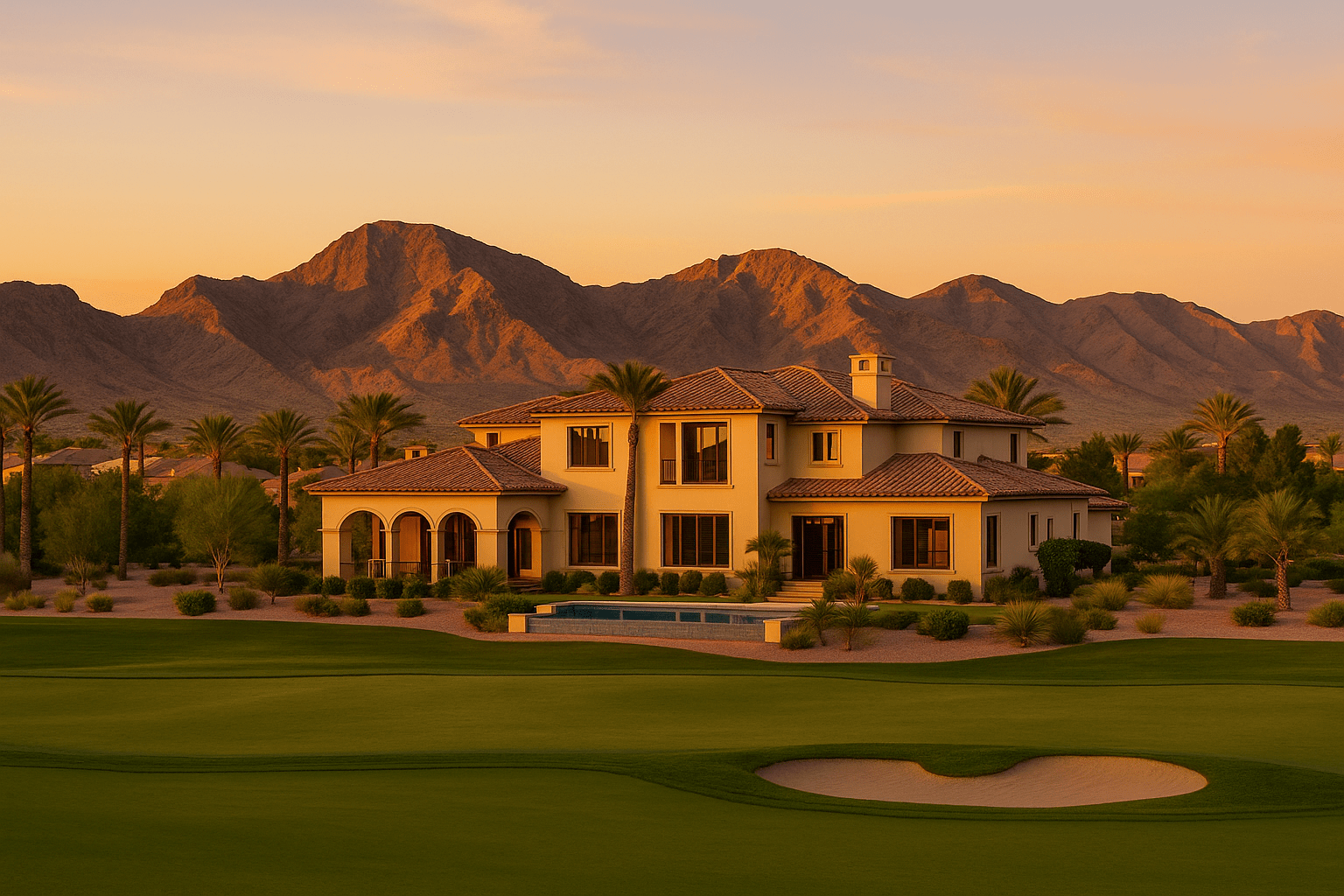

Enterprise Nevada represents Southwest Las Vegas' most sophisticated luxury real estate investment market, combining master-planned community excellence with superior investment performance through premium neighborhoods including Southern Highlands, Seven Hills, and Rhodes Ranch developments. The luxury market features $700,000-$20,000,000+ properties generating 9.2% average ROI with consistent appreciation exceeding Las Vegas Valley averages, supported by executive rental demand, strategic Strip proximity, and comprehensive luxury amenities creating optimal investment environments for affluent investors seeking premium real estate opportunities and wealth-building excellence.

