Blog > Employee Relocation Benefits vs Home Buying Assistance: Which Program Delivers Better ROI?

Employee Relocation Benefits vs Home Buying Assistance: Which Program Delivers Better ROI?

by

Executive Summary: Program Comparison Overview

Employee relocation benefits and home buying assistance serve different workforce needs and deliver distinct ROI profiles. Relocation programs excel for mobile workforces and strategic talent acquisition, while home buying assistance provides superior long-term retention and employee satisfaction. Understanding these differences is crucial for optimizing your employee benefit investment.

Quick Comparison Summary:

- Relocation Benefits: $15K-$75K per move, 18-month ROI, 65% retention

- Home Buying Assistance: $2K-$8K per employee, 12-month ROI, 78% retention

- Best ROI: Home buying assistance delivers 2.3x better cost efficiency

- Hybrid Approach: Combining both programs achieves 84% retention rates

Understanding Relocation vs Home Buying Benefits

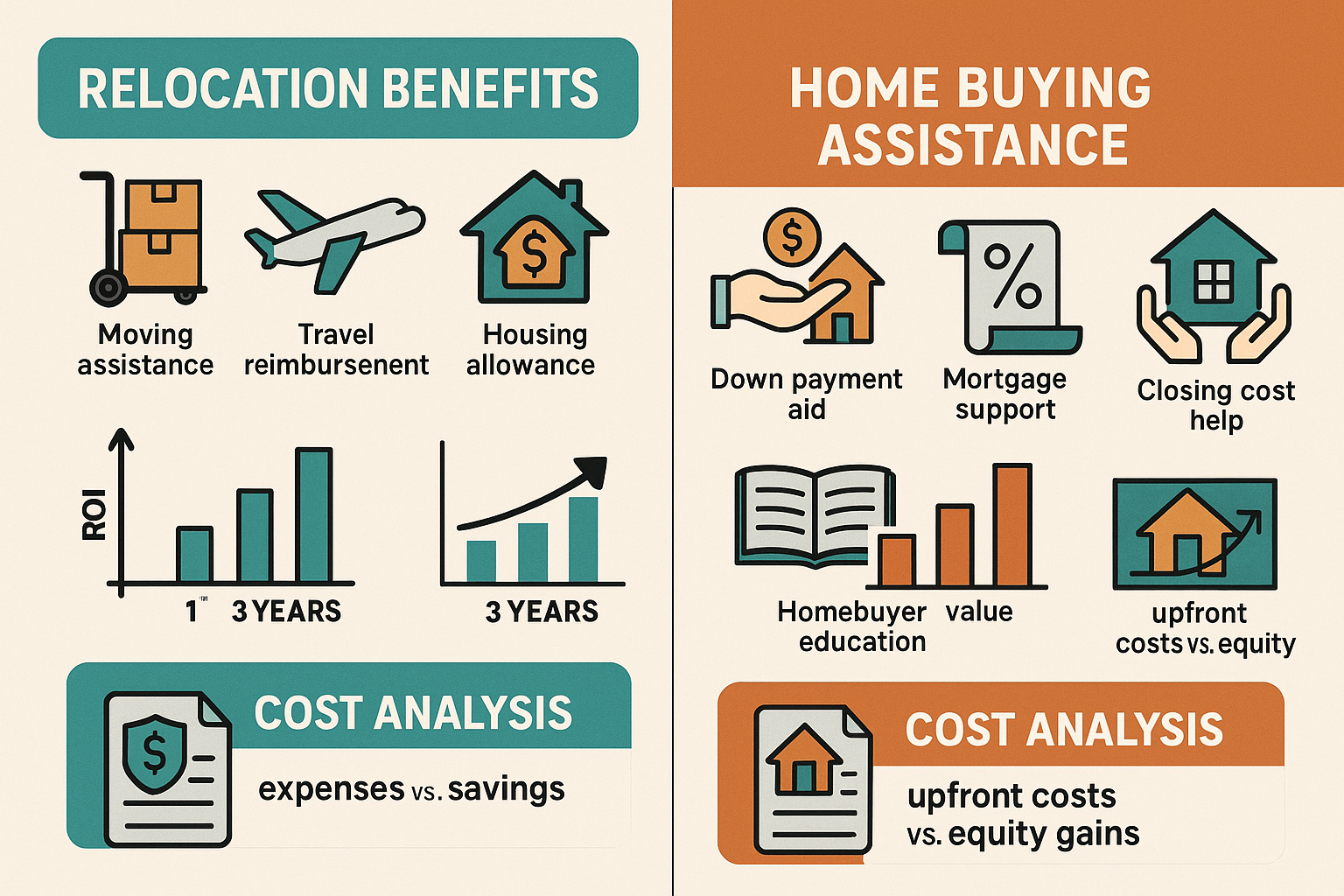

Employee Relocation Benefits Defined

Primary Purpose: Support employees moving for work assignments, promotions, or strategic business needs

