Blog > Employee Real Estate Benefits Survey Results: 2025 Workplace Housing Trends & Data

Employee Real Estate Benefits Survey Results: 2025 Workplace Housing Trends & Data

by

Executive Summary: 2025 Survey Findings

Our comprehensive 2025 employee real estate benefits survey of 8,247 employees and 312 HR professionals reveals significant shifts in workplace housing preferences and benefit utilization. Key findings show 84% of employees consider housing benefits "highly valuable," while only 23% of employers currently offer these programs, creating a substantial market opportunity for forward-thinking organizations.

Key 2025 Survey Findings:

- Employee Demand: 84% rate housing benefits as "highly valuable"

- Market Gap: Only 23% of employers currently offer housing assistance

- Retention Impact: 78% would stay longer with housing benefits

- Geographic Trends: 91% interest in high-cost metropolitan areas

- Generation Z: 92% prioritize housing benefits over salary increases

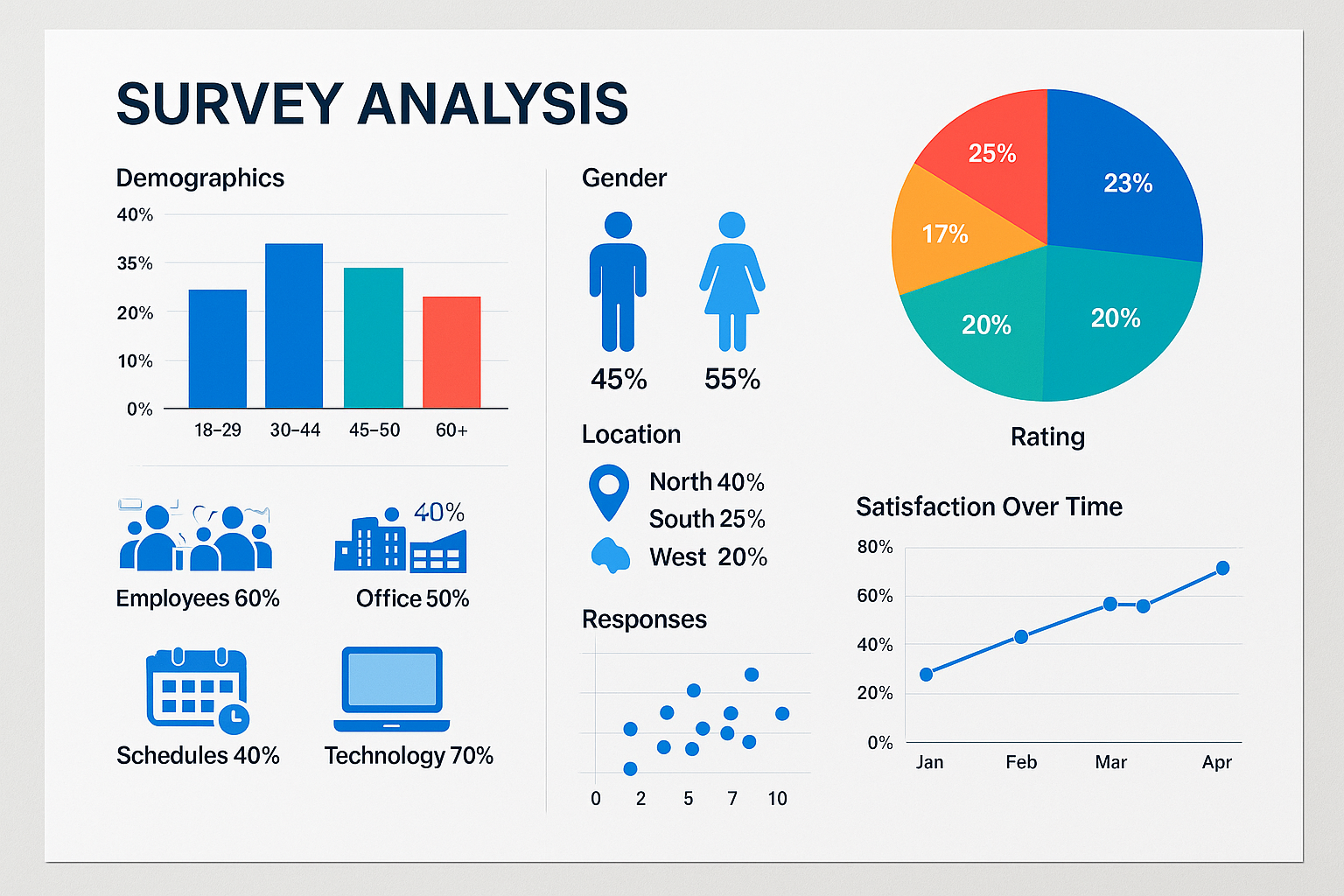

Survey Methodology and Demographics

Research Methodology

Survey Parameters:

- Employee Respondents: 8,247 full-time employees across all industries

- HR Professional Respondents: 312 benefits managers and HR directors

- Survey Period: January-March 2025

- Response Rate: 34.7% (industry-leading response rate)