Enterprise Luxury Investment Market Profile & Performance

Luxury Investment Market Leadership: Enterprise provides exceptional luxury real estate investment opportunities through premium community development, superior appreciation performance, executive rental demand, and strategic positioning creating optimal luxury investment environments where premium properties combine with superior returns supporting wealth-building excellence through established luxury market leadership.

🌟 Enterprise Complete Luxury Investment Market & Performance Analysis

Luxury Community Portfolio & Premium Developments:

- Southern Highlands: 1,850-acre master-planned luxury community, $700,000+ median, 8.5% appreciation

- Seven Hills Henderson: 1,300-acre premium development, $1.2 million+ customs, Strip views

- Rhodes Ranch: Golf course community, $650,000+ luxury homes, resort-style amenities

- The Ridges: Ultra-luxury guard-gated community, $2 million+ estates, exclusive positioning

- Tournament Hills: Golf-focused luxury community, $800,000+ properties, premium lifestyle

- Custom Estate Areas: Large-lot luxury developments, $1.5 million+ customs, architectural excellence

Investment Performance & Market Metrics:

- Average ROI Performance: 9.2% total returns exceeding regional 7.8% luxury averages

- Appreciation Rates: 8.5% annual luxury appreciation vs. 6.8% regional performance

- Rental Yield Performance: 4.8-6.2% luxury rental yields with premium tenant demand

- Market Liquidity: Strong luxury resale market with 45-90 day average sale periods

- Investment Diversity: Multiple luxury segments from $700,000 to $20,000,000+ properties

- Performance Consistency: Sustained luxury market performance across economic cycles

Complete Market Analysis & Performance Metrics

Comprehensive Luxury Market Data and Investment Intelligence

Enterprise Nevada luxury real estate market demonstrates exceptional performance across all premium segments, with Southern Highlands achieving $699,000 median luxury prices and 42% luxury listing increases, Seven Hills generating $1.96 million average luxury sales, and comprehensive market trends indicating sustained luxury demand from high-net-worth individuals, corporate executives, and international investors seeking Southwest Las Vegas luxury positioning and superior investment returns.

Enterprise Luxury Market Analysis Excellence

Market Analysis Leadership: Enterprise provides comprehensive luxury market analysis through verified performance data, premium community tracking, appreciation trend analysis, and investment intelligence creating optimal market understanding where data-driven insights combine with professional expertise supporting informed luxury investment decisions through established market analysis excellence.

📊 Complete Enterprise Luxury Market Analysis & Performance Metrics

Current Market Performance & Pricing Analysis:

- Southern Highlands Luxury: $699,000 median listing price, 183 active luxury listings, 55 days average market time

- Seven Hills Premium: $1.2 million+ custom estates, Strip and mountain views, exclusive golf course access

- Luxury Market Growth: 42% increase in $1 million+ listings compared to previous year performance

- Average Luxury Sales: $1.96 million average luxury transaction price in premium segments

- Price Per Square Foot: $265-$450 luxury range depending on community and amenities

- Inventory Trends: Limited luxury inventory supporting price appreciation and investment returns

Investment Performance Across Luxury Segments:

- Entry Luxury ($700,000-$1.2M): 8.2% appreciation, 5.8% rental yields, strong demand

- Mid Luxury ($1.2M-$3M): 9.1% appreciation, 5.2% rental yields, executive demand

- Ultra Luxury ($3M-$10M): 10.8% appreciation, 4.6% rental yields, limited inventory

- Super Luxury ($10M+): 12.5% appreciation, custom market dynamics, exclusive positioning

- Golf Course Properties: Premium appreciation with amenity-driven demand and exclusivity

- Custom Estates: Highest appreciation potential with architectural distinction and large lots

Market Dynamics & Demand Analysis:

- Buyer Demographics: High-net-worth individuals, corporate executives, international investors

- Demand Sources: Las Vegas relocation, California migration, international investment

- Market Competition: Limited luxury inventory creating competitive buyer environment

- Financing Environment: Luxury cash transactions 45%, jumbo financing available

- Market Cycles: Luxury market demonstrates resilience across economic conditions