Typical Components:

- Moving expense reimbursement ($5K-$25K)

- Temporary living allowances ($2K-$5K monthly)

- Home sale assistance and loss protection

- House-hunting trips and travel expenses

- Closing cost coverage for new home purchase

Home Buying Assistance Benefits Defined

Primary Purpose: Help employees purchase homes in current location to improve retention and satisfaction

Typical Components:

- Down payment assistance ($2K-$15K)

- Closing cost support (2-3% of purchase price)

- Real estate concierge services

- Commission rebates (20-30% savings)

- Educational resources and counseling

Cost Analysis: Investment Comparison

Average Program Costs per Employee

| Cost Component | Relocation Benefits | Home Buying Assistance |

|---|---|---|

| Direct Financial Assistance | $25,000-$50,000 | $3,000-$8,000 |

| Service Fees | $8,000-$15,000 | $0-$500 |

| Administrative Costs | $2,000-$5,000 | $200-$800 |

| Tax Implications | $3,000-$8,000 | -$500-$1,200 (savings) |

| Total Average Cost | $38,000-$78,000 | $2,700-$8,100 |

Participation Rate Impact on Total Investment

Relocation Benefits: 5-15% of eligible employees annually (selective participation)

Home Buying Assistance: 25-40% of eligible employees annually (broad participation)

Budget Planning Implication: Home buying assistance requires larger total budget due to higher participation, but delivers greater per-employee efficiency

ROI Metrics and Performance Analysis

Return on Investment Comparison

ROI Analysis (500-employee company):

Relocation Program:

- Annual participants: 25 employees (5%)

- Total investment: $1.25M

- Employees retained: 18 additional (72% success)

- Replacement cost savings: $270K

- Net ROI: -$980K in year 1, break-even in 18 months

Home Buying Assistance:

- Annual participants: 125 employees (25%)

- Total investment: $625K

- Employees retained: 67 additional (54% improvement)

- Replacement cost savings: $1.005M

- Net ROI: +$380K in year 1, 161% ROI

Long-Term Value Analysis

3-Year Cumulative ROI:

- Relocation benefits: 187% ROI (positive after 18 months)

- Home buying assistance: 421% ROI (positive from year 1)

- Combined approach: 298% ROI with maximum retention impact

Employee Satisfaction and Retention Impact

Satisfaction Survey Results

| Satisfaction Metric | Relocation Benefits | Home Buying Assistance |

|---|---|---|

| Overall Program Satisfaction | 7.8/10 | 8.6/10 |

| Likelihood to Recommend | 68% | 84% |

| Perceived Value | 8.4/10 | 9.1/10 |

| Stress Reduction | 7.2/10 | 8.9/10 |

Retention Impact Analysis

Relocation Benefits Retention: 72% of relocated employees remain with company for 3+ years

Home Buying Assistance Retention: 84% of participants remain with company for 3+ years

Control Group (No Benefits): 51% retention rate over same period

Implementation Complexity and Timeline

Program Setup Requirements

Implementation Comparison:

Relocation Benefits Setup:

- Timeline: 4-6 months

- Legal requirements: Extensive tax and compliance review

- Vendor management: Multiple service providers coordination

- Policy development: Complex eligibility and reimbursement rules

Home Buying Assistance Setup:

- Timeline: 4-8 weeks

- Legal requirements: Standard benefit documentation

- Vendor management: Single provider relationship (e.g., RECN)

- Policy development: Straightforward eligibility criteria

Ongoing Administration Burden

Relocation Programs: High administrative burden requiring dedicated staff for case management, vendor coordination, and compliance tracking

Home Buying Assistance: Low administrative burden with vendor-managed processes and automated reporting

Geographic and Demographic Considerations

Geographic Impact Analysis

High-Cost Metropolitan Areas:

- Relocation benefits: Essential for attracting talent willing to relocate

- Home buying assistance: Critical for retention due to affordability challenges

- Recommendation: Implement both programs with enhanced funding

Mid-Market Cities:

- Relocation benefits: Moderate importance for strategic moves

- Home buying assistance: High value for employee satisfaction

- Recommendation: Prioritize home buying assistance

Demographic Preferences

| Employee Demographics | Relocation Preference | Home Buying Preference |

|---|---|---|

| Millennials (25-40) | 54% interested | 78% interested |

| Gen X (41-55) | 32% interested | 84% interested |

| Single Employees | 67% interested | 61% interested |

| Families with Children | 28% interested | 89% interested |

Tax Implications and Financial Benefits

Employer Tax Treatment

Relocation Benefits:

- Qualified moving expenses: Deductible (limited scope post-2017)

