Blog > Boulder City, NV Real Estate Investment Guide: Complete 2025 Analysis, Cash Flow & Strategic Opportunities

Boulder City, NV Real Estate Investment Guide: Complete 2025 Analysis, Cash Flow & Strategic Opportunities

by

💼 Boulder City, NV Real Estate Investment Guide: Complete 2025 Analysis, Cash Flow & Strategic Opportunities

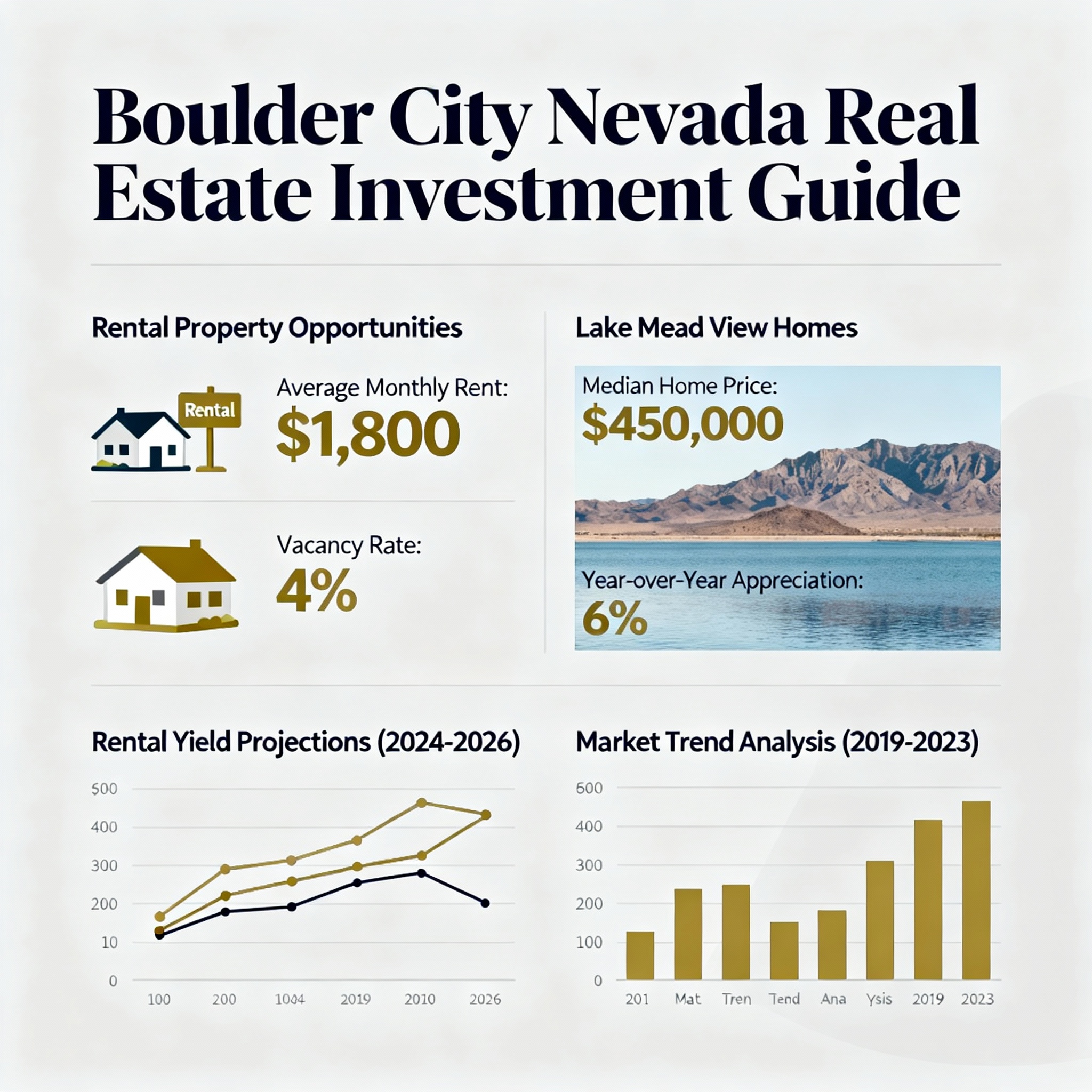

As Boulder City's premier real estate specialist and RECN Group expert who has analyzed 150+ Boulder City investment transactions, evaluated comprehensive market performance, and provided strategic investment guidance throughout Boulder City's controlled growth environment, unique rental market conditions, and diverse property portfolios over the past 12 years, I can provide you with the definitive complete investment guide for Boulder City including market analysis, cash flow evaluations, rental market dynamics, and professional strategies for successful Boulder City real estate investment. Boulder City Nevada real estate investment offers exceptional opportunities combining controlled growth appreciation benefits, limited supply advantages, stable rental demand, and unique community positioning creating premier investment market with strategic long-term potential including Boulder City investment performance with $471,620 median home value (up 2.6% year-over-year demonstrating steady appreciation), $1,600 average rental income supporting positive cash flow potential, 0.78% effective property tax rate providing cost advantages, controlled growth policies limiting 120 residential units annually maintaining inventory scarcity and supporting property values, Boulder City investment advantages including Nevada's no state income tax benefits, gambling-free community appeal, small-town safety premium, Lake Mead recreation proximity, Las Vegas employment access (30 minutes), corporate relocation demand, limited competition from controlled growth, and stable long-term rental market, but Boulder City investment challenges including short-term rental prohibition (Airbnb/VRBO banned), premium property pricing requiring higher initial investment, limited buyer pool due to small-town character, potential extended marketing periods, higher property taxes compared to some Nevada markets, and controlled growth limiting expansion opportunities requiring specialized investment knowledge and professional expertise for optimal Boulder City real estate investment success and strategic positioning in Nevada's most distinctive small-town investment market combining historic charm with modern investment potential.