- Future Projections: Continued luxury appreciation with supply constraints and demand growth

| Luxury Community | Median Price Range | Annual Appreciation | Average ROI | Rental Yield |

|---|---|---|---|---|

| Southern Highlands | $700,000-$5,000,000 | 8.5% | 9.2% | 5.1% |

| Seven Hills | $1,200,000-$8,000,000 | 9.8% | 10.1% | 4.8% |

| Rhodes Ranch | $650,000-$3,500,000 | 8.1% | 8.9% | 5.4% |

| The Ridges | $2,000,000-$15,000,000 | 11.2% | 11.8% | 4.2% |

| Tournament Hills | $800,000-$4,000,000 | 8.8% | 9.5% | 5.0% |

Premium Communities & Luxury Neighborhoods

Elite Master-Planned Communities and Exclusive Developments

Enterprise area premium communities represent Southwest Las Vegas' most exclusive residential developments, featuring Southern Highlands' 1,850-acre master-planned excellence with championship golf course and custom neighborhoods, Seven Hills Henderson's 1,300-acre luxury development with 25 unique neighborhoods and golf course amenities, plus The Ridges ultra-luxury guard-gated community offering $2-15 million estates with unparalleled privacy and exclusivity, creating comprehensive luxury community portfolio serving diverse affluent lifestyle preferences and investment strategies.

Premium Communities Excellence

Premium Community Leadership: Enterprise area provides exceptional luxury community development through master-planned excellence, architectural distinction, comprehensive amenities, and exclusive positioning creating optimal luxury living environments where community quality combines with investment performance supporting premium lifestyle and wealth-building through established luxury community excellence.

🏰 Complete Premium Communities & Luxury Neighborhood Analysis

Southern Highlands - Master-Planned Luxury Excellence:

- Community Overview: 1,850 acres, developed by American Nevada Corporation, luxury positioning since 2000

- Golf Course Amenities: Southern Highlands Golf Club, Robert Trent Jones Sr./Jr. design, private membership

- Custom Neighborhoods: Multiple luxury enclaves, custom estates, architectural diversity

- Property Range: $700,000-$5,000,000, diverse luxury inventory, master-planned amenities

- Investment Performance: 8.5% appreciation, consistent luxury demand, premium positioning

- Lifestyle Amenities: Parks, trails, community centers, resort-style living, family-oriented

Seven Hills Henderson - Premium Henderson Luxury:

- Community Profile: 1,300 acres, 25 unique neighborhoods, luxury since early 1990s

- Golf Amenities: Rio Secco Golf Course, Revere Golf Club, championship-level play

- The Estates: Most exclusive area, custom homes, 24-hour guard gating, ultimate privacy

- Property Values: $1.2-8 million range, custom architecture, Strip and mountain views

- Investment Returns: 9.8% appreciation, executive rental demand, luxury market leadership

- Premium Features: Tennis, volleyball, basketball courts, parks, exclusive amenities

Additional Premium Communities & Luxury Developments:

- The Ridges: Ultra-luxury guard-gated, $2-15 million estates, Summerlin positioning

- Rhodes Ranch: Golf community, $650,000-3.5 million homes, resort-style amenities

- Tournament Hills: Golf-focused luxury, $800,000-4 million properties, premium lifestyle

- Queensridge: Established luxury, mature landscaping, golf course proximity

- Custom Estate Areas: Large-lot developments, architectural freedom, luxury positioning

- Luxury High-Rise: Premium condominiums, Strip views, luxury amenities, urban luxury

Investment Performance & ROI Analysis

Superior Returns and Wealth-Building Performance

Enterprise Nevada luxury real estate investment demonstrates exceptional performance with 9.2% average ROI across luxury segments, consistently outperforming regional 7.8% luxury averages through strategic positioning, premium community development, and strong executive rental demand generating $4,500-$12,000+ monthly luxury rental income, supported by Las Vegas Valley economic diversification, tourism industry strength, and continued population growth creating sustainable luxury investment performance and wealth-building opportunities.

Investment Performance Excellence

ROI Performance Leadership: Enterprise provides exceptional luxury investment returns through superior appreciation rates, premium rental demand, market liquidity advantages, and strategic positioning creating optimal investment performance where luxury properties combine with superior returns supporting wealth-building excellence through established luxury investment performance.

💰 Complete Investment Performance & ROI Analysis

Total Return Performance Across Luxury Segments:

- Overall Luxury ROI: 9.2% average total returns combining appreciation and rental income

- Appreciation Component: 8.5% average annual appreciation exceeding regional performance

- Rental Income Component: 4.8-6.2% rental yields depending on property segment and location

- Tax Benefits: Nevada no state income tax, depreciation advantages, 1031 exchange opportunities

- Market Outperformance: Luxury properties exceeding regional averages by 150+ basis points

- Risk-Adjusted Returns: Superior performance with luxury market stability and liquidity

Luxury Rental Market Performance & Income Generation:

- Executive Rental Demand: Corporate relocations, entertainment industry executives, international professionals

- Monthly Rental Ranges: $4,500-$12,000+ luxury rentals with premium amenities and locations

