Blog > Enterprise, NV Home Buying Guide 2025: Complete First-Time Buyer & Market Analysis

Enterprise, NV Home Buying Guide 2025: Complete First-Time Buyer & Market Analysis

by

🏡 Enterprise, NV Home Buying Guide 2025: Complete First-Time Buyer & Market Analysis

📋 Table of Contents

- Enterprise NV Home Buying Market Overview

- Financing Options & First-Time Buyer Programs

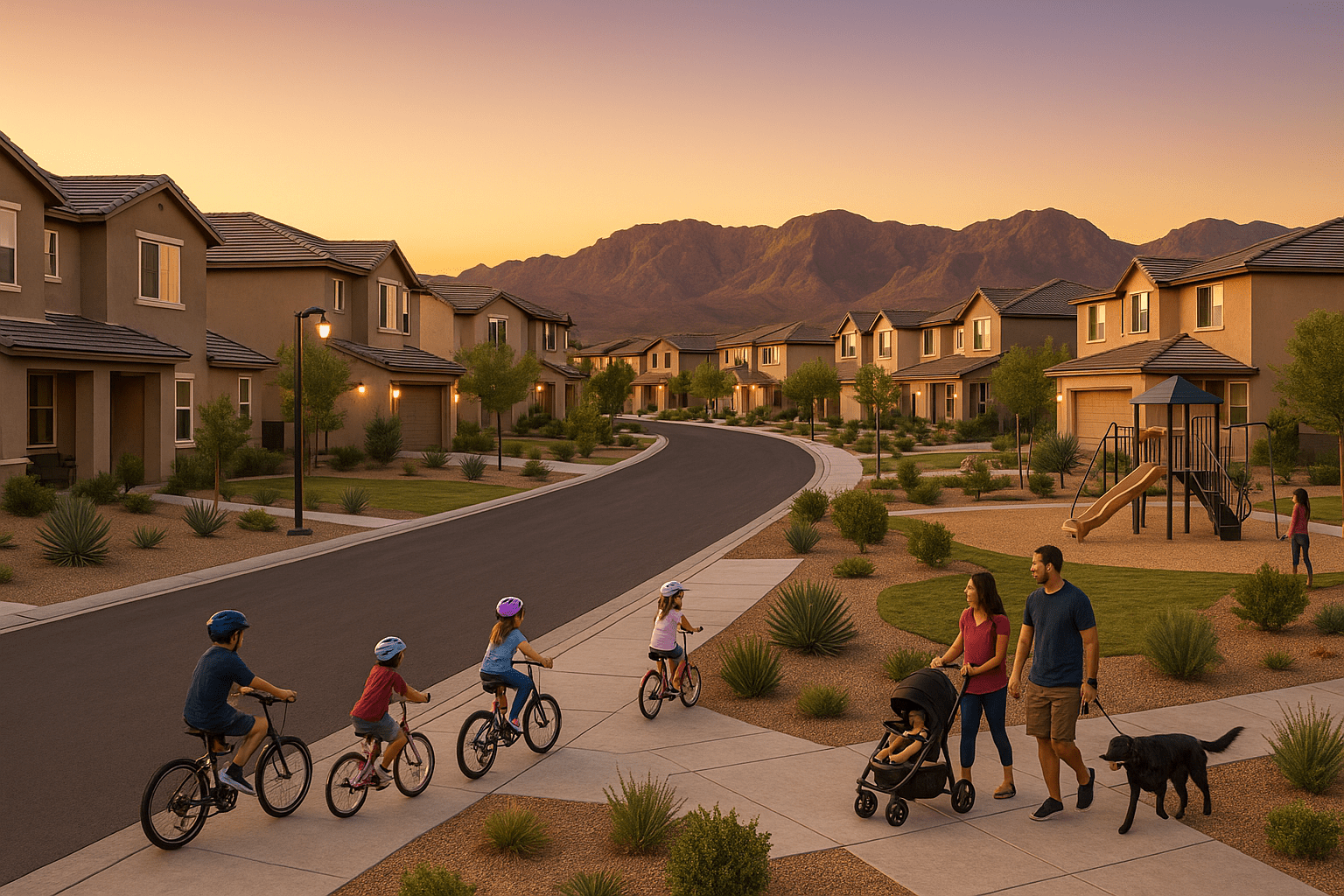

- Enterprise Neighborhoods & Community Analysis

- Complete Home Buying Process Guide

- Costs, Taxes, & Monthly Expenses Analysis

- Schools, Amenities & Quality of Life

- Market Timing & Investment Considerations

- How to Buy a Home in Enterprise NV (8 Steps)