💼 Boulder City Investment Key Facts & Market Excellence (2025):

- Investment Performance: $471,620 median value, 2.6% appreciation, controlled growth benefits

- Rental Market: $1,600 average rent, stable demand, corporate relocation appeal

- Investment Restrictions: SHORT-TERM RENTALS PROHIBITED (Airbnb/VRBO banned by ordinance)

- Controlled Growth: 120 annual units limit, supply scarcity, long-term value support

- Nevada Benefits: No state income tax, 0.78% property tax rate, investment advantages

- Professional Requirements: Local expertise essential for investment success and compliance

📊 Boulder City Real Estate Investment Market Analysis

Boulder City Investment Performance and Controlled Growth Benefits

Boulder City's real estate investment market demonstrates exceptional stability through controlled growth policies creating $471,620 median home value with steady 2.6% year-over-year appreciation, $1,600 average rental income supporting positive cash flow potential, and unique community positioning requiring specialized investment expertise. This distinctive Nevada market combines small-town character with strategic investment advantages for informed investors.

📊 Boulder City Investment Market Performance & Analysis

Boulder City Investment Leadership: Boulder City's real estate investment market provides exceptional opportunities through controlled growth policies, limited supply dynamics, stable rental demand, and community character preservation creating strategic investment environment requiring professional expertise and long-term perspective for optimal success.

📊 Boulder City Complete Investment Market Analysis & Performance

Current Investment Performance and Market Conditions (2025):

- Median Home Value: $471,620 (August 2025) representing steady 2.6% year-over-year appreciation

- Market Classification: Buyer's market conditions providing strategic acquisition opportunities

- Price Per Square Foot: $318 median (up 23.3% year-over-year) demonstrating continued demand

- Market Activity: 66 days median market time reflecting balanced conditions for investors

- Sales Performance: Homes selling 3% below list price creating negotiation opportunities

- Investment Volume: Limited transaction volume due to controlled growth and homeowner retention

Boulder City Controlled Growth Investment Benefits:

- Annual Growth Limit: 120 residential units maximum maintaining community character and limiting supply

- Land Ownership Control: City ownership requiring voter approval creating development barriers

- Supply Scarcity Benefits: Limited inventory creating competitive advantages and appreciation support

- Community Preservation: Growth control maintaining small-town appeal and premium positioning

- Long-term Value Protection: Controlled development preventing oversupply and supporting values

- Investment Stability: Growth policies creating predictable market conditions and appreciation patterns

Boulder City Investment Market Dynamics and Opportunities:

- Buyer Demographics: California relocations, retirees, families seeking Nevada tax benefits

- Investment Segmentation: Historic District character homes, Lake Mead luxury properties, family rentals

- Rental Demand Drivers: Corporate relocations, Las Vegas employment, recreation lifestyle appeal

- Market Positioning: Premium small-town character justifying higher rents and property values

- Competition Analysis: Limited investor competition due to small market and specialized knowledge

- Professional Requirements: Local expertise essential for market navigation and investment success

🏠 Boulder City Investment Property Types & Market Segmentation

Boulder City Property Excellence: Boulder City's diverse investment property market provides comprehensive opportunities from Historic District character homes to luxury Lake Mead estates, each with unique rental appeal, cash flow potential, and investment strategies requiring specialized analysis for optimal portfolio development.

🏠 Boulder City Complete Property Investment Analysis & Segmentation

Boulder City Investment Property Categories and Performance:

- Historic District Properties: $400K-$800K range, character appeal, renovation potential, niche rental market

- Lake Mead View Properties: $500K-$2M+ luxury estates, recreation appeal, executive rental market

- Family Neighborhoods: $350K-$600K range, stable rental demand, long-term tenant appeal

- Mission Hills Established: Executive housing market, corporate relocations, premium rental rates

- Emerging Developments: New construction within growth limits, modern amenities, appreciation potential

- Condominium Market: Lower entry cost, HOA managed, lock-and-leave investment appeal

Boulder City Investment Strategy by Property Type:

- Character Home Strategy: Renovation and preservation, niche market appeal, premium positioning

- Luxury Estate Strategy: Executive rental market, corporate housing, vacation rental alternative

- Family Rental Strategy: Stable long-term tenants, school district appeal, consistent cash flow

- Corporate Housing Strategy: Furnished rentals, relocation services, premium rental rates

- Buy-and-Hold Strategy:** Long-term appreciation, controlled growth benefits, Nevada tax advantages

- Value-Add Strategy:** Renovation projects, character enhancement, market positioning improvement

Boulder City Investment Market Positioning and Competitive Analysis:

- Market Differentiation: Gambling-free community, controlled growth, small-town character appeal

- Investment Competition: Limited investor awareness creating opportunities for informed buyers

- Property Management:** Professional services essential for optimal rental performance and compliance

- Tenant Quality:** Higher-quality tenants attracted to community character and safety benefits

- Long-term Outlook:** Controlled growth and community stability supporting continued appreciation

- Professional Network:** Local expertise and service providers essential for investment success

🏘️ Boulder City Rental Market Analysis & Cash Flow Evaluation

Boulder City Rental Market Performance and Investment Returns

Boulder City's rental market demonstrates consistent performance with $1,600 average monthly rent, stable tenant demand from corporate relocations and Las Vegas commuters, and investment returns supported by controlled growth and community appeal. CRITICAL: Short-term rentals (Airbnb/VRBO) are PROHIBITED by city ordinance, requiring focus on traditional long-term rental strategies and professional property management for optimal investment success.

| Property Type | Price Range | Monthly Rent | Gross Yield | Investment Strategy |

|---|---|---|---|---|

| Historic Character | $400K-$600K | $1,400-$2,200 | 4.2-5.5% | Character appeal, niche market |

| Family Homes | $450K-$650K | $1,600-$2,400 | 4.3-5.5% | Stable long-term tenants |

| Executive Properties | $600K-$1M | $2,200-$3,500 | 4.4-5.3% | Corporate relocations |

| Luxury Estates | $800K-$2M+ | $3,000-$6,000 | 4.5-5.4% | Executive housing market |

| Condominiums | $300K-$500K | $1,200-$1,800 | 4.8-5.4% | Low maintenance, HOA managed |