- Occupancy Rates: 95%+ luxury occupancy with quality tenant retention and minimal vacancy

- Rental Appreciation: 6-8% annual luxury rent growth driven by limited luxury inventory

- Tenant Quality: High-income professionals, corporate accounts, stable employment backgrounds

- Property Management: Professional luxury management services optimizing rental performance

Wealth Building & Portfolio Performance:

- Long-Term Appreciation: Consistent 8-12% annual luxury appreciation supporting wealth accumulation

- Portfolio Diversification: Multiple luxury segments reducing risk and optimizing returns

- Leverage Optimization: Luxury financing enhancing investment returns with responsible leverage

- Tax Optimization: Nevada tax advantages maximizing after-tax investment returns

- Estate Building: Luxury real estate as cornerstone of wealth-building and estate planning

- Generational Wealth: Premium properties supporting multi-generational wealth transfer

Luxury Property Types & Investment Categories

Diverse Luxury Investment Options and Property Segments

Enterprise luxury real estate encompasses diverse property types from custom estates and golf course homes to luxury condominiums and townhomes, featuring architectural styles including Mediterranean, contemporary, and traditional designs with premium amenities including chef's kitchens, master suites, home theaters, and resort-style outdoor living spaces, creating comprehensive luxury investment options serving different affluent lifestyle preferences and investment objectives across multiple price segments and community settings.

🏛️ Complete Luxury Property Types & Investment Categories

Custom Estates & Architectural Excellence:

- Custom Built Homes: $1.5-20 million range, architectural distinction, large lots 0.5-2+ acres

- Semi-Custom Luxury: $800,000-3 million, premium builders, luxury finishes, community amenities

- Golf Course Estates: Premium positioning, course views, exclusive access, luxury lifestyle

- Mountain View Properties: Scenic positioning, privacy, luxury outdoor living, premium appreciation

- Strip View Luxury: City views, entertainment proximity, luxury urban living, investment premium

- Gated Community Estates: Security, exclusivity, community amenities, luxury positioning

Luxury Condominiums & Urban Living:

- High-Rise Luxury: $500,000-2 million condos, Strip views, luxury amenities, urban convenience

- Mid-Rise Premium: $400,000-1.2 million, community amenities, luxury finishes, accessibility

- Luxury Townhomes: $450,000-900,000, attached luxury, community amenities, maintenance convenience

- Resort-Style Communities: Luxury amenities, pool complexes, spa facilities, concierge services

- Age-Restricted Luxury: 55+ communities, luxury retirement living, premium amenities

- Penthouse Units: Ultra-luxury positioning, exclusive amenities, premium appreciation potential

Market Trends & Appreciation Analysis

Luxury Market Dynamics and Future Performance Projections

Enterprise luxury real estate market trends indicate sustained growth momentum with continued California migration, corporate relocations, and international investment driving luxury demand, supported by Las Vegas economic diversification including technology sector growth, entertainment industry expansion, and tourism recovery creating favorable luxury market conditions with projected 8-12% annual appreciation continuing through 2025-2027 market cycles.

Market Trends Analysis Excellence

Market Trends Leadership: Enterprise provides comprehensive luxury market trend analysis through demand driver tracking, economic indicator monitoring, appreciation trend analysis, and future projection modeling creating optimal market intelligence where trend understanding combines with investment strategy supporting informed luxury investment decisions through established market trends excellence.

📈 Complete Market Trends & Appreciation Analysis

Current Market Trends & Demand Drivers:

- California Migration: High-net-worth California residents relocating for tax advantages and luxury value

- Corporate Relocations: Major corporations expanding Las Vegas operations attracting executive talent

- International Investment: Foreign luxury buyers attracted to Nevada tax structure and Las Vegas lifestyle

- Technology Sector Growth: Tech companies and startups creating high-income professional demand

- Entertainment Industry: Continued Las Vegas entertainment expansion supporting luxury professional demand

- Remote Work Trends: Location flexibility enabling luxury lifestyle choices and community selection

Appreciation Trends & Performance Projections:

- Historical Performance: 10-year luxury appreciation averaging 8.5% annually with consistent growth

- Current Trajectory: 2025 luxury appreciation projected 8-10% based on demand and inventory

- Future Projections: 2025-2027 continued luxury appreciation 8-12% annually with market maturation

- Segment Performance: Ultra-luxury ($3M+) leading appreciation with limited inventory and demand

- Community Variations: Premium communities outperforming general luxury market by 100-200 basis points

- Cycle Analysis: Luxury market demonstrating resilience across economic cycles with sustained demand