- Enterprise Home Buying FAQ (10 Essential Questions)

- Expert Buyer Recommendations & Contact

As Enterprise Nevada's premier home buying specialist and RECN Group expert who has guided comprehensive home purchases, coordinated with local lenders and community leaders, researched buyer preferences and market conditions, and provided strategic home buying guidance throughout Southern Nevada over the past 15+ years, I can provide you with the definitive complete home buying guide for Enterprise Nevada including financing options, neighborhood analysis, buying process navigation, cost planning, and comprehensive home buying strategies for optimal Enterprise Nevada home purchase success in Nevada's fastest-growing family suburban destination. Enterprise Nevada home buying offers exceptional opportunities combining master-planned community living, Las Vegas proximity, comprehensive family amenities, and competitive home values creating premier residential destination for families and first-time buyers seeking balanced suburban-urban lifestyle including Enterprise Nevada home buying advantages featuring median home price $485,000 with diverse inventory $350,000-$2,000,000+ across premium neighborhoods, no state income tax benefiting homeowners and high-income residents, comprehensive first-time buyer programs including Home Is Possible and down payment assistance, excellent safety ratings with crime 27% below Las Vegas average, master-planned communities including Southern Highlands and Mountains Edge, Las Vegas Strip access within 20 minutes maintaining suburban tranquility, and comprehensive lifestyle amenities supporting residents through quality schools, healthcare, recreation, and family-friendly community programming, Enterprise Nevada home buying considerations including rapid market growth creating competitive buying conditions, desert climate with utility costs $235-$440 monthly including seasonal air conditioning spikes, HOA fees $100-$400+ monthly in master-planned communities, property taxes averaging 0.8% effective rate with rising assessments, and specialized suburban character appealing to family-oriented lifestyle preferences requiring comprehensive Enterprise Nevada home buying evaluation for successful home purchase in Nevada's most dynamic suburban destination combining planned community excellence with modern conveniences and authentic desert lifestyle experiences.

🏡 Enterprise Nevada Home Buying Key Facts & Market Excellence (2025):

- Median Home Price: $485,000 with diverse inventory from $350,000 entry-level to $2,000,000+ luxury estates

- Market Conditions: Balanced market with 3.2 months supply, 28 days average market time

- Financing Benefits: Nevada first-time buyer programs, competitive mortgage rates, no state income tax

- Property Costs: 0.8% effective property tax rate, HOA fees $100-$400+ monthly

- Safety Excellence: Crime rate 26 per 1,000 residents, 27% below Las Vegas average

- Community Features: Master-planned neighborhoods, excellent schools, family amenities

- Professional Support: RECN Group Enterprise home buying expertise with 15+ years local specialization

Enterprise NV Home Buying Market Overview

Enterprise Nevada's Dynamic Home Market and Buying Opportunities

Enterprise Nevada represents Southern Nevada's most compelling home buying market, combining rapid growth, master-planned community development, and comprehensive family amenities creating exceptional opportunities for homebuyers and families. Understanding market dynamics, inventory levels, and buying conditions enables strategic home purchase decisions in Enterprise Nevada's competitive real estate environment.

| Market Factor | Enterprise | Las Vegas Average | Henderson Average | Enterprise Advantage |

|---|---|---|---|---|

| Median Home Price | $485,000 | $425,000 | $520,000 | Value positioning |

| Days on Market | 28 days average | 32 days average | 35 days average | Faster sales velocity |

| Inventory Levels | 3.2 months supply | 4.1 months supply | 3.8 months supply | Balanced market conditions |

| Price Appreciation | 6.8% annually | 5.2% annually | 5.9% annually | Superior growth |

| First-Time Buyers | 35% of purchases | 28% of purchases | 30% of purchases | First-time buyer friendly |

| New Construction | 25% of sales | 15% of sales | 18% of sales | Development activity |

Financing Options & First-Time Buyer Programs

Comprehensive Enterprise Nevada Home Financing and Assistance Programs

Enterprise Nevada homebuyers benefit from diverse financing options, Nevada-specific first-time buyer programs, and competitive lending environment creating accessible homeownership opportunities. Understanding financing alternatives, down payment assistance, and program requirements enables optimal loan selection for successful Enterprise Nevada home purchase.