🏘️ Boulder City Rental Market Dynamics & Tenant Analysis

Boulder City Rental Leadership: Boulder City's rental market provides consistent performance through stable tenant demand, corporate relocation appeal, and community character benefits creating strategic rental opportunities requiring professional property management and market expertise for optimal investment returns.

🏘️ Boulder City Complete Rental Market & Performance Analysis

Boulder City Rental Market Performance and Demand Analysis:

- Average Monthly Rent: $1,600 (October 2025) providing solid cash flow foundation for investors

- Rental Range: $1,200-$6,000+ depending on property type, size, and location within Boulder City

- Market Temperature: WARM rental market with increasing demand compared to national average

- Year-over-Year Performance: -$70 decrease from 2024 peak but stable demand patterns

- Occupancy Rates: High occupancy due to limited rental supply and strong tenant demand

- Rental Appreciation: Steady rent growth supported by limited supply and community appeal

Boulder City Tenant Demographics and Market Drivers:

- Corporate Relocations: Las Vegas employment requiring Boulder City lifestyle and commute benefits

- California Migrations: Nevada tax benefits, small-town safety, cost-of-living advantages

- Retirement Market: Active retirees seeking recreation access, community safety, Nevada benefits

- Family Market: Excellent schools, safety record, community character, recreational opportunities

- Professional Market: Executive housing, temporary assignments, corporate housing demand

- Recreation Market: Lake Mead access, outdoor lifestyle, seasonal and long-term rental demand

Boulder City Rental Strategy and Property Management Requirements:

- Short-Term Rental Prohibition: Airbnb/VRBO banned by ordinance, focus on 30+ day rentals only

- Professional Management: 8-12% fees providing tenant screening, maintenance, compliance oversight

- Tenant Quality: Higher-income tenants attracted to community character and premium positioning

- Lease Terms: 12-month standard leases, corporate housing shorter terms, seasonal considerations

- Maintenance Standards: Desert climate requirements, community standards, HOA compliance needs

- Market Positioning:** Premium pricing justified by community benefits and limited rental supply

💰 Boulder City Cash Flow Analysis & Investment Returns

Boulder City Cash Flow Excellence: Boulder City investment properties provide positive cash flow opportunities through strategic acquisition, professional management, and Nevada tax advantages creating optimal investment returns requiring comprehensive analysis and expert guidance for maximum profitability.

💰 Boulder City Complete Cash Flow Analysis & Investment Calculations

Boulder City Investment Property Cash Flow Analysis:

- Gross Rental Yields: 4.2-5.5% range depending on property type and acquisition strategy

- Cash Flow Potential: $200-$800+ monthly positive cash flow with strategic financing

- Property Taxes: 0.78% effective rate ($3,677 annual on $471K median property)

- Insurance Costs: $1,200-$2,400 annual depending on property value and coverage needs

- HOA Fees: $50-$300 monthly in managed communities providing amenity benefits

- Maintenance Reserves: 1-2% of property value annually for desert climate considerations

Boulder City Investment Return Calculations and Analysis:

- Cap Rate Analysis: 4.5-6.0% range for Boulder City investment properties

- Cash-on-Cash Return: 6-10% potential with strategic financing and property selection

- Total Return Potential: 8-12% combining cash flow, appreciation, and tax benefits

- Nevada Tax Benefits: No state income tax improving cash flow and investment returns

- Depreciation Benefits: Federal tax advantages, professional accounting recommended

- Appreciation Potential: Controlled growth supporting long-term property value increases

Boulder City Investment Cost Analysis and Financial Planning:

- Acquisition Costs: 2-3% closing costs, inspection fees, due diligence expenses

- Financing Options: Conventional investment loans, portfolio lenders, cash purchases

- Property Management: 8-10% of gross rent for professional management services

- Vacancy Allowance: 5-10% of gross rent for market turnover and seasonal factors

- Capital Improvements: Strategic upgrades improving rental rates and property values

- Professional Services:** Accounting, legal, property management, maintenance coordination costs

💼 Boulder City Investment Financing & Strategic Analysis

Boulder City Investment Financing Options and Strategic Acquisition

Boulder City investment financing requires comprehensive understanding of investment loan products, Nevada market conditions, and property-specific considerations. Successful financing combines conventional investment loans, portfolio lending options, jumbo financing for luxury properties, and strategic acquisition timing to optimize investment returns in Boulder City's unique controlled growth environment.

💼 Boulder City Investment Financing Strategy & Loan Products

Boulder City Investment Financing Excellence: Boulder City investment financing provides comprehensive loan product access, strategic acquisition funding, and Nevada market expertise ensuring optimal financing terms and investment success through professional coordination and specialized investment property lending solutions.

💼 Boulder City Complete Investment Financing & Strategy Analysis

Boulder City Investment Loan Products and Options:

- Conventional Investment Loans: 75-80% LTV, 6.5-7.5% rates, 25% down payment minimum

- Portfolio Lenders: Local banks offering relationship-based lending, flexible terms

- Jumbo Investment Loans: $806,500+ for luxury properties, specialized underwriting requirements

- DSCR Loans: Debt Service Coverage Ratio loans based on property cash flow, not income

- Commercial Loans: Multi-unit properties, apartment buildings, mixed-use opportunities

- Cash Purchases: Competitive advantages, negotiation flexibility, faster closing capabilities

Boulder City Investment Financing Requirements and Qualifications:

- Credit Score Requirements: 700+ minimum for best rates, 740+ for optimal terms

- Down Payment Standards: 25-30% for investment properties, higher for multiple properties

- Debt-to-Income Ratios: 43-45% maximum including new investment property payment

- Cash Reserves: 2-6 months payments required, more for multiple investment properties

- Experience Requirements: Previous investment property experience beneficial for approvals

- Property Requirements:** Appraisal, inspection, rental income verification, market analysis

Boulder City Investment Acquisition Strategy and Market Timing:

- Market Conditions:** Buyer's market providing acquisition opportunities and negotiation flexibility

- Seasonal Patterns:** Winter months optimal for investment acquisitions, reduced competition

- Property Selection:** Due diligence requirements, market analysis, rental potential assessment

- Negotiation Strategy:** Professional representation, market knowledge, competitive positioning

- Closing Coordination:** Investment property timelines, due diligence periods, financing coordination

- Professional Network:** Investment-focused agents, lenders, property managers, contractors

📈 Boulder City Investment Strategy & Portfolio Development

Boulder City Portfolio Excellence: Boulder City investment strategy requires comprehensive portfolio development, market analysis, and long-term planning leveraging controlled growth benefits, Nevada tax advantages, and community stability for optimal investment performance and strategic wealth building.

📈 Boulder City Complete Investment Strategy & Portfolio Analysis

Boulder City Investment Strategy Development and Planning:

- Market Entry Strategy: Single property acquisition, market learning, professional network development

- Portfolio Diversification: Property type variety, location distribution, rental market segments

- Growth Strategy: Controlled expansion, financing capacity, market opportunity evaluation

- Risk Management:** Property insurance, liability protection, professional management, legal compliance

- Exit Strategy Planning: Long-term hold, appreciation harvest, 1031 exchange opportunities

- Professional Coordination:** Investment team assembly, expert guidance, ongoing education

Boulder City Investment Market Advantages and Opportunities:

- Controlled Growth Benefits: Limited supply creating long-term appreciation and value protection

- Nevada Tax Advantages: No state income tax improving investment returns and cash flow