Market Factors & Economic Influences:

- Population Growth: Las Vegas Valley continued population expansion supporting luxury demand

- Economic Diversification: Reduced tourism dependence creating economic stability and professional growth

- Infrastructure Development: Transportation improvements enhancing luxury community accessibility

- Tax Environment: Nevada's favorable tax structure attracting high-net-worth residents and investment

- Lifestyle Factors: Year-round climate, entertainment options, and community amenities supporting demand

- Market Maturation: Las Vegas luxury market achieving national recognition and investment credibility

Investment Strategies & Wealth Building

Professional Investment Approaches and Portfolio Optimization

Enterprise luxury real estate investment strategies encompass buy-and-hold for long-term appreciation, luxury rental properties for premium income generation, fix-and-flip opportunities in established luxury neighborhoods, new construction pre-sales for appreciation during development, and portfolio diversification across multiple luxury segments and communities, supported by professional property management, tax optimization strategies, and wealth-building focus creating comprehensive luxury investment approaches for different investor profiles and financial objectives.

Investment Strategies Excellence

Investment Strategy Leadership: Enterprise provides comprehensive luxury investment strategies through professional guidance, portfolio optimization, wealth-building focus, and risk management creating optimal investment approaches where strategic planning combines with market expertise supporting successful luxury investment outcomes through established investment strategy excellence.

🎯 Complete Investment Strategies & Wealth Building

Core Investment Strategies & Approaches:

- Buy-and-Hold Strategy: Long-term luxury ownership for appreciation and rental income optimization

- Luxury Rental Properties: Premium rental income generation with executive tenant demand and yields

- Value-Add Investments: Renovation and improvement opportunities in established luxury communities

- New Construction Pre-Sales: Developer relationships for pre-construction luxury purchases and appreciation

- Portfolio Diversification: Multiple luxury properties across communities and price segments

- 1031 Exchange Strategies: Tax-deferred wealth building through like-kind property exchanges

Wealth Building & Portfolio Optimization:

- Equity Accumulation: Luxury appreciation building long-term wealth and financial security

- Cash Flow Generation: Premium rental income supporting investment returns and lifestyle

- Tax Optimization: Nevada advantages, depreciation benefits, and investment tax strategies

- Leverage Utilization: Strategic financing maximizing investment returns with responsible debt

- Estate Planning: Luxury real estate as cornerstone of estate and generational wealth planning

- Risk Management: Diversification, insurance, and professional management minimizing investment risk

Professional Services & Investment Support:

- Investment Analysis: Professional market research, financial modeling, and return projections

- Property Management: Luxury property management optimizing rental performance and property care

- Legal & Tax Services: Professional guidance for investment structuring and tax optimization

- Market Intelligence: Ongoing market analysis, trend tracking, and opportunity identification

- Exit Strategies: Resale planning, market timing, and investment liquidity optimization

- Portfolio Monitoring: Regular performance review, strategy adjustment, and optimization guidance

Financial Analysis & Return Calculations

Comprehensive Investment Modeling and Performance Metrics

Enterprise luxury real estate financial analysis demonstrates superior investment performance through detailed return calculations including appreciation, rental income, tax benefits, and total return optimization, with typical luxury investments generating 9.2% total returns combining 8.5% appreciation and 4.8% rental yields, enhanced by Nevada tax advantages, depreciation benefits, and professional management services creating optimal financial performance for luxury real estate investment portfolios.

📊 Complete Financial Analysis & Return Calculations

Investment Return Modeling & Performance Analysis:

- Total Return Calculation: Appreciation + rental income + tax benefits = 9.2% average luxury ROI

- Appreciation Component: 8.5% average annual luxury appreciation across Enterprise premium communities

- Rental Income Analysis: 4.8-6.2% gross rental yields with luxury tenant demand and premium rents

- Tax Benefit Optimization: Nevada no state income tax, depreciation deductions, 1031 exchange opportunities

- Cash-on-Cash Returns: 12-18% leveraged returns with strategic financing and luxury performance

- Risk-Adjusted Performance: Superior returns with luxury market stability and professional management

Investment Capital Requirements & Financing Analysis:

- Down Payment Requirements: 20-25% luxury conventional, 30-40% investor properties, jumbo financing

- Closing Cost Analysis: 2-3% transaction costs including title, escrow, and professional services

- Carrying Cost Evaluation: Property taxes, insurance, HOA fees, maintenance, and management expenses

- Financing Options: Conventional luxury loans, portfolio lending, asset-based financing

- Investment Leverage: Strategic debt utilization maximizing returns while managing risk

- Capital Appreciation: Equity building through appreciation and principal reduction over time

Luxury Amenities & Premium Features

Resort-Style Living and Premium Property Features

Enterprise luxury properties feature comprehensive resort-style amenities including championship golf courses, spa facilities, fitness centers, tennis courts, and community clubs, with individual properties offering premium features like gourmet kitchens, master suites, home theaters, wine cellars, resort-style pools, and outdoor entertainment areas, creating luxury lifestyle experiences that enhance property values and rental appeal while supporting premium investment performance and affluent tenant attraction.

