Blog > Divorce Real Estate Enterprise, NV 2025: Complete Guide to Property Division, Home Sales & Legal Requirements

Divorce Real Estate Enterprise, NV 2025: Complete Guide to Property Division, Home Sales & Legal Requirements

by

⚖️ Divorce Real Estate Enterprise, NV 2025: Complete Guide to Property Division, Home Sales & Legal Requirements

📋 Table of Contents

- Enterprise Divorce Real Estate Overview & Nevada Laws

- Nevada Community Property Laws & Property Division

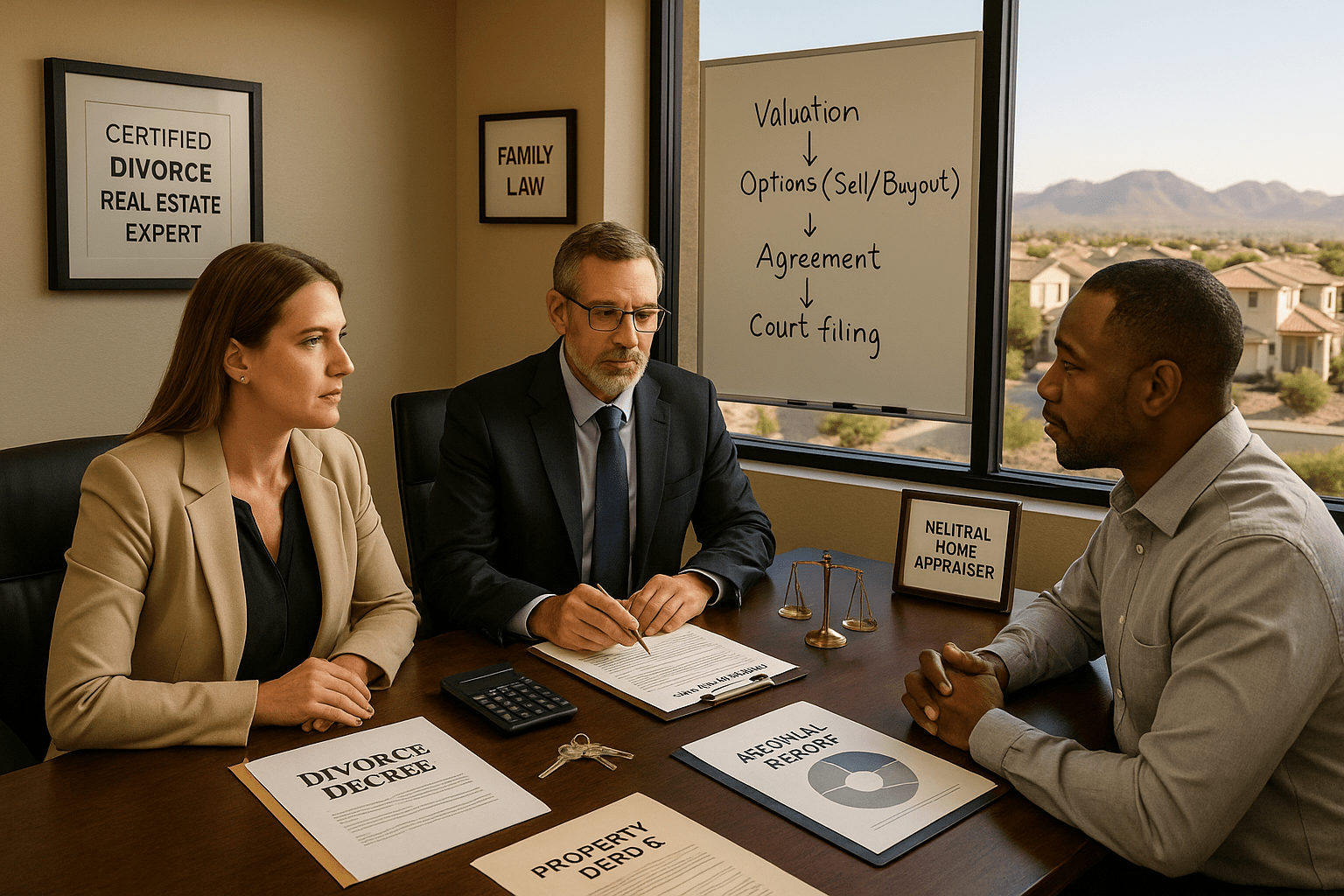

- Certified Divorce Real Estate Experts & Professional Services

- Home Appraisal & Property Valuation Requirements

- Property Sale vs. Buyout Options & Decision Making

- Legal Requirements & Court Procedures

- Tax Implications & Financial Considerations

- Divorce Timeline & Property Division Process

- Complete Professionals Directory & Services

- How to Navigate Divorce Real Estate

- Enterprise Divorce Real Estate FAQ

As Southern Nevada's premier real estate specialist and RECN Group Enterprise expert who has analyzed comprehensive Nevada community property laws, coordinated with certified divorce real estate experts and family law attorneys, researched Enterprise Nevada property division patterns and divorce real estate transactions, and provided strategic divorce property guidance throughout Southwest Las Vegas for over 15+ years serving couples seeking fair property division and emotional support during challenging family transitions, I can provide you with the definitive complete Enterprise divorce real estate guide including Nevada community property state requiring equal 50/50 division of marital assets acquired during marriage under NRS 123.220, certified divorce real estate experts (CDRE) providing neutral guidance and professional property services, comprehensive property valuation through licensed appraisers ensuring accurate market values for fair division, Enterprise Nevada median home values creating substantial marital assets requiring careful division strategies, complete legal framework with Nevada's 6-week residency requirement and 20-day waiting period, specialized professional services including family law attorneys, neutral real estate agents, and court-admissible appraisers, and comprehensive property division options including sale with proceeds split, buyout by one spouse, or continued joint ownership for optimal Enterprise Nevada divorce real estate outcomes combining legal compliance with emotional sensitivity and financial protection. Enterprise Nevada divorce real estate excellence combines legal expertise with emotional support, Nevada community property laws ensuring fair 50/50 asset division with professional guidance through certified divorce real estate experts providing neutral property services, comprehensive property valuation and market analysis supporting accurate division calculations, experienced family law attorneys specializing in high-asset property division and complex real estate matters, Enterprise housing market median values creating significant marital assets requiring strategic division