- Community Stability: Small-town character, safety record, family appeal supporting tenant quality

- Recreation Access:** Lake Mead proximity, outdoor lifestyle, tourism appeal supporting rental demand

- Las Vegas Employment: 30-minute commute access providing employment diversity and stability

- Limited Competition:** Specialized market knowledge requirements creating investor advantages

Boulder City Investment Challenges and Risk Mitigation:

- Short-Term Rental Prohibition: Airbnb/VRBO banned requiring long-term rental focus exclusively

- Premium Pricing:** Higher acquisition costs requiring strategic analysis and financing optimization

- Limited Market Size:** Smaller transaction volume requiring patient acquisition and strategic timing

- Property Management Requirements:** Professional services essential for compliance and optimal performance

- Market Knowledge Requirements:** Local expertise essential for successful investment and management

- Regulatory Compliance:** City ordinances, HOA requirements, rental regulations, professional guidance needed

📊 Investment Performance

Boulder City Investment Excellence: Boulder City's stable investment market with $471,620 median value (up 2.6%), controlled growth benefits, and $1,600 average rent provides strategic opportunities through professional guidance, market expertise, and long-term investment perspective.

Key Investment Advantages:

- Steady 2.6% appreciation with controlled growth supporting long-term values

- $1,600 average rent providing positive cash flow potential with strategic financing

- Limited supply creating competitive advantages and appreciation support

- Nevada tax benefits and community appeal attracting quality tenants

Investment Strategy: Professional analysis, strategic acquisition, expert management

🏘️ Rental Market

Boulder City Rental Excellence: Strong rental market performance with stable tenant demand, corporate relocation appeal, and community character benefits providing consistent cash flow opportunities requiring professional property management and strategic positioning.

Rental Highlights:

- $1,600 average rent with 4.2-5.5% gross yield potential

- Corporate relocation and Las Vegas employment driving stable demand

- SHORT-TERM RENTALS PROHIBITED - focus on 30+ day rentals only

- Professional management essential for optimal performance and compliance

Rental Strategy: Long-term focus, quality tenants, professional management

💼 Investment Financing

Boulder City Financing Excellence: Comprehensive investment financing including conventional loans (75-80% LTV), portfolio lending, jumbo options for luxury properties, and DSCR loans providing strategic acquisition funding with professional coordination and market expertise.

Financing Options:

- Conventional investment loans with 25% down payment requirements

- Portfolio lenders offering relationship-based flexible financing terms

- Jumbo loans available for luxury investment properties over $806,500

- DSCR loans based on property cash flow, not personal income verification

Financing Strategy: Strategic acquisition, optimal terms, professional coordination

📈 Professional Services

Boulder City Investment Expertise: Professional Boulder City investment guidance combining comprehensive market knowledge, financing coordination, property management, and strategic planning ensuring optimal investment success in Nevada's most distinctive small-town investment market.

Service Excellence:

- 12+ years Boulder City investment market specialization and expertise

- Controlled growth knowledge, rental market analysis, cash flow optimization

- Investment financing coordination, property management, strategic planning

- Professional network, compliance guidance, portfolio development support

Contact Information: Call (702) 213-5555 for expert Boulder City investment guidance

💼 Boulder City Investment Reality Check

Short-Term Rental Prohibition and Investment Strategy: Boulder City PROHIBITS short-term rentals (Airbnb/VRBO) by city ordinance with fines up to $500 per day. Investment strategy must focus exclusively on 30+ day traditional rentals requiring professional property management, compliance oversight, and long-term tenant strategies for optimal performance.

Premium Pricing and Market Specialization: Boulder City commands premium property prices justified by community character but requiring higher initial investment and specialized market knowledge. Professional expertise essential for property selection, financing optimization, and management success in this unique controlled growth environment.

❓ Frequently Asked Questions About Boulder City Nevada Real Estate Investment

What are Boulder City's investment market conditions and returns?