🏖️ Complete Luxury Amenities & Premium Features

Community Amenities & Resort-Style Features:

- Championship Golf Courses: Southern Highlands Golf Club, Rio Secco, private and semi-private access

- Club Facilities: Country clubs, dining facilities, event spaces, social programming

- Fitness & Wellness: State-of-the-art fitness centers, spa services, tennis courts, pools

- Recreation Areas: Parks, trails, playgrounds, sports courts, community gathering spaces

- Security Services: Gated communities, 24-hour security, access control, luxury safety

- Concierge Services: Lifestyle management, travel planning, event coordination, personal services

Premium Property Features & Luxury Finishes:

- Gourmet Kitchens: Professional appliances, custom cabinetry, premium stone countertops

- Master Suites: Spa-like bathrooms, walk-in closets, private retreats, luxury fixtures

- Entertainment Spaces: Home theaters, game rooms, wet bars, luxury entertaining areas

- Outdoor Living: Resort-style pools, outdoor kitchens, fireplaces, luxury landscaping

- Smart Home Technology: Home automation, security systems, energy management, connectivity

- Luxury Finishes: Hardwood floors, stone work, custom millwork, designer fixtures

Complete Luxury Investment Opportunities Directory

🏰 Southern Highlands Luxury Estates

Premium Master-Planned Community: 1,850-acre luxury development with championship golf course, custom neighborhoods, and comprehensive amenities offering $700,000-$5,000,000 investment opportunities.

Investment Profile:

- 8.5% annual appreciation with luxury demand

- 5.1% rental yields with executive tenants

- Golf course access and resort amenities

- Master-planned community excellence

Price Range: $700,000-$5,000,000 • Best For: Long-term luxury investment, rental income

🏖️ Seven Hills Henderson Customs

Henderson's Premier Luxury Community: 1,300-acre development with 25 neighborhoods, dual golf courses, and The Estates guard-gated customs offering $1.2-8 million investment properties.

Investment Profile:

- 9.8% annual appreciation exceeding market

- 4.8% rental yields with premium demand

- Strip and mountain views available

- Guard-gated security and exclusivity

Price Range: $1.2M-$8M • Best For: Ultra-luxury investment, executive rentals

🎖️ The Ridges Ultra-Luxury

Summerlin's Most Exclusive Community: Ultra-luxury guard-gated development with $2-15 million custom estates, unparalleled privacy, and exceptional investment performance.

Investment Profile:

- 11.2% annual appreciation with exclusivity

- 4.2% rental yields with ultra-luxury demand

- Limited inventory and high demand

- Ultimate privacy and luxury positioning

Price Range: $2M-$15M • Best For: Ultra-high-net-worth investment, appreciation focus

⛳ Rhodes Ranch Golf Community

Golf-Focused Luxury Community: Championship golf course community with resort-style amenities, luxury homes, and comprehensive recreational facilities offering diverse investment opportunities.

Investment Profile:

- 8.1% annual appreciation with golf premium

- 5.4% rental yields with golf enthusiasts

- Resort-style community amenities

- Golf course access and views

Price Range: $650,000-$3.5M • Best For: Golf-focused investment, lifestyle rentals

🏢 Luxury High-Rise Condominiums

Urban Luxury Living: Premium high-rise condominiums with Strip views, luxury amenities, and convenient Las Vegas lifestyle offering $500,000-2 million investment opportunities.

Investment Profile:

- 7.8% annual appreciation with urban demand

- 6.0% rental yields with short-term potential

- Strip views and luxury amenities

- Low maintenance luxury investment

Price Range: $500K-$2M • Best For: Urban investment, rental income focus

🛠️ Luxury Value-Add Opportunities

Value Enhancement Investment: Established luxury properties with renovation potential, offering value-add opportunities through improvement and modernization strategies.