planning, creating Southwest Las Vegas' most comprehensive divorce real estate support system serving couples and families including Enterprise advantages featuring established professional network and specialized divorce real estate services, Nevada community property protections ensuring fair division regardless of individual contributions, comprehensive legal framework with clear procedures and timelines, and strategic location with strong real estate values supporting asset protection, versus Enterprise considerations including emotional decision-making affecting property choices, complex legal requirements necessitating professional guidance, potential spousal disagreements requiring neutral mediation, and timeline pressures with court requirements and market conditions for authentic Southwest Las Vegas divorce real estate experiences and optimal family transition outcomes.

⚖️ Enterprise Nevada Divorce Real Estate Key Facts & Legal Excellence (2025):

- Legal Framework: Nevada community property state (NRS 123) requiring equal division of marital real estate

- Professional Support: Certified Divorce Real Estate Experts (CDRE), family law attorneys, neutral appraisers

- Property Values: Enterprise median home values creating substantial marital assets requiring division

- Division Options: Property sale, buyout arrangements, continued joint ownership, court-ordered sale

- Timeline Requirements: Nevada 6-week residency, 20-day waiting period, complete process 1-18 months

- Tax Considerations: $250,000 capital gains exclusion per spouse, community property implications

- Expert Analysis: RECN Group divorce real estate expertise with 15+ years Enterprise navigation

Enterprise Divorce Real Estate Overview & Nevada Laws

Nevada Community Property State and Divorce Real Estate Excellence

Enterprise Nevada divorce real estate operates under Nevada's community property laws, requiring equal 50/50 division of all marital assets including real estate acquired during marriage. Nevada Revised Statutes 123.220 defines community property as all property acquired after marriage by either spouse, with courts mandating equal distribution unless compelling circumstances exist. Enterprise provides comprehensive divorce real estate support through certified divorce real estate experts (CDRE), experienced family law attorneys, professional appraisers, and specialized services designed to navigate complex property division while protecting both spouses' interests during emotionally challenging family transitions.

Enterprise Divorce Real Estate Legal Framework & Professional Excellence

Nevada Community Property Leadership: Enterprise provides comprehensive divorce real estate services through Nevada community property laws ensuring fair division, certified professionals providing neutral guidance, court-admissible property valuations, and specialized services creating optimal divorce property outcomes where legal compliance combines with emotional support and financial protection supporting family transitions through professional divorce real estate management.