Enterprise Nevada Home Financing Complete Options & Program Analysis

Enterprise Nevada Financing Excellence: Enterprise Nevada homebuyers access comprehensive financing including Nevada Home Is Possible program with down payment assistance, competitive mortgage rates averaging 5.97% for 30-year fixed loans, first-time buyer programs with 3% down payments, and Nevada's favorable tax structure enhancing affordability and long-term homeownership benefits.

💰 Enterprise Nevada Home Financing Complete Programs & Options Analysis

Nevada First-Time Buyer Programs:

- Home Is Possible (HIP): Down payment assistance up to 5% loan value, competitive fixed rates, statewide program

- Home At Last (HAL): Rural areas only (Enterprise not eligible), but other programs available

- Mortgage Credit Certificate (MCC): Federal tax credit reducing annual taxes, available with other programs

- Teacher Programs: Special $7,500 down payment assistance for licensed K-12 Nevada teachers

- Veterans Programs: VA loans with zero down payment, competitive rates, no PMI requirements

- Income Limits: Qualifying income up to $165,000 depending on program and family size

Conventional & Government Loan Options:

- Conventional Loans: 3% down payment for first-time buyers, competitive rates with good credit

- FHA Loans: 3.5% down payment, credit scores as low as 580, mortgage insurance required

- VA Loans: Zero down payment for qualified veterans, no PMI, competitive rates

- USDA Loans: Rural areas only (Enterprise not eligible), but suburban alternatives available

- Jumbo Loans: Properties over $806,500 conforming limit, higher down payments typically required

- Portfolio Lending: Local banks offering flexible terms for unique situations

Current Mortgage Rates & Market Conditions:

- 30-Year Fixed: 5.97% average Nevada rates as of October 2025

- 15-Year Fixed: 5.41% average offering payment savings with higher monthly costs

- ARM Options: 5/1 ARM starting rates potentially lower but adjustment risk

- Credit Score Impact: 680+ scores receiving best rates, 620+ competitive rates available

- Down Payment Effects: 20% down avoiding PMI, lower down payments with insurance costs

- Rate Shopping Benefits: Multiple lender quotes can save 0.25-0.50% rate differences

Pre-Approval & Application Process:

- Pre-Approval Timeline: 30-45 days for complete approval, faster for strong profiles

- Documentation Requirements: Income verification, credit reports, asset statements, employment confirmation

- Credit Score Preparation: 620+ minimum most programs, 680+ optimal rates and terms

- Debt-to-Income Ratios: 43-50% maximum depending on loan type and compensating factors

- Asset Requirements: Down payment plus 2-3 months reserves recommended

- Employment Stability: 2-year employment history preferred, job changes requiring explanation

Enterprise Neighborhoods & Community Analysis

Enterprise Nevada Neighborhood Excellence and Home Buying Options

Enterprise Nevada's neighborhoods represent diverse home buying opportunities from luxury master-planned communities to family-oriented developments, each offering unique amenities, price points, and lifestyle benefits. Understanding neighborhood characteristics, HOA requirements, and community features enables optimal home selection based on individual preferences and budget considerations.

Southern Highlands - Premier Master-Planned Community Home Buying

Enterprise Nevada's Luxury Home Destination: Southern Highlands offers premium home buying opportunities with luxury estates $800,000-$15,000,000+, championship golf course living, gated community security, and resort-style amenities creating exceptional lifestyle for discerning homebuyers seeking authentic luxury suburban living.