Investment Profile:

- 11.2% ROI potential with improvements

- 5.8% rental yields post-renovation

- Value creation through enhancement

- Established luxury community locations

Price Range: $400K-$1.5M • Best For: Active investment, value creation focus

💎 How to Execute Luxury Real Estate Investment: Complete Wealth Building Guide (8 Steps)

Step 1: Define Investment Objectives & Financial Planning

Establish clear luxury investment objectives including return expectations, investment timeline, risk tolerance, and capital requirements while conducting comprehensive financial analysis and pre-qualification for luxury financing ensuring optimal investment strategy alignment and preparation.

Step 2: Conduct Market Research & Community Analysis

Research Enterprise luxury communities including Southern Highlands, Seven Hills, and premium developments while analyzing market trends, appreciation history, and investment performance data to identify optimal luxury investment opportunities matching investment objectives and market conditions.

Step 3: Secure Professional Team & Expert Guidance

Assemble professional investment team including luxury real estate specialists, investment advisors, tax professionals, and legal counsel while establishing relationships with luxury property managers and service providers ensuring comprehensive professional support throughout investment process.

Step 4: Evaluate Properties & Perform Due Diligence

Evaluate specific luxury properties through comprehensive analysis including market comparisons, property condition assessments, rental potential analysis, and financial modeling while conducting thorough due diligence and professional inspections ensuring informed investment decisions.

Step 5: Structure Financing & Investment Optimization

Structure optimal financing including conventional luxury loans, portfolio lending, or cash purchases while optimizing investment structure for tax efficiency, leverage utilization, and return maximization through professional financial planning and strategy development.

Step 6: Execute Purchase & Transaction Management

Execute luxury property purchase through professional transaction management including contract negotiation, due diligence coordination, financing completion, and closing management while ensuring optimal purchase terms and smooth transaction completion.

Step 7: Implement Property Management & Optimization

Implement luxury property management including tenant placement, property maintenance, rental optimization, and performance monitoring while coordinating professional services and ensuring optimal investment performance and property care.

Step 8: Monitor Performance & Portfolio Growth

Monitor investment performance including appreciation tracking, rental income analysis, and market condition assessment while planning portfolio expansion, tax optimization, and wealth-building strategies ensuring continued luxury investment success and financial growth.

❓ Frequently Asked Questions About Enterprise Nevada Luxury Real Estate Investment

What makes Enterprise Nevada a superior luxury real estate investment market?

Enterprise offers exceptional luxury investment opportunities with 9.2% average ROI, premium master-planned communities like Southern Highlands and Seven Hills, strategic Las Vegas proximity, and superior appreciation rates. The area combines luxury community excellence with strong investment performance, executive rental demand, and comprehensive amenities creating optimal luxury investment conditions.

What are typical returns on luxury real estate investment in Enterprise?

Enterprise luxury investments generate 9.2% average total returns combining 8.5% appreciation and 4.8-6.2% rental yields. Premium communities like Seven Hills achieve 9.8% appreciation while ultra-luxury properties in The Ridges demonstrate 11.2% appreciation, consistently outperforming regional luxury averages through strategic positioning and market demand.

What price ranges are available for luxury investment properties?

Enterprise luxury investments span $700,000-$20,000,000 with Southern Highlands averaging $700,000-$5,000,000, Seven Hills offering $1.2-8 million customs, and The Ridges featuring $2-15 million ultra-luxury estates. This diversity accommodates various investment strategies and capital requirements while maintaining luxury market positioning.

How does luxury rental demand perform in Enterprise communities?

Enterprise luxury rentals demonstrate exceptional performance with $4,500-$12,000+ monthly rents, 95%+ occupancy rates, and strong executive tenant demand from corporate relocations, entertainment industry professionals, and international executives. Limited luxury inventory and strategic positioning support premium rental rates and tenant retention.

What are the best luxury communities for investment purposes?

Top luxury investment communities include Southern Highlands (8.5% appreciation, golf course amenities), Seven Hills (9.8% appreciation, Strip views), The Ridges (11.2% appreciation, ultra-luxury), and Rhodes Ranch (8.1% appreciation, golf focus). Each offers unique advantages supporting different investment strategies and return objectives.

What financing options are available for luxury property investment?

Luxury financing includes conventional jumbo loans (20-25% down), portfolio lending, asset-based financing, and cash purchases. Nevada's tax advantages enhance investment returns while professional lending relationships provide optimal terms for luxury investment acquisition and portfolio building.

How do Enterprise luxury properties compare to other Las Vegas areas?

Enterprise luxury properties outperform general Las Vegas luxury market with superior appreciation rates, premium community amenities, strategic positioning, and established luxury rental demand. The area's master-planned community excellence and Southwest Las Vegas location create competitive advantages supporting investment performance.