🌟 Enterprise Complete Divorce Real Estate & Legal Analysis

Nevada Community Property Laws & Legal Framework:

- Community Property State: Nevada Revised Statutes 123.220 requiring equal division of marital assets

- Equal Division Mandate: 50/50 split of all property acquired during marriage regardless of contributions

- Separate Property Protection: Assets owned before marriage or received as gifts/inheritance remain separate

- Real Estate Specific Rules: Both spouses must consent to community real estate transactions during marriage

- Court Jurisdiction: Nevada courts have authority to order property division and sales when necessary

- Professional Standards: Licensed appraisers required for court-admissible property valuations

Enterprise Divorce Real Estate Professional Network:

- Certified Divorce Real Estate Experts: CDRE professionals providing neutral property guidance

- Family Law Attorneys: Nevada-licensed attorneys specializing in high-asset property division

- Professional Appraisers: Licensed appraisers providing court-admissible home valuations

- Neutral Real Estate Agents: Specialized agents trained in divorce property sales

- Financial Professionals: Tax advisors and financial planners for divorce property implications

- Court Support Services: Professionals experienced in court testimony and legal procedures

Nevada Community Property Laws & Property Division

Understanding Nevada's 50/50 Property Division Requirements

Nevada community property laws under NRS 123.220 mandate equal division of all assets acquired during marriage, including real estate purchases, home improvements using marital funds, and property appreciation during marriage. Community property includes primary residences, investment properties, vacation homes, and any real estate purchased with marital income or funds. Separate property includes homes owned before marriage, inherited properties, and gifts to one spouse, though commingling separate property with marital funds can convert it to community property requiring professional legal analysis to determine proper characterization.

Nevada Community Property Laws & Division Requirements

Community Property Legal Excellence: Nevada provides comprehensive property division through community property laws ensuring equal distribution, clear legal framework protecting both spouses, professional guidance requirements, and court oversight creating optimal property division outcomes where legal compliance combines with fair distribution and professional support through established Nevada community property procedures.

⚖️ Complete Nevada Community Property Laws & Division Analysis

Community Property Definition & Requirements:

- Marital Asset Classification: All property acquired during marriage presumed community property

- Income Integration: Both spouses' earnings during marriage become community property

- Real Estate Purchases: Homes bought during marriage with marital funds are community property

- Property Improvements: Marital funds used for home improvements create community interest

- Appreciation Rights: Property value increases during marriage become community property

- Equal Ownership: Both spouses own 50% of community property regardless of individual contributions

Separate Property Protection & Characterization:

- Pre-Marital Assets: Property owned before marriage remains separate if properly maintained

- Gifts & Inheritances: Property received as gifts or inheritance to one spouse stays separate

- Personal Injury Awards: Damages awarded to one spouse for personal injury remain separate

- Commingling Risks: Mixing separate property with marital funds can convert to community property

- Documentation Requirements: Clear records necessary to prove separate property character

- Transmutation Rules: Separate property can become community through written agreements or actions

Court Division Authority & Procedures:

- Equal Division Mandate: Courts must divide community property equally unless compelling reasons exist

- Property Valuation Requirements: Professional appraisals required for accurate division calculations

- Sale Authorization: Courts can order property sales when equal division not otherwise possible

- Compelling Circumstances: Economic waste or fraud can justify unequal division

- Timing Considerations: Property values determined as of divorce filing or separation date

- Debt Allocation: Community debts divided equally along with community assets

Certified Divorce Real Estate Experts & Professional Services

Specialized Professionals for Neutral Property Guidance

Enterprise Nevada provides comprehensive divorce real estate professional services through Certified Divorce Real Estate Experts (CDRE) trained specifically in divorce property matters, neutral real estate agents experienced in handling emotional property sales, specialized family law attorneys focusing on high-asset property division, and professional appraisers providing court-admissible valuations. These professionals understand the unique challenges of divorce real estate including emotional decision-making, legal requirements, timeline pressures, and the need for neutral guidance protecting both spouses' interests throughout the property division process.

Certified Divorce Real Estate Experts & Professional Services

Professional Services Excellence: Enterprise provides comprehensive divorce real estate professionals through certified specialists, neutral guidance services, legal expertise, and court-qualified professionals creating optimal divorce property outcomes where professional competence combines with emotional sensitivity and legal compliance supporting fair property division through specialized divorce real estate services.

🏢 Complete Divorce Real Estate Professionals & Services Analysis

Certified Divorce Real Estate Experts (CDRE):

- Specialized Training: CDRE certification requiring extensive divorce real estate education

- Neutral Guidance: Trained to work objectively with both spouses during property decisions

- Legal Knowledge: Understanding of Nevada community property laws and court procedures

- Emotional Support: Skills in managing emotional aspects of divorce property sales

- Process Management: Expertise in coordinating complex divorce real estate transactions

- Court Experience: Qualified to provide expert testimony in divorce proceedings when needed

Family Law Attorneys Specializing in Property Division:

- Nevada Bar Licensed: Attorneys licensed to practice family law in Nevada courts

- Property Division Expertise: Specialized experience in high-asset real estate division

- Community Property Knowledge: Deep understanding of Nevada's community property statutes

- Litigation Experience: Trial experience when property division disputes require court resolution