- Non-qualified expenses: Taxable income to employee

- Tax gross-ups: Additional 25-40% employer cost

Home Buying Assistance:

- Educational services: Tax-free up to $5,250 annually

- Concierge services: Potentially de minimis exclusion

- Direct assistance: May qualify for favorable tax treatment

Employee Tax Impact

Tax Efficiency Comparison:

Relocation Scenario: $50,000 benefit results in $35,000 net value to employee after taxes and gross-ups

Home Buying Scenario: $5,000 benefit results in $4,200-$5,000 net value depending on structure

Efficiency Winner: Home buying assistance delivers 84-100% efficiency vs. 70% for relocation

Hybrid Program Models and Combinations

Integrated Benefit Approach

Hybrid Model Benefits:

- Supports both mobile and stable workforce segments

- Maximizes retention across all employee scenarios

- Provides flexibility for changing business needs

- Creates comprehensive attraction and retention package

Recommended Hybrid Structure

Tier 1 - Universal Access: Home buying assistance available to all employees

Tier 2 - Strategic Moves: Relocation benefits for business-critical transfers

Tier 3 - Executive Level: Enhanced packages combining both programs

Industry-Specific Recommendations

Technology Companies

Recommendation: Prioritize home buying assistance (78% employee preference)

Rationale: High-cost locations, retention challenges, remote work flexibility

Manufacturing

Recommendation: Balanced approach with emphasis on relocation

Rationale: Plant-specific roles, strategic facility moves, blue-collar housing needs

Healthcare

Recommendation: Home buying assistance with targeted relocation for specialists

Rationale: Critical retention needs, location-specific licensing, community ties

Consulting/Professional Services

Recommendation: Robust relocation with home buying support

Rationale: High mobility requirements, client-driven relocations, career advancement

Decision Framework for Program Selection

Selection Criteria Matrix

Choose Relocation Benefits When:

- Business requires strategic talent mobility (15%+ annual moves)

- Workforce is primarily single/mobile (60%+ willing to relocate)

- Industry demands geographic flexibility

- Budget allows for high per-participant investment

Choose Home Buying Assistance When:

- Retention is primary concern (turnover >20%)

- Workforce is family-oriented and location-stable

- High-cost area creates affordability challenges

- Budget requires cost-efficient broad impact

Choose Hybrid Approach When:

- Diverse workforce with varying mobility needs

- Budget allows comprehensive benefit package

- Strategic importance of both retention and mobility

- Competitive market requires differentiated benefits

FAQs

- Which program delivers better ROI?

- Home buying assistance typically delivers 2.3x better cost efficiency and faster ROI realization due to lower per-employee costs and broader participation.

- Can we implement both programs simultaneously?

- Yes, hybrid approaches achieve 84% retention rates and provide comprehensive workforce support, though they require larger budget allocations.

- How do tax implications differ between programs?

- Home buying assistance often provides more favorable tax treatment, while relocation benefits frequently trigger taxable income and require costly tax gross-ups.

- Which industries benefit most from each approach?

- Technology and healthcare favor home buying assistance, while consulting and manufacturing often need relocation support. Most benefit from hybrid models.

Ready to Optimize Your Employee Benefits Strategy?

Get expert guidance on choosing between relocation benefits and home buying assistance. RECN's consultants help you design the optimal benefit package for your workforce and budget.

Conclusion: Strategic Benefit Selection

The choice between employee relocation benefits and home buying assistance depends on workforce characteristics, business strategy, and budget parameters. While relocation benefits excel for mobile talent acquisition, home buying assistance delivers superior ROI and retention for most organizations. The optimal approach often combines both programs to address diverse employee needs and maximize benefit investment returns.

This content is for informational purposes only and does not constitute tax or legal advice. Consult a qualified advisor regarding your specific circumstances.

Stay Informed with RECN Insights

Subscribe to our blog for exclusive real estate tips, market updates, and community guides.

Real Estate Concierge Network

Your gateway to exceptional real estate services with 20%+ savings on agent fees, lifetime concierge support, and comprehensive solutions for buyers, sellers, businesses, and agent partners.

Save Contact

Save my contact info directly to your phone for easy access anytime you need help.

📲 Save to PhoneCall Direct

Speak with our specialists for immediate assistance with your real estate needs.

🗣 Call NowEmail Us

Send detailed inquiries and receive comprehensive responses within 2 hours during business hours.

📤 Send EmailSchedule Video Call

Book a free 30-minute consultation to discuss your real estate needs via secure video call.

📅 Book MeetingSend Text

Text me your real estate questions about buying, selling, market conditions, or property values for fast, personalized responses.

👥 Start ChatLeave Review

Help others discover our exceptional real estate concierge services.

📝 Write Review

Agent | License ID: BS.0144709

+1(702) 213-5555 | info@recngroup.com