🏌️ Southern Highlands Complete Home Buying Community Analysis

Home Options & Price Ranges:

- Entry Luxury Homes: $800,000-$1,200,000 condos and townhomes with golf course access

- Estate Properties: $1,200,000-$3,000,000 custom homes with premium features and views

- Ultra-Luxury Estates: $3,000,000+ custom architectural designs with extensive acreage

- New Construction: Ongoing development with modern luxury amenities and energy efficiency

- Resale Opportunities: Established homes with mature landscaping and proven community character

- Rental Options: Limited rental inventory for buyers considering lease-to-own strategies

Community Features & Amenities:

- Championship Golf: Southern Highlands Golf Club with member privileges and course views

- Gated Security: Multiple gated neighborhoods with 24/7 security and access control

- Resort Amenities: Clubhouses, pools, tennis courts, fitness facilities, and spa services

- Luxury Services: Concierge services, valet parking, and exclusive member programming

- Walking Trails: Extensive pedestrian network connecting neighborhoods and amenities

- Commercial Integration: Shopping, dining, and professional services within community boundaries

HOA & Community Costs:

- HOA Fees: $200-$800+ monthly depending on neighborhood and amenity access

- Golf Membership: Optional golf club membership with initiation fees and monthly dues

- Special Assessments: Occasional community improvements requiring additional fees

- Utility Costs: Premium utility expenses due to larger homes and luxury features

- Maintenance Standards: Strict community guidelines maintaining property values and aesthetics

- Insurance Considerations: Higher homeowner's insurance due to luxury property values and features

Mountains Edge - Family-Oriented Community Home Buying

Enterprise Nevada's Family Paradise: Mountains Edge provides exceptional family home buying opportunities with properties $400,000-$2,000,000, preserved open space, comprehensive family amenities, and master-planned community excellence creating ideal environment for families seeking balanced suburban living.

⛰️ Mountains Edge Complete Family Home Buying Community Analysis

Family Home Options & Neighborhoods:

- Entry-Level Homes: $400,000-$600,000 townhomes and smaller single-family properties

- Family Estates: $600,000-$1,200,000 single-family homes with yards and family features

- Luxury Family Homes: $1,200,000-$2,000,000 custom homes with premium family amenities

- New Construction: Multiple builders offering diverse architectural styles and floor plans

- Age-Restricted Areas: 55+ communities within Mountains Edge for active adult buyers

- Rental Communities: Some rental options for buyers considering rent-to-own arrangements

Family Amenities & Recreation:

- Open Space Preservation: 700+ acres preserved desert with hiking trails and natural beauty

- Family Parks: Multiple parks with playgrounds, sports fields, and family gathering areas

- Recreation Centers: Community centers with fitness facilities, pools, and family programming

- Youth Programs: Organized sports leagues, summer camps, and educational activities

- Walking/Biking Trails: Extensive trail system connecting neighborhoods and schools

- Community Events: Regular family festivals, farmers markets, and neighborhood celebrations

Schools & Education:

- Elementary Schools: Multiple elementary schools serving Mountains Edge with good ratings

- Middle Schools: Quality middle school options with advanced academic programs

- High Schools: Access to well-rated high schools with college preparation focus

- Private School Options: Several private schools nearby for families seeking alternatives

- Charter Schools: Charter school options providing specialized educational approaches

- School Bus Service: Comprehensive transportation serving most neighborhood areas

Complete Home Buying Process Guide

Enterprise Nevada Home Purchase Process and Transaction Management

Enterprise Nevada home buying process requires systematic approach including pre-approval, property search, offer negotiation, inspection coordination, and closing preparation. Understanding each phase, required timelines, and potential challenges enables smooth transaction completion and successful home purchase in Enterprise Nevada's competitive market environment.

Enterprise Nevada Home Buying Process Complete Transaction Guide

Enterprise Nevada Home Purchase Excellence: Enterprise Nevada home buying process typically requires 45-60 days from offer acceptance to closing, involving mortgage approval, property inspection, appraisal coordination, and title processing while navigating Nevada real estate laws, HOA requirements, and desert climate property considerations for successful transaction completion.