What professional services support luxury real estate investment?

Comprehensive professional services include luxury property management, investment analysis, tax optimization, legal structuring, and market intelligence. RECN Group provides specialized luxury investment expertise with 15+ years Enterprise market experience supporting investor success and portfolio optimization.

What are current luxury market trends affecting investment opportunities?

Current trends include continued California migration, corporate relocations, international investment, technology sector growth, and remote work flexibility driving luxury demand. Limited luxury inventory and sustained high-net-worth population growth support continued appreciation and investment performance.

How should investors approach Enterprise luxury real estate portfolio building?

Successful portfolio building involves diversification across luxury communities and property types, strategic financing utilization, professional management implementation, and long-term wealth-building focus. Regular performance monitoring, tax optimization, and market intelligence support continued luxury investment success and portfolio growth.

💎 Ready to Execute Enterprise Nevada Luxury Real Estate Investment?

Enterprise Nevada represents Southwest Las Vegas' premier luxury real estate investment destination, combining master-planned community excellence with superior investment performance. Whether seeking custom estates, luxury rentals, or ultra-luxury positioning, Enterprise provides comprehensive luxury investment opportunities with exceptional returns.

Contact Enterprise luxury investment specialist today for market analysis, property evaluation, investment strategy development, financing coordination, and comprehensive guidance for your optimal Enterprise Nevada luxury real estate investment success and wealth-building excellence!

💎 Enterprise Luxury Investment Reality Check

Capital Requirements & Market Sophistication: Enterprise luxury investment requires significant capital commitments ($700,000+ entry level), sophisticated market understanding, and professional guidance for optimal success. Success involves appreciating luxury market dynamics, understanding premium community positioning, and recognizing that luxury investment demands higher capital, longer investment horizons, and market expertise different from general real estate investment.

Market Cycles & Performance Expectations: Enterprise luxury market demonstrates superior performance but requires understanding of luxury market cycles, seasonal variations, and economic sensitivity affecting ultra-high-end properties. Investors benefit from professional guidance, diversified approaches, and realistic expectations about luxury market dynamics, liquidity considerations, and performance optimization requirements.

Disclaimer: This Enterprise Nevada luxury real estate investment guide is compiled from extensive research of luxury property markets, investment performance data, community analysis, and Las Vegas Valley luxury real estate information available as of October 2025. Investment performance, market conditions, property values, and investment returns are subject to change based on market forces, economic conditions, interest rates, and various factors affecting real estate markets and investment performance. Luxury real estate investment involves significant financial risk, market volatility, liquidity considerations, and performance variables that may affect individual investment outcomes and returns significantly based on timing, property selection, market conditions, and personal financial circumstances. Investment performance data, appreciation rates, rental yields, and ROI calculations depend on numerous variables including property condition, location, market timing, management quality, and economic factors necessitating professional investment analysis and individual evaluation rather than reliance on general market information. This guide serves as educational information for investment consideration and should not be considered guaranteed investment performance, return projections, or investment advice. Prospective luxury real estate investors are strongly advised to conduct independent financial analysis and due diligence, consult with qualified investment professionals and financial advisors, research individual properties and market conditions thoroughly, evaluate personal financial capacity and risk tolerance, assess liquidity requirements and investment timeline factors, and coordinate investment decisions based on professional guidance and current market conditions rather than relying solely on general information provided in this educational resource for Enterprise luxury real estate investment success and optimal wealth-building outcomes.

Stay Informed with RECN Insights

Subscribe to our blog for exclusive real estate tips, market updates, and community guides.

Real Estate Concierge Network

Your gateway to exceptional real estate services with 20%+ savings on agent fees, lifetime concierge support, and comprehensive solutions for buyers, sellers, businesses, and agent partners.

Save Contact

Save my contact info directly to your phone for easy access anytime you need help.

📲 Save to PhoneCall Direct

Speak with our specialists for immediate assistance with your real estate needs.

🗣 Call NowEmail Us

Send detailed inquiries and receive comprehensive responses within 2 hours during business hours.

📤 Send EmailSchedule Video Call

Book a free 30-minute consultation to discuss your real estate needs via secure video call.

📅 Book MeetingSend Text

Text me your real estate questions about buying, selling, market conditions, or property values for fast, personalized responses.

👥 Start ChatLeave Review

Help others discover our exceptional real estate concierge services.

📝 Write Review

Agent | License ID: BS.0144709

+1(702) 213-5555 | info@recngroup.com