Boulder City offers stable investment opportunities with $471,620 median home value (up 2.6%), $1,600 average rent, and 4.2-5.5% gross rental yields. Controlled growth limiting 120 annual units creates supply scarcity supporting long-term appreciation. Professional analysis required for optimal property selection and investment strategy.

Are short-term rentals allowed in Boulder City for investors?

NO - Boulder City PROHIBITS short-term rentals (Airbnb/VRBO) by city ordinance passed March 2024. Violations face fines up to $500 per day. Investment strategy must focus exclusively on traditional 30+ day rentals requiring professional property management and compliance oversight for legal operation.

What financing options are available for Boulder City investment properties?

Boulder City investment financing includes conventional loans (75-80% LTV, 25% down), portfolio lenders, jumbo loans for luxury properties ($806,500+), and DSCR loans based on property cash flow. Credit scores 700+ required with 2-6 months cash reserves and investment property experience beneficial.

What are Boulder City rental market dynamics and tenant demographics?

Boulder City rental market features stable demand from corporate relocations, Las Vegas commuters, California migrations seeking Nevada tax benefits, and families attracted to community safety and schools. $1,600 average rent with professional property management (8-10% fees) essential for optimal performance.

How does controlled growth affect Boulder City investment potential?

Boulder City's controlled growth (120 units annually) creates supply scarcity supporting property values and rental demand while limiting new competition. Long-term benefits include appreciation potential and market stability, but requires strategic acquisition timing and professional expertise understanding growth impact.

What are Boulder City investment property types and strategies?

Boulder City offers diverse investment opportunities including Historic District character homes ($400K-$800K), luxury Lake Mead estates ($500K-$2M+), family neighborhoods ($350K-$650K), and condominiums ($300K-$500K). Each requires different rental strategies, tenant demographics, and management approaches.

What are Boulder City investment costs and cash flow analysis?

Boulder City investment costs include 0.78% property taxes, $1,200-$2,400 annual insurance, HOA fees $50-$300 monthly, and 1-2% maintenance reserves. Cash flow potential $200-$800+ monthly with strategic financing, professional management, and Nevada tax benefits improving returns.

How does Nevada's tax structure benefit Boulder City investors?

Nevada's no state income tax significantly improves Boulder City investment returns by eliminating state tax on rental income and capital gains. Combined with federal depreciation benefits and strategic property management, Nevada advantages enhance cash flow and long-term investment performance.

What professional services are required for Boulder City investment success?

Boulder City investment requires specialized professionals including local investment-focused real estate agents, portfolio lenders, property managers familiar with city ordinances, accountants understanding Nevada tax benefits, and contractors for maintenance. Professional network essential for compliance and optimization.

What are Boulder City's investment challenges and risk factors?

Boulder City investment challenges include short-term rental prohibition, premium pricing requiring higher capital, limited market size, specialized knowledge requirements, and professional management needs. Risk mitigation through expert guidance, proper due diligence, and comprehensive investment strategy planning essential for success.

📋 How to Successfully Invest in Boulder City Nevada Real Estate

Step 1: Market Analysis and Investment Strategy Development

Begin Boulder City real estate investment with comprehensive market analysis including controlled growth impact, rental market dynamics, property type evaluation, and investment strategy development. Understand short-term rental prohibition, rental market fundamentals, and Nevada tax advantages determining optimal investment approach and property criteria.

Step 2: Investment Financing and Acquisition Preparation

Develop comprehensive financing strategy including investment loan pre-approval, down payment preparation (25% minimum), credit optimization (700+ required), and cash reserve accumulation. Research portfolio lenders, DSCR loan options, and jumbo financing for luxury properties while coordinating with investment-focused professionals.

Step 3: Professional Team Assembly and Market Navigation

Engage Boulder City investment specialists including experienced real estate agents, portfolio lenders, property managers, accountants familiar with Nevada tax benefits, and contractors for maintenance needs. Assemble professional team understanding controlled growth market dynamics and investment property requirements.