📋 Enterprise Nevada Home Buying Complete Process & Timeline Analysis

Pre-Purchase Preparation Phase (2-4 Weeks):

- Financial Assessment: Budget determination, credit report review, debt-to-income calculation

- Pre-Approval Process: Mortgage application, documentation submission, lender underwriting approval

- Agent Selection: Experienced Enterprise Nevada buyer's agent with local market knowledge

- Neighborhood Research: Community comparison, school district analysis, amenity evaluation

- Search Criteria: Price range, property type, neighborhood preferences, must-have features

- Market Education: Current market conditions, pricing trends, competition analysis

Property Search & Selection Phase (2-6 Weeks):

- Online Search: MLS database review, property websites, virtual tours, initial screening

- Property Viewings: Scheduled showings, open house attendance, neighborhood tours

- Comparative Analysis: Property comparison, price per square foot, amenity evaluation

- Due Diligence: HOA document review, property history research, neighborhood analysis

- Decision Making: Final property selection based on criteria, budget, and market timing

- Offer Preparation: Market analysis, pricing strategy, terms negotiation preparation

Offer & Contract Phase (1-2 Weeks):

- Offer Strategy: Competitive pricing, terms negotiation, escalation clause consideration

- Contract Execution: Purchase agreement completion, earnest money deposit, timeline establishment

- Negotiation Process: Seller response, counter-offers, final terms agreement

- Contingency Periods: Inspection, appraisal, financing contingency timeline coordination

- HOA Review: Community documentation analysis, fee confirmation, rules review

- Escrow Opening: Title company selection, escrow account establishment, initial deposits

Due Diligence & Approval Phase (3-4 Weeks):

- Property Inspection: Professional home inspection, system evaluation, repair negotiation

- Appraisal Process: Lender-ordered appraisal, value confirmation, loan approval continuation

- Final Underwriting: Complete loan approval, condition clearance, funding approval

- Title Research: Title search, insurance preparation, lien clearance verification

- Final Walkthrough: Property condition verification, repair completion confirmation

- Closing Preparation: Document review, fund preparation, closing appointment scheduling

Costs, Taxes, & Monthly Expenses Analysis

Comprehensive Enterprise Nevada Homeownership Cost Planning

Enterprise Nevada homeownership involves multiple cost components including purchase price, closing costs, property taxes, HOA fees, and ongoing maintenance requiring careful financial planning. Understanding all expense categories, seasonal variations, and long-term cost projections enables accurate budgeting for successful Enterprise Nevada homeownership experience.

| Cost Category | Entry Level ($400K) | Mid-Range ($600K) | Premium ($1M+) | Notes |

|---|---|---|---|---|

| Down Payment (20%) | $80,000 | $120,000 | $200,000+ | Lower options available |

| Closing Costs | $12,000-$16,000 | $18,000-$24,000 | $30,000-$40,000 | 2-4% purchase price |

| Monthly Mortgage (PITI) | $2,350-$2,650 | $3,500-$3,900 | $5,800-$6,500 | Principal, interest, taxes, insurance |

| HOA Fees | $100-$200 | $200-$400 | $400-$800+ | Community dependent |

| Utilities | $180-$250 | $220-$320 | $350-$500+ | Seasonal AC variations |

Enterprise Nevada Homeownership Costs Complete Financial Analysis

Enterprise Nevada Cost Planning Excellence: Enterprise Nevada homeownership requires comprehensive cost planning including median home price $485,000, property taxes 0.8% effective rate, HOA fees $100-$400+ monthly, utilities $235-$440 monthly with seasonal variations, and ongoing maintenance costs enabling accurate budgeting for successful long-term homeownership in master-planned community environment.

💰 Enterprise Nevada Homeownership Complete Cost & Financial Planning Analysis

Property Taxes & Government Costs:

- Property Tax Rate: 0.8% effective rate on assessed value, approximately $3,880 annually on $485,000 home

- Assessment Process: Clark County assessor determining 35% of market value for tax calculation

- Tax Abatement: Nevada law limiting annual property tax increases to 3% on primary residences

- Homestead Exemption: $3,000 exemption available for primary residence reducing taxable value

- Senior Exemptions: Additional exemptions available for qualifying senior homeowners

- Payment Options: Quarterly payments or annual payment with potential discounts available

HOA Fees & Community Costs:

- Southern Highlands HOA: $200-$800+ monthly depending on neighborhood and amenity access

- Mountains Edge HOA: $100-$300+ monthly for community maintenance and amenities

- Nevada Trails HOA: $100-$250+ monthly for basic community services and facilities