- Settlement Negotiation: Skills in negotiating property division agreements outside court

- Professional Networks: Relationships with appraisers, CPAs, and other divorce professionals

Professional Appraisers & Valuation Services:

- Licensed Appraisers: Nevada-licensed professionals qualified for court-admissible appraisals

- Divorce Experience: Specialized experience in divorce-related property valuations

- Market Analysis: Comprehensive market analysis supporting accurate property values

- Court Testimony: Qualified to testify as expert witnesses in divorce proceedings

- Neutral Valuations: Objective property valuations protecting both spouses' interests

- Timeline Compliance: Ability to provide timely appraisals meeting court scheduling requirements

Home Appraisal & Property Valuation Requirements

Court-Admissible Property Valuations for Fair Division

Nevada divorce proceedings require professional property appraisals from licensed appraisers to establish accurate market values for community property division. Court-admissible appraisals must meet Uniform Standards of Professional Appraisal Practice (USPAP) requirements and provide comprehensive market analysis supporting property values. Enterprise divorce real estate appraisals include comparable sales analysis, property condition assessment, market trend evaluation, and detailed reporting necessary for court proceedings or settlement negotiations, ensuring both spouses receive accurate property valuations for fair division calculations.

Property Valuation Requirements & Appraisal Excellence

Property Valuation Leadership: Enterprise provides comprehensive property valuation through licensed appraisers, court-admissible reports, professional market analysis, and USPAP compliance creating optimal property division valuations where accuracy combines with legal requirements and professional standards supporting fair property division through reliable valuation services.

🏠 Complete Property Valuation & Appraisal Analysis

Court-Admissible Appraisal Requirements:

- Licensed Appraiser Required: Nevada-licensed appraisers qualified for court proceedings

- USPAP Compliance: Uniform Standards of Professional Appraisal Practice requirements

- Market Value Definition: Fair market value as of specific valuation date required

- Comparable Sales Analysis: Recent comparable sales supporting property value conclusions

- Property Inspection: Thorough interior and exterior property condition assessment

- Written Report: Comprehensive written appraisal report meeting court standards

Valuation Date & Timing Considerations:

- Valuation Date Selection: Property valued as of separation date or divorce filing date

- Market Timing: Current market conditions affecting property values and division

- Multiple Valuations: Updated appraisals may be required for extended proceedings

- Agreement on Date: Spouses may agree on specific valuation date for property assessment

- Court Determination: Judges may establish valuation date when spouses disagree

- Appeal Considerations: Valuation dates important for potential appeals and modifications

Property Valuation Factors & Market Analysis:

- Property Condition: Current condition and needed repairs affecting market value

- Market Trends: Local real estate market conditions and pricing trends

- Neighborhood Analysis: Comparable neighborhood sales and market characteristics

- Property Features: Unique features, improvements, and amenities affecting value

- Economic Factors: Interest rates, employment, and economic conditions affecting values

- Highest and Best Use: Property's optimal use considering zoning and market factors

Property Sale vs. Buyout Options & Decision Making

Strategic Property Division Options and Decision Framework

Enterprise divorce real estate offers three primary property division options: sale with proceeds divided equally, buyout by one spouse acquiring full ownership, or continued joint ownership with future sale provisions. Property sale provides clean division and immediate liquidity but may result in capital gains taxes and transaction costs. Buyout arrangements allow one spouse to retain the family home but require refinancing and adequate liquid assets for the buyout payment. Decision factors include emotional attachment, financial capacity, tax implications, children's needs, and market conditions affecting optimal property division strategies.

Property Division Options & Strategic Decision Making

Property Division Strategy Excellence: Enterprise provides comprehensive property division options through sale arrangements, buyout strategies, financial analysis, and decision support creating optimal property outcomes where strategic planning combines with financial capacity and family needs supporting informed property division decisions through comprehensive analysis and professional guidance.

🏡 Complete Property Division Options & Strategy Analysis

Property Sale & Equal Proceeds Division:

- Clean Division: Sale provides exact 50/50 division of net proceeds after expenses

- Immediate Liquidity: Both spouses receive cash for post-divorce housing and financial needs

- Market Timing: Sale timing can be optimized for favorable market conditions

- Transaction Costs: Real estate commissions, closing costs, and repairs reduce net proceeds

- Tax Implications: Capital gains may apply depending on ownership period and gains

- Emotional Closure: Sale can provide psychological closure and fresh start for both spouses

Buyout Arrangements & Ownership Transfer:

- Home Retention: One spouse keeps family home and familiar living environment

- Refinancing Required: Buying spouse must qualify for mortgage to refinance existing loan