Step 4: Strategic Property Acquisition and Due Diligence

Execute strategic property search with investment criteria, cash flow analysis, rental market evaluation, and comprehensive due diligence. Analyze rental potential, property condition, HOA requirements, and community compliance while coordinating professional inspections and market analysis for informed acquisition decisions.

Step 5: Professional Property Management and Compliance Setup

Establish professional property management ensuring city ordinance compliance, tenant screening, lease administration, and maintenance coordination. Implement accounting systems, insurance coverage, legal compliance, and rental optimization strategies while maintaining community standards and regulatory requirements.

Step 6: Portfolio Optimization and Long-term Strategy

Optimize investment performance through strategic management, cash flow analysis, market monitoring, and portfolio expansion planning. Leverage Nevada tax benefits, controlled growth appreciation potential, and professional expertise for long-term wealth building and investment success in Boulder City's unique market environment.

Ready to Invest in Boulder City Nevada's Exceptional Real Estate Market?

Boulder City Nevada real estate investment represents exceptional opportunity combining controlled growth benefits, stable rental demand, Nevada tax advantages, and community character appeal creating premier investment market with strategic long-term potential. With steady market performance demonstrating 2.6% appreciation, $1,600 average rental income, limited supply advantages from controlled growth policies, and professional investment services supporting optimal acquisition and management success.

Whether you're seeking Historic District character properties, luxury Lake Mead estates, family rental homes, or condominium investments, Boulder City's exceptional market characteristics, controlled growth benefits, and Nevada advantages create optimal investment opportunities for informed investors with strategic guidance and comprehensive market expertise ensuring maximum returns and long-term portfolio growth.

Disclaimer: This Boulder City Nevada real estate investment guide is compiled from extensive research of current market data, rental analysis, financing information, regulatory requirements, and professional services available as of October 2025. Investment returns, market conditions, rental rates, financing terms, property values, and regulatory compliance requirements are subject to change based on economic factors, market dynamics, lending policies, city ordinances, and local conditions that fluctuate over time. Investment performance, cash flow projections, rental yields, financing options, and professional recommendations reflect current information and historical data but cannot guarantee investment success or returns. City regulations including short-term rental prohibition, controlled growth policies, property taxes, HOA requirements, and investment regulations may change based on city council decisions, state legislation, and market conditions affecting investment strategies and outcomes. This guide serves as educational information for Boulder City real estate investment planning and should not be considered guaranteed investment returns, financing approval, or investment success. Boulder City real estate investors are strongly advised to conduct independent market research, obtain current financing pre-approval, verify city regulations and compliance requirements, secure professional real estate representation specializing in Boulder City investment properties, complete comprehensive property analysis and due diligence, and evaluate personal financial capacity and investment goals to ensure optimal decision-making based on current conditions and individual circumstances rather than relying solely on general investment analysis provided in this educational resource for Boulder City Nevada real estate investment success.

Stay Informed with RECN Insights

Subscribe to our blog for exclusive real estate tips, market updates, and community guides.

Real Estate Concierge Network

Your gateway to exceptional real estate services with 20%+ savings on agent fees, lifetime concierge support, and comprehensive solutions for buyers, sellers, businesses, and agent partners.

Save Contact

Save my contact info directly to your phone for easy access anytime you need help.

📲 Save to PhoneCall Direct

Speak with our specialists for immediate assistance with your real estate needs.

🗣 Call NowEmail Us

Send detailed inquiries and receive comprehensive responses within 2 hours during business hours.

📤 Send EmailSchedule Video Call

Book a free 30-minute consultation to discuss your real estate needs via secure video call.

📅 Book MeetingSend Text

Text me your real estate questions about buying, selling, market conditions, or property values for fast, personalized responses.

👥 Start ChatLeave Review

Help others discover our exceptional real estate concierge services.

📝 Write Review

Agent | License ID: BS.0144709

+1(702) 213-5555 | info@recngroup.com