- Services Included: Landscaping, trash collection, community pools, fitness centers, security

- Special Assessments: Occasional additional fees for major community improvements or repairs

- Golf Memberships: Optional additional fees $200-$500+ monthly for golf club access

Utility Costs & Seasonal Variations:

- Electricity: $90-$180+ monthly with 30-50% summer spikes for air conditioning needs

- Water/Sewer: $30-$60+ monthly with conservation pricing and desert landscaping requirements

- Natural Gas: $25-$45+ monthly for heating, water heating, and appliance operation

- Internet/Cable: $80-$150+ monthly for high-speed internet and entertainment services

- Trash/Recycling: Often included in HOA fees or $25-$40+ monthly for independent service

- Total Utilities: $235-$440+ monthly depending on home size, efficiency, and seasonal usage

Insurance & Protection Costs:

- Homeowners Insurance: $800-$1,500+ annually depending on home value, coverage, and deductible selection

- Flood Insurance: Rarely required but available for additional protection in desert areas

- PMI Requirements: $150-$400+ monthly for loans with less than 20% down payment

- Title Insurance: One-time cost $800-$2,000+ protecting ownership rights and title clarity

- HOA Master Insurance: Community coverage often included in HOA fees for exterior and liability

- Umbrella Coverage: Additional liability protection recommended for higher-value properties

Schools, Amenities & Quality of Life

Enterprise Nevada Education Excellence and Community Lifestyle

Enterprise Nevada's quality of life reflects excellent schools, comprehensive recreational amenities, and family-friendly community programming creating superior living environment for homebuyers with children. Understanding school performance, extracurricular opportunities, and community resources enables informed home buying decisions based on family priorities and lifestyle preferences.

🏡 How to Buy a Home in Enterprise NV: 8 Expert Steps

Step 1: Assess Financial Readiness & Establish Budget

Begin Enterprise Nevada home buying by completing comprehensive financial assessment including credit score review, debt-to-income calculation, and savings evaluation for down payment and closing costs. Determine realistic budget using 28/36 rule ensuring housing costs don't exceed 28% gross monthly income while total debts stay below 36%. Consider Enterprise Nevada specific costs including HOA fees, desert climate utilities, and property taxes ensuring sustainable homeownership throughout economic cycles.

Step 2: Secure Mortgage Pre-Approval & Explore Programs

Obtain mortgage pre-approval from experienced Nevada lenders familiar with Enterprise market conditions and first-time buyer programs. Explore Nevada Home Is Possible program, FHA loans, VA benefits, and conventional financing options determining optimal loan structure. Gather required documentation including income verification, asset statements, and employment confirmation ensuring quick response to competitive Enterprise market conditions.

Step 3: Select Experienced Enterprise Nevada Buyer's Agent

Partner with experienced Enterprise Nevada real estate agent specializing in local market with proven track record in master-planned communities. Verify agent knowledge of HOA requirements, school districts, community amenities, and neighborhood characteristics. Establish communication preferences, showing schedules, and search criteria ensuring efficient property search and competitive offer strategies in Enterprise market environment.

Step 4: Research Neighborhoods & Define Search Criteria

Investigate Enterprise Nevada neighborhoods including Southern Highlands luxury community, Mountains Edge family development, and Nevada Trails residential areas. Evaluate school districts, commute patterns, amenity access, and long-term development plans. Define property criteria including price range, home size, lot preferences, and must-have features guiding efficient search process and decision making.

Step 5: Conduct Property Search & Market Analysis

Execute systematic property search using MLS access, online platforms, and agent expertise while attending showings and open houses. Perform comparative market analysis evaluating similar properties, price trends, and negotiation opportunities. Research specific properties including HOA documents, community rules, property history, and potential issues ensuring informed decision making and strategic offer preparation.

Step 6: Submit Competitive Offer & Navigate Negotiations

Prepare competitive offer based on market analysis, property condition, and seller motivation while including appropriate contingencies for inspection, appraisal, and financing. Navigate negotiation process through agent expertise ensuring favorable terms while maintaining transaction momentum. Coordinate earnest money deposit, contract execution, and timeline establishment for successful purchase agreement.