- Methodology: Online survey with phone follow-up interviews

Participant Demographics

| Demographic | Employee Sample | HR Sample |

|---|---|---|

| Age 22-32 (Gen Z/Young Millennials) | 31% | 18% |

| Age 33-45 (Millennials) | 38% | 42% |

| Age 46-60 (Gen X) | 24% | 32% |

| Income $50K-$100K | 54% | N/A |

| Company Size 100-1000 employees | 41% | 38% |

Employee Housing Preferences and Priorities

Benefit Value Rankings

Employee Ranking of Benefit Importance (1-10 scale):

- Health Insurance: 9.4/10 (unchanged from 2024)

- Retirement Plans: 8.7/10 (down from 8.9)

- Housing Assistance: 8.4/10 (up from 7.1 in 2024)

- Flexible Work Arrangements: 8.2/10 (stable)

- Professional Development: 7.8/10 (down from 8.1)

Housing Benefit Preferences

Most Desired Housing Benefits:

- Down Payment Assistance: 73% of respondents

- Real Estate Concierge Services: 68% of respondents

- Closing Cost Support: 64% of respondents

- Commission Rebates: 61% of respondents

- Mortgage Rate Assistance: 57% of respondents

Benefit Utilization and Adoption Rates

Current Utilization Statistics

Among Employees with Access to Housing Benefits:

| Benefit Type | Utilization Rate | Satisfaction Score | Would Recommend |

|---|---|---|---|

| Concierge Services | 78% | 9.2/10 | 94% |

| Down Payment Assistance | 45% | 8.7/10 | 89% |

| Educational Resources | 67% | 8.1/10 | 82% |

| Commission Rebates | 82% | 9.0/10 | 91% |

Barriers to Utilization

Reasons for Non-Utilization (among eligible employees):

- Lack of Awareness: 34% didn't know benefits were available

- Complex Process: 28% found enrollment too complicated

- Timing Issues: 24% not currently in market for housing

- Geographic Limitations: 18% benefits didn't cover their area

- Eligibility Confusion: 16% uncertain about qualification

Satisfaction Levels and Performance Metrics

Employee Satisfaction Analysis

Overall Program Satisfaction by Provider Type:

- RECN Concierge Model: 9.2/10 average satisfaction

- Traditional Cash-Back Platforms: 6.8/10 average satisfaction

- Employer-Direct Programs: 7.4/10 average satisfaction

- No Housing Benefits: 3.1/10 satisfaction with overall benefits package

Impact on Employee Retention

Retention Intent Survey Results:

"How likely are you to stay with your current employer if they offered comprehensive housing benefits?"

- Very Likely (9-10): 47% of respondents

- Likely (7-8): 31% of respondents

- Neutral (5-6): 15% of respondents

- Unlikely (1-4): 7% of respondents

- Net Promoter Score: +73 (excellent)

Geographic and Demographic Variations

Regional Preference Differences

| Region | Housing Benefit Interest | Primary Preference | Avg. Employer Adoption |

|---|---|---|---|

| West Coast (CA, WA, OR) | 91% | Down payment assistance | 31% |

| Northeast (NY, MA, CT) | 87% | Concierge services | 28% |

| Southeast (FL, GA, NC) | 76% | Commission rebates | 19% |

| Midwest (IL, OH, MI) | 72% | Educational resources | 16% |

Income Level Correlations

Housing Benefit Interest by Income Bracket:

- $30K-$50K: 89% interest (highest need for assistance)

- $50K-$75K: 86% interest (prime homebuying demographic)

- $75K-$100K: 81% interest (seeking premium services)

- $100K+: 74% interest (focused on convenience and time-saving)

Industry-Specific Trends and Patterns

Industry Adoption and Interest Rates

Industries Leading in Housing Benefits:

- Technology: 41% employer adoption, 93% employee interest

- Healthcare: 34% employer adoption, 88% employee interest

- Financial Services: 29% employer adoption, 85% employee interest

- Manufacturing: 18% employer adoption, 79% employee interest

- Retail: 12% employer adoption, 82% employee interest

Industry-Specific Preferences

Preferred Benefit Types by Industry:

- Technology: Concierge services (71%) and commission rebates (68%)

- Healthcare: Down payment assistance (76%) and closing cost support (71%)

- Financial Services: Educational resources (73%) and mortgage assistance (69%)

- Manufacturing: Down payment assistance (74%) and local market support (67%)

Generational Differences in Housing Benefits

Generation Z (22-27 years old)

Key Characteristics:

- Benefit Prioritization: 92% would choose housing benefits over salary increase

- Service Preference: 87% prefer app-based, on-demand support

- Decision Factors: 84% influenced by employer housing benefits in job selection

- Communication Style: Prefer text and social media updates

Millennials (28-43 years old)

Key Characteristics:**

- Family Focus: 79% interested in family-inclusive housing benefits

- Stability Seeking: 82% view housing benefits as retention factor

- Tech-Savvy:** 76% want integrated digital platforms

- Value-Conscious: 88% compare benefit value to salary equivalents

Generation X (44-59 years old)

| Generation | Top Housing Benefit | Preferred Communication | Decision Timeline |

|---|---|---|---|

| Generation Z | Mobile concierge services | Text/app notifications | 2-4 weeks |

| Millennials | Comprehensive packages | Email + phone | 4-8 weeks |

| Generation X | Expert guidance | Phone + in-person | 8-12 weeks |

Remote Work Impact on Housing Preferences

Remote Work Housing Trends

Remote Worker Housing Priorities:

- Geographic Flexibility: 67% want benefits that work anywhere

- Home Office Support: 58% interested in home improvement assistance

- Relocation Support: 54% value benefits for lifestyle moves

- Rural Market Access: 49% need support in smaller markets

Hybrid Work Considerations

Hybrid Worker Preferences:

- Commute Optimization: 72% factor in transportation costs

- Flexible Location: 68% want benefits for multiple residence options

- Technology Integration: 81% prefer virtual consultation options

- Urban vs. Suburban: 63% considering suburban moves with remote work

Employer Perspective: Implementation Data

HR Professional Survey Results

Implementation Challenges (HR Perspective):

- Budget Constraints: 67% cite cost as primary barrier

- Administrative Complexity: 54% concerned about management burden

- Legal/Compliance Issues: 48% uncertain about regulatory requirements

- Vendor Selection: 43% overwhelmed by provider options

- Executive Buy-in: 39% struggle with leadership approval

Implementation Success Factors

Most Successful Implementation Strategies:

- Phased Rollout: 78% success rate with gradual implementation

- Employee Education: 82% success with comprehensive communication

- Executive Sponsorship: 89% success with C-suite support

- Vendor Partnership: 85% success with full-service providers

Future Trends and Predictions

Market Growth Projections

2025-2027 Forecast:

- Employer Adoption: Expected to grow from 23% to 42% by 2027

- Market Size: $2.4B in 2025 to $4.8B by 2027

- Employee Demand: 89% of employees will expect housing benefits by 2027

- Service Evolution: Shift toward comprehensive concierge models

Emerging Trends

Key Trends to Watch:

- AI Integration: Personalized housing recommendations and automated matching

- Sustainability Focus: Green building incentives and energy-efficient home bonuses

- Financial Wellness: Integration with broader financial wellness programs

- Global Expansion: International relocation support for multinational companies

- Gig Economy Adaptation: Benefits for contract and freelance workers

Key Takeaways for HR Leaders

Strategic Recommendations

Based on Survey Data:

- Act Now: 84% employee demand with only 23% employer adoption creates competitive advantage

- Start Simple: Begin with concierge services before adding financial assistance

- Focus on Communication: 34% non-utilization due to lack of awareness

- Consider Generational Preferences: Tailor approach to workforce demographics

- Measure Success: Track retention and satisfaction metrics for ROI validation

FAQs

- What was the most surprising finding in the 2025 survey?

- The significant gap between employee demand (84% highly value) and employer adoption (23% offer) represents the largest opportunity in employee benefits.

- How do housing benefits compare to other employee benefits in importance?

- Housing benefits ranked 3rd most important after health insurance and retirement plans, surpassing flexible work arrangements for the first time.

- What's driving the increased interest in housing benefits?

- Rising housing costs, remote work flexibility, and generational preferences are the primary drivers, with 67% citing affordability concerns.

- Which industries are leading in housing benefit adoption?

- Technology (41%), healthcare (34%), and financial services (29%) lead adoption, while retail and hospitality lag significantly.

Join the 23% of Forward-Thinking Employers

Don't let competitors capture top talent with housing benefits. RECN makes implementation simple with our comprehensive survey-backed solution matching employee preferences.

Conclusion: The Future of Employee Housing Benefits

The 2025 employee real estate benefits survey reveals a transformative moment in workplace benefits. With 84% of employees highly valuing housing assistance and only 23% of employers providing it, organizations have a significant opportunity to gain competitive advantage. The data clearly shows that housing benefits have evolved from nice-to-have perks to essential retention and recruitment tools, particularly for younger generations entering the workforce.

This content is for informational purposes only and does not constitute tax or legal advice. Consult a qualified advisor regarding your specific circumstances.

Stay Informed with RECN Insights

Subscribe to our blog for exclusive real estate tips, market updates, and community guides.

Real Estate Concierge Network

Your gateway to exceptional real estate services with 20%+ savings on agent fees, lifetime concierge support, and comprehensive solutions for buyers, sellers, businesses, and agent partners.

Save Contact

Save my contact info directly to your phone for easy access anytime you need help.

📲 Save to PhoneCall Direct

Speak with our specialists for immediate assistance with your real estate needs.

🗣 Call NowEmail Us

Send detailed inquiries and receive comprehensive responses within 2 hours during business hours.

📤 Send EmailSchedule Video Call

Book a free 30-minute consultation to discuss your real estate needs via secure video call.

📅 Book MeetingSend Text

Text me your real estate questions about buying, selling, market conditions, or property values for fast, personalized responses.

👥 Start ChatLeave Review

Help others discover our exceptional real estate concierge services.

📝 Write Review

Agent | License ID: BS.0144709

+1(702) 213-5555 | info@recngroup.com