- Buyout Payment: Buying spouse pays other spouse 50% of home equity value

- Financial Qualification: Income and credit requirements for sole mortgage responsibility

- Property Maintenance: Buying spouse assumes all ongoing property expenses and maintenance

- Future Sale Rights: Agreements may include future sale provisions and profit sharing

Continued Joint Ownership & Deferred Sale:

- Temporary Arrangement: Joint ownership until specific trigger events like children graduating

- Occupancy Rights: Agreements specifying which spouse may occupy property

- Expense Allocation: Arrangements for mortgage, taxes, insurance, and maintenance costs

- Future Sale Terms: Pre-agreed terms for eventual property sale and proceeds division

- Decision Making: Procedures for property decisions requiring both spouses' consent

- Exit Strategies: Provisions for early sale if circumstances change or disputes arise

Legal Requirements & Court Procedures

Nevada Divorce Legal Framework and Court Procedures

Nevada divorce legal requirements include 6-week residency requirement for filing spouse, 20-day waiting period after service of divorce papers, and comprehensive property disclosure requirements. Court procedures for property division include filing financial disclosures, property valuations, settlement negotiations, and potential trial if agreements cannot be reached. Nevada courts have jurisdiction to order property sales when equal division cannot be achieved through other means, and judges consider factors including property values, debt allocation, spousal needs, and compelling circumstances that might justify deviation from equal division requirements.

Legal Requirements & Court Procedures Excellence

Legal Framework Leadership: Enterprise provides comprehensive legal requirements guidance through Nevada divorce procedures, court compliance requirements, professional legal support, and procedural expertise creating optimal legal outcomes where compliance combines with strategic positioning and professional representation supporting successful divorce property division through established Nevada legal framework.

⚖️ Complete Legal Requirements & Court Procedures Analysis

Nevada Divorce Filing Requirements:

- Residency Requirement: At least one spouse must be Nevada resident for 6 weeks before filing

- Grounds for Divorce: Nevada allows no-fault divorce based on incompatibility or separation

- Filing Location: Divorce filed in county where either spouse resides

- Service Requirements: Divorce papers must be properly served on non-filing spouse

- Waiting Period: 20-day waiting period after service before divorce can be granted

- Response Deadlines: Served spouse has specific timeframes to respond to divorce petition

Property Division Court Procedures:

- Financial Disclosures: Both spouses must provide comprehensive financial information

- Property Inventory: Complete listing of all community and separate property required

- Valuation Requirements: Professional appraisals for real estate and significant assets

- Settlement Conferences: Court-mandated settlement discussions before trial

- Discovery Process: Legal procedures for obtaining financial information and documentation

- Trial Procedures: Court trial if settlement cannot be reached through negotiation

Court Authority & Property Division Orders:

- Equal Division Authority: Courts must divide community property equally absent compelling reasons

- Sale Authorization: Judges can order property sales when equal division otherwise impossible

- Temporary Orders: Courts can issue temporary property use and support orders during proceedings

- Contempt Powers: Court authority to enforce property division orders and prevent asset waste

- Modification Limitations: Property division orders generally final and not modifiable after divorce

- Appeal Rights: Limited appeal rights for property division decisions and legal errors

Tax Implications & Financial Considerations

Capital Gains, Tax Benefits, and Financial Planning

Divorce real estate transactions involve significant tax implications including capital gains exclusions, community property tax basis advantages, and timing considerations for optimal tax outcomes. Nevada residents benefit from $250,000 capital gains exclusion per spouse ($500,000 total) when selling primary residence, provided ownership and residency requirements are met. Community property receives stepped-up tax basis upon divorce, potentially reducing future capital gains exposure. Property transfers between spouses during divorce are generally tax-free, but post-divorce sales may trigger capital gains obligations requiring professional tax planning and strategic timing considerations.

Tax Implications & Financial Planning Excellence

Tax Planning Leadership: Enterprise provides comprehensive tax implications analysis through capital gains planning, financial strategy development, professional tax guidance, and optimal timing considerations creating beneficial tax outcomes where tax efficiency combines with financial planning and professional support supporting optimal divorce property financial results through strategic tax management.

💰 Complete Tax Implications & Financial Considerations Analysis

Capital Gains Exclusion & Tax Benefits:

- Primary Residence Exclusion: $250,000 capital gains exclusion per spouse for primary residence

- Joint Exclusion: $500,000 total exclusion available if both spouses qualify

- Ownership Requirements: Property must be owned at least 2 years before sale

- Residency Requirements: Property must be primary residence for 2 of past 5 years

- Timing Strategies: Sale timing can be optimized to maximize exclusion benefits

- Future Exclusion: Each spouse can claim exclusion on future primary residence sales

Community Property Tax Basis & Advantages:

- Stepped-Up Basis: Community property receives favorable tax basis treatment

- Basis Allocation: Tax basis divided between spouses based on property division

- Depreciation Recapture: Rental properties may have depreciation recapture obligations

- Installment Sales: Buyout payments may qualify for installment sale tax treatment

- Like-Kind Exchanges: 1031 exchanges may defer capital gains on investment properties

- Professional Guidance: Tax professionals required for complex property tax planning

Financial Planning & Cash Flow Considerations:

- Liquidity Needs: Cash flow requirements for post-divorce housing and living expenses

- Mortgage Qualification: Income and credit requirements for post-divorce home financing

- Property Maintenance: Ongoing costs for property ownership including taxes, insurance, repairs

- Investment Analysis: Comparing property retention vs. investment of sale proceeds

- Retirement Planning: Impact of property division on retirement savings and planning

- Estate Planning: Updates to estate planning documents reflecting property ownership changes

Divorce Timeline & Property Division Process

Complete Divorce Process Timeline and Property Division Steps

Nevada divorce timeline varies from 1-18 months depending on complexity, with property division adding significant time for appraisals, negotiations, and potential court proceedings. Uncontested divorces with agreed property division can be completed in 60-90 days after the 20-day waiting period, while contested divorces involving property disputes may require 6-18 months for resolution. Key timeline factors include property appraisal scheduling, settlement negotiations, court availability, and complexity of asset division, with strategic planning and professional guidance helping minimize delays and expedite property division outcomes.

📅 Complete Divorce Timeline & Property Division Process Analysis

Initial Filing & Response Period (Weeks 1-8):

- Week 1: Divorce petition filed with court and filed spouse establishes Nevada residency

- Weeks 2-3: Service of divorce papers on responding spouse with legal requirements

- Week 4: 20-day waiting period begins after proper service completed

- Weeks 5-8: Responding spouse files answer and any counter-petitions with court

- Ongoing: Temporary orders for property use, support, and asset protection if needed

- Timeline Factors: Service difficulties and response filing can extend initial timeline

Discovery & Property Valuation Period (Weeks 8-16):

- Weeks 8-10: Financial disclosures and property inventory exchange between parties

- Weeks 10-12: Property appraisals scheduled and completed by licensed professionals

- Weeks 12-14: Discovery process for complex assets and business valuations if applicable

- Weeks 14-16: Review of appraisals and financial information for settlement discussions

- Ongoing: Legal preparation for settlement negotiations or trial proceedings

- Timeline Factors: Appraiser availability and complex assets can extend valuation period

Settlement & Resolution Period (Weeks 16-52+):

- Weeks 16-20: Settlement negotiations between attorneys and spouses

- Weeks 20-24: Mediation or settlement conferences if initial negotiations unsuccessful

- Weeks 24-40: Trial preparation and court proceedings for contested property division

- Weeks 40-52: Final divorce decree and property division implementation

- Post-Decree: Property transfers, deed changes, and refinancing completion

- Timeline Factors: Court scheduling and complexity can significantly extend resolution period

Complete Professionals Directory & Services

⚖️ Certified Divorce Real Estate Expert

Specialized Divorce Real Estate: Certified professionals trained specifically in divorce property matters providing neutral guidance, property valuations, and expert sales services protecting both spouses' interests.

Services Provided:

- Neutral property guidance and consultation

- Market analysis and property valuations

- Divorce property sales and marketing

- Court testimony and expert witness services

Best For: Neutral guidance, property sales, expert testimony, emotional support

👨💼 Family Law Attorney

Property Division Legal: Nevada-licensed family law attorneys specializing in high-asset property division, community property law, and complex real estate matters in divorce proceedings.

Services Provided:

- Legal representation in property division

- Community property law guidance

- Settlement negotiation and mediation

- Court representation and litigation

Best For: Legal representation, complex property, court proceedings, settlement

🏠 Professional Appraiser

Property Valuation Expert: Nevada-licensed appraisers providing court-admissible property valuations, comprehensive market analysis, and expert testimony for divorce property division.

Services Provided:

- Court-admissible property appraisals

- Comprehensive market analysis

- Expert witness testimony

- Multiple property valuation dates

Best For: Property valuation, court testimony, market analysis, legal compliance

💼 Tax Professional

Divorce Tax Planning: Certified Public Accountants and Enrolled Agents specializing in divorce tax implications, capital gains planning, and financial strategy development.

Services Provided:

- Capital gains tax planning and analysis

- Property transfer tax implications

- Financial planning and strategy

- Post-divorce tax preparation

Best For: Tax planning, capital gains, financial strategy, compliance

🏡 Neutral Real Estate Agent

Divorce Property Sales: Real estate agents with specialized training in divorce property sales providing neutral representation, emotional support, and professional marketing services.

Services Provided:

- Neutral representation for both spouses

- Professional property marketing

- Emotional support during sales process

- Coordination with legal professionals

Best For: Property sales, neutral representation, marketing, emotional support

💰 Financial Planner

Post-Divorce Planning: Certified Financial Planners specializing in divorce financial planning, asset allocation, and long-term financial strategy development for post-divorce life.

Services Provided:

- Post-divorce financial planning

- Asset allocation and investment strategy

- Retirement planning updates

- Cash flow and budgeting analysis

Best For: Financial planning, investment strategy, retirement planning, budgeting

⚖️ How to Navigate Divorce Real Estate: Complete Professional Guide (8 Steps)

Step 1: Understand Nevada Community Property Laws & Your Rights

Learn Nevada community property requirements including equal division mandates, separate property protections, and legal procedures while consulting with experienced family law attorneys to understand your specific rights, property characterization, and optimal strategies for protecting your interests throughout the divorce process.

Step 2: Engage Certified Divorce Real Estate Professionals

Assemble professional team including Certified Divorce Real Estate Expert (CDRE), family law attorney, and licensed appraiser while ensuring all professionals have divorce-specific experience, neutral approach, and ability to work collaboratively for fair property division outcomes and emotional support.

Step 3: Complete Comprehensive Property Inventory & Documentation

Compile complete inventory of all real estate assets including primary residence, investment properties, vacation homes, and property improvements while gathering documentation including deeds, mortgages, tax records, and improvement receipts supporting property characterization and valuation requirements.

Step 4: Obtain Professional Property Appraisals & Market Analysis

Schedule court-qualified appraisals for all real estate assets while ensuring appraiser neutrality, USPAP compliance, and appropriate valuation dates for accurate property values supporting fair division calculations and potential court proceedings or settlement negotiations.

Step 5: Analyze Property Division Options & Financial Implications

Evaluate sale vs. buyout vs. continued ownership options while considering financial capacity, tax implications, children's needs, and long-term goals for optimal property division strategy supporting post-divorce financial stability and family transition needs.

Step 6: Negotiate Property Division Agreement or Prepare for Court

Engage in settlement negotiations with professional guidance while preparing for potential court proceedings including financial disclosures, expert testimony preparation, and legal strategy development for achieving fair property division through agreement or court order.

Step 7: Implement Property Division & Complete Legal Requirements

Execute property transfers, refinancing, or sales according to divorce decree while coordinating with professionals for deed changes, mortgage modifications, tax reporting, and compliance with court orders for complete property division implementation.

Step 8: Plan Post-Divorce Housing & Financial Strategy

Develop post-divorce housing plan and financial strategy while working with financial professionals for optimal asset allocation, tax planning, and long-term financial security ensuring successful transition to post-divorce life and financial independence.

❓ Frequently Asked Questions About Enterprise Divorce Real Estate

How does Nevada's community property law affect real estate division in divorce?

Nevada community property law requires equal 50/50 division of all real estate acquired during marriage, regardless of which spouse's name is on the deed or who made mortgage payments. Property owned before marriage or received as gifts/inheritance remains separate property, but improvements made with marital funds can create community interest requiring professional legal analysis.

Do I need a Certified Divorce Real Estate Expert (CDRE) for my divorce?

While not legally required, CDRE professionals provide specialized training in divorce real estate matters, neutral guidance protecting both spouses, expertise in emotional aspects of property sales, and coordination with legal professionals. Their specialized knowledge can prevent costly mistakes and reduce conflict during property division.

What are my options for dividing the family home in divorce?

Three primary options exist: sell the home and divide proceeds equally, one spouse buys out the other's 50% interest, or continue joint ownership with future sale provisions. Each option has financial, tax, and emotional implications requiring professional analysis of your specific situation and goals.

How long does divorce real estate division take in Nevada?

Timeline varies from 2-18 months depending on complexity. Uncontested divorces with agreed property division can complete in 60-90 days after the 20-day waiting period. Contested divorces requiring court proceedings, multiple appraisals, or complex asset analysis may take 6-18 months for complete resolution.

What are the tax implications of selling our home during divorce?

Primary residence sales may qualify for $250,000 capital gains exclusion per spouse ($500,000 total) if ownership and residency requirements are met. Community property receives favorable tax basis treatment, and property transfers between spouses during divorce are generally tax-free, but professional tax guidance is essential.

Can the court force us to sell our home if we can't agree?

Yes, Nevada courts have authority to order property sales when equal division cannot be achieved through other means. Courts prefer negotiated settlements but will order sales to ensure fair property division when spouses cannot reach agreement on buyouts or continued ownership arrangements.

How is property valued for divorce purposes in Nevada?

Property must be valued by Nevada-licensed appraisers using fair market value as of separation date or divorce filing date. Court-admissible appraisals must meet Uniform Standards of Professional Appraisal Practice (USPAP) requirements and include comprehensive market analysis supporting value conclusions.

What happens to property improvements made during marriage?

Property improvements made with community funds (marital income) create community interest even in separate property. The community may be entitled to reimbursement for improvements plus appreciation, requiring professional appraisal to determine separate vs. community interests and fair compensation.

Should we use the same real estate agent or separate agents?

Using a neutral Certified Divorce Real Estate Expert (CDRE) or divorce-trained agent often works best, providing objective guidance to both spouses. Separate agents can create conflicts and reduced cooperation. Neutral representation helps ensure fair marketing, pricing, and proceeds distribution while reducing emotional stress.

What if my spouse is hiding assets or refusing to cooperate?

Nevada courts have authority to prevent asset waste and enforce disclosure requirements. Your attorney can file motions for protective orders, seek contempt sanctions, and use discovery procedures to locate hidden assets. Courts can award additional property to compensate for concealed or wasted community assets.

⚖️ Ready to Navigate Enterprise Divorce Real Estate with Expert Support?

Enterprise Nevada provides comprehensive divorce real estate support through Nevada's community property laws ensuring fair division, certified divorce real estate experts providing neutral guidance, professional appraisers offering court-admissible valuations, and experienced family law attorneys protecting your property interests during challenging family transitions.

Contact Enterprise divorce real estate specialist today for confidential consultation, professional team coordination, property valuation guidance, legal requirement compliance, and comprehensive support for your successful Enterprise Nevada divorce real estate outcomes and optimal family transition results!

⚖️ Divorce Real Estate Reality Check

Emotional & Financial Complexity: Divorce real estate involves significant emotional stress affecting decision-making, complex legal requirements necessitating professional guidance, potential spousal conflicts requiring neutral mediation, and substantial financial implications including taxes, transaction costs, and long-term financial planning requiring comprehensive professional support throughout the process.

Legal Requirements & Timeline Pressures: Nevada community property laws mandate equal division but require proper legal procedures, court-admissible appraisals, comprehensive financial disclosures, and potential court proceedings creating timeline pressures and procedural requirements necessitating experienced professional guidance for successful outcomes and legal compliance.

Disclaimer: This Enterprise Nevada divorce real estate guide is compiled from extensive research of Nevada community property laws, professional services, court procedures, and divorce real estate practices available as of October 2025. Legal requirements, court procedures, tax implications, and professional service availability are subject to change based on Nevada law modifications, court rule updates, tax law changes, and individual circumstances that vary significantly among divorce cases. Divorce real estate involves complex legal, financial, and emotional considerations requiring personalized professional guidance rather than general information. Legal outcomes, property division results, tax implications, and financial consequences depend on specific case facts, court decisions, and individual circumstances requiring professional analysis and guidance. This guide serves as educational information for divorce planning consideration and should not be considered legal, tax, or financial advice. Enterprise residents facing divorce are strongly advised to consult with qualified Nevada family law attorneys, certified divorce real estate experts, professional appraisers, tax professionals, and financial planners to ensure compliance with current laws, protect individual interests, optimize financial outcomes, and achieve fair property division throughout the divorce process based on current conditions and individual circumstances rather than relying solely on general information provided in this educational resource for Enterprise divorce real estate success and optimal family transition outcomes.

Stay Informed with RECN Insights

Subscribe to our blog for exclusive real estate tips, market updates, and community guides.

Real Estate Concierge Network

Your gateway to exceptional real estate services with 20%+ savings on agent fees, lifetime concierge support, and comprehensive solutions for buyers, sellers, businesses, and agent partners.

Save Contact

Save my contact info directly to your phone for easy access anytime you need help.

📲 Save to PhoneCall Direct

Speak with our specialists for immediate assistance with your real estate needs.

🗣 Call NowEmail Us

Send detailed inquiries and receive comprehensive responses within 2 hours during business hours.

📤 Send EmailSchedule Video Call

Book a free 30-minute consultation to discuss your real estate needs via secure video call.

📅 Book MeetingSend Text

Text me your real estate questions about buying, selling, market conditions, or property values for fast, personalized responses.

👥 Start ChatLeave Review

Help others discover our exceptional real estate concierge services.

📝 Write Review

Agent | License ID: BS.0144709

+1(702) 213-5555 | info@recngroup.com