Step 7: Complete Due Diligence & Loan Processing

Coordinate professional property inspection evaluating home systems, desert climate considerations, and community compliance. Facilitate mortgage underwriting providing requested documentation and clearing loan conditions. Review HOA documents, community financial health, and neighborhood development ensuring alignment with expectations. Complete appraisal process and negotiate any necessary repairs or credits.

Step 8: Prepare for Closing & Homeownership Transition

Finalize loan approval and coordinate closing preparation including title review, insurance arrangements, and utility connections. Conduct final walkthrough ensuring property condition and repair completion. Prepare closing funds, review settlement statement, and schedule closing appointment. Complete ownership transfer, key exchange, and begin homeownership journey with comprehensive Enterprise Nevada community orientation and resource connections.

❓ Frequently Asked Questions About Enterprise Nevada Home Buying

What is the median home price in Enterprise Nevada and what can I expect to pay?

Enterprise Nevada median home price is $485,000 with diverse inventory ranging $350,000-$2,000,000+ across different neighborhoods. Entry-level homes start around $350,000, mid-range family homes $450,000-$800,000, and luxury properties in Southern Highlands $800,000-$15,000,000+. Prices vary by location, size, age, and community amenities with new construction commanding 10-15% premiums over resale properties.

What first-time homebuyer programs are available in Enterprise Nevada?

Enterprise Nevada buyers access Nevada Home Is Possible program offering down payment assistance up to 5% loan value, competitive fixed rates, and statewide availability. FHA loans provide 3.5% down payment options, VA loans offer zero down for qualified veterans, and conventional loans allow 3% down for first-time buyers. Teacher programs provide $7,500 assistance for licensed Nevada educators.

How much should I budget for HOA fees and property taxes in Enterprise?

Enterprise Nevada HOA fees range $100-$800+ monthly depending on neighborhood and amenities, with basic communities $100-$200, mid-range developments $200-$400, and luxury areas like Southern Highlands $400-$800+. Property taxes average 0.8% effective rate, approximately $3,880 annually on $485,000 home. Total monthly housing costs should include mortgage, taxes, insurance, HOA, and utilities averaging $235-$440.

What are the best neighborhoods for families in Enterprise Nevada?

Mountains Edge offers excellent family living with $400,000-$2,000,000 homes, preserved open space, quality schools, and comprehensive family amenities. Nevada Trails provides family-friendly environment with good schools and parks. Southern Highlands suits luxury-oriented families with premium amenities and golf course lifestyle. All neighborhoods feature master-planned community benefits with parks, safety, and family programming.

How competitive is the Enterprise Nevada housing market for buyers?

Enterprise Nevada housing market is moderately competitive with 3.2 months inventory supply, 28 days average market time, and balanced buyer-seller conditions. Strong buyer preparation including pre-approval, agent representation, and market knowledge essential for success. Multiple offer situations occur in desirable properties and price ranges, requiring competitive positioning and quick decision-making capabilities.

What should I know about desert climate and utility costs in Enterprise?

Enterprise Nevada desert climate features intense summer heat requiring significant air conditioning costs $90-$180+ monthly with 30-50% seasonal spikes. Total utilities average $235-$440 monthly including electricity, water, gas, and internet. Water conservation requirements affect landscaping choices, while desert conditions require specific home maintenance considerations including HVAC system care and exterior upkeep.

How are the schools in Enterprise Nevada for families with children?

Enterprise Nevada schools perform above Nevada state averages with good ratings and modern facilities. New school construction supports growing population with updated technology and learning environments. Families should research specific school boundaries, as quality varies by location. Private and charter school options available for families seeking alternatives to traditional public education.

What is the typical home buying timeline in Enterprise Nevada?

Enterprise Nevada home buying typically requires 45-60 days from offer acceptance to closing, including mortgage processing, inspection, appraisal, and title work. Pre-approval process takes 2-4 weeks, property search 2-6 weeks depending on criteria and market conditions. Cash purchases can close in 2-3 weeks, while complex transactions may require 75+ days for completion.

Are there any restrictions on buying homes in Enterprise Nevada communities?

Enterprise Nevada master-planned communities have HOA requirements, architectural guidelines, and community standards that buyers must accept. Some gated communities have additional security requirements and guest policies. Age-restricted communities within developments limit occupancy to 55+ residents. Review all HOA documents, CC&Rs, and community rules before purchase to ensure compatibility with lifestyle preferences.

What closing costs should I expect when buying a home in Enterprise Nevada?

Enterprise Nevada closing costs typically range 2-4% of purchase price, including lender fees, title insurance, escrow costs, inspection fees, and prepaid items. Expect $12,000-$16,000 on $400,000 home, $18,000-$24,000 on $600,000 property. Nevada has no state transfer taxes, but other fees include appraisal ($500-$800), inspection ($400-$600), and title insurance ($800-$2,000) depending on property value.

🏡 Ready to Start Your Enterprise Nevada Home Buying Journey?

Enterprise Nevada offers exceptional home buying opportunities combining master-planned community excellence, comprehensive family amenities, competitive pricing, and Las Vegas proximity creating ideal suburban lifestyle. From entry-level family homes to luxury Southern Highlands estates, Enterprise Nevada provides diverse options for successful homeownership in Nevada's fastest-growing community.

Contact Enterprise Nevada's home buying specialist today for personalized market analysis, financing guidance, and comprehensive support throughout your Enterprise Nevada home purchase journey!

🏡 Enterprise Nevada Home Buying Reality Check

Market Competition & Preparation Requirements: Enterprise Nevada's growing popularity creates competitive buying conditions requiring strong financial preparation, pre-approval completion, and experienced agent representation. Rapid community development means changing inventory levels, construction activity, and evolving neighborhood character requiring careful timing and realistic expectations about market conditions and availability.

Long-Term Community Planning & Sustainability: Enterprise Nevada's explosive growth requires careful evaluation of infrastructure capacity, school expansion, and community service development ensuring sustainable living experience. Buyers should research specific developments, HOA financial health, and long-term community planning ensuring quality investment rather than speculative purchases based solely on rapid appreciation and population growth trends.

Disclaimer: This Enterprise Nevada home buying guide is compiled from extensive research of market data, financing options, community information, and buying process requirements available as of October 2025. Real estate markets, home prices, financing terms, and community conditions are subject to change based on economic factors, interest rates, development progress, and local circumstances that fluctuate over time. Home buying outcomes, financing approval, community satisfaction, and living experiences may vary significantly based on individual circumstances, credit profiles, income levels, and personal preferences affecting overall home buying success. Real estate information, financing options, neighborhood analysis, and process timelines may vary significantly based on market conditions, lender requirements, and individual circumstances affecting buying decisions and transaction completion. This analysis serves as educational information for Enterprise Nevada home buying consideration and should not be considered guaranteed financing terms, market conditions, or buying outcomes. Enterprise Nevada home buyers are strongly advised to conduct personal financial analysis, verify current market conditions and financing options, research specific neighborhoods and properties, evaluate individual buying qualifications and objectives, obtain professional real estate and financial guidance, and assess personal community compatibility and living priorities to ensure optimal decision-making based on current conditions and individual circumstances rather than relying solely on general information provided in this educational resource for Enterprise Nevada home buying success and community satisfaction.

Stay Informed with RECN Insights

Subscribe to our blog for exclusive real estate tips, market updates, and community guides.

Real Estate Concierge Network

Your gateway to exceptional real estate services with 20%+ savings on agent fees, lifetime concierge support, and comprehensive solutions for buyers, sellers, businesses, and agent partners.

Save Contact

Save my contact info directly to your phone for easy access anytime you need help.

📲 Save to PhoneCall Direct

Speak with our specialists for immediate assistance with your real estate needs.

🗣 Call NowEmail Us

Send detailed inquiries and receive comprehensive responses within 2 hours during business hours.

📤 Send EmailSchedule Video Call

Book a free 30-minute consultation to discuss your real estate needs via secure video call.

📅 Book MeetingSend Text

Text me your real estate questions about buying, selling, market conditions, or property values for fast, personalized responses.

👥 Start ChatLeave Review

Help others discover our exceptional real estate concierge services.

📝 Write Review

Agent | License ID: BS.0144709

+1(702) 213-5555 | info@